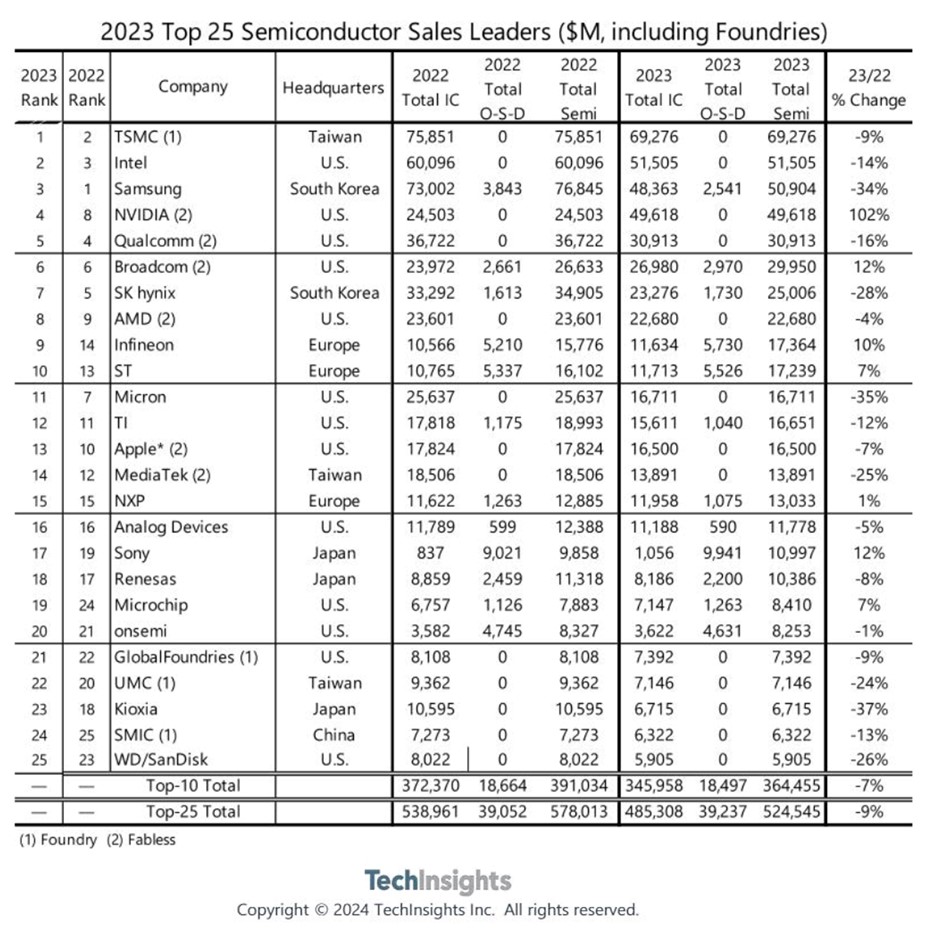

Semiconductor research platform TechInsights released the final 2023 ranking of the top 25 semiconductor suppliers based on sales revenues, which showed that no new suppliers broke into the top 25 list in 2023. Still, there were significant changes in where companies were ranked.

The top-25 ranking has 13 suppliers headquartered in the United States; 3 each based in Europe, Japan, and Taiwan; 2 in South Korea; and 1 in China. It is worth noting that the top 25 list includes foundries since it is intended to compare annual sales volumes of the largest semiconductor companies and is not intended as a market share ranking.

It took about US$5.9 billion in sales for a company to make it into the top 25 supplier list in 2023. Taiwan Semiconductor Manufacturing Company (TSMC), the world's largest semiconductor foundry, claimed the No.1 ranking in 2023 despite posting sales that declined 9% to US$69.3 billion. TSMC, like the three other pure-play foundries in the top-25 ranking, saw demand for wafer-processing services decline in 2023 because of slow growth and inventory buildups in smartphones, personal computers, data center servers, and other end-use markets.

Among other foundries, sales at GlobalFoundries, ranked 21st, fell 9% to US$7.4 billion in 2023; revenue at 22nd-ranked UMC declined 24% to US$7.1 billion; and sales at China-based SMIC slid 13% to US$6.3 billion, moving it to 24th in the 2023 ranking.

Collectively, memory IC suppliers experienced the steepest declines among the top 25 suppliers in 2023. For example, semiconductor revenue at memory IC giant Samsung Electronics fell 34% to US$50.9 billion, its lowest annual semiconductor sales output since 2016.

Samsung dropped to third place in the 2023 ranking. Sales growth at other memory suppliers ranged from a 26% decline at Western Digital, a 28% drop at SK Hynix, a 35% decline at Micron, and a 37% decline at Kioxia. As dire as the sales results were for memory suppliers last year, prices for DRAM and NAND flash memory are trending strongly upward, which should result in memory IC suppliers posting some of the strongest revenue gains in 2024.

By far, the fastest-growing semiconductor supplier in 2023 was fabless Nvidia whose calendar year sales surged 102% to US$49.6 billion, moving it into fourth place in the 2023 ranking. Nvidia's meteoric climb resulted from the tremendous growth of its processors used for artificial intelligence (AI) workloads in data center servers. Leveraging its graphics processing unit (GPU) technology, Nvidia dominates the fast-growing generative AI movement in data centers.

Despite a difficult macroeconomic environment, automotive applications offered stability and/or growth opportunities at each of the three European semiconductor suppliers in the top 25 rankings. Infineon, ST, and NXP posted revenue gains in 2023.

Source: TechInsights

TechInsights is the most trusted source of in-depth intelligence to the semiconductor industry. Find out more on TechInsights' platform.