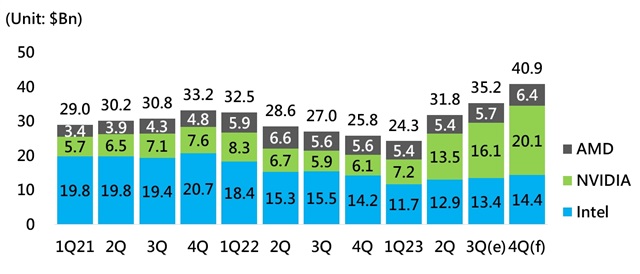

Despite the semiconductor industry's current downturn, competition in the HPC chip sector remains fierce. According to findings from DIGITIMES Research, the first half of 2023 saw all major HPC chip manufacturers, namely Intel, AMD, and Nvidia, grappling with lackluster revenue due to weak demand for high-performance computing (HPC) applications. However, there is a glimmer of hope as the NB/PC and server markets are gradually stabilizing, with expectations of a revenue upswing for these major companies in the latter half of 2023.

Major HPC vendors' revenue projection

Source: Intel, AMD, Nvidia, DIGITIMES Research, September 2023

According to estimates by Eric Chen, the analyst from DIGITIMES Research, results from surveys on NB/PC and server shipments indicate that the latter part of 2023 will witness improved shipment volumes compared to the first half. This, combined with the resurgence in demand for HPC chips, is projected to bolster the revenues of Intel, AMD, and Nvidia. Nevertheless, the revival in the NB/PC market appears more robust than that in the server market, resulting in Intel and AMD, which contribute significantly to NB/PC revenues, having less growth momentum in the latter half of the year compared to Nvidia, which holds an advantage in the AI server sector.

The three major players are actively introducing new CPU/GPU products to capitalize on the surging demand for AI model training and inference.

In the realm of server GPUs, Nvidia continues to dominate the AI server market. The expansion of TSMC's CoWoS packaging capacity will influence Nvidia's quarterly revenue growth potential. However, the MI300 series GPU, set to commence mass production by AMD in the fourth quarter of 2023, should not be underestimated. AMD's announcement regarding Amazon Web Services (AWS) expanding its utilization of fourth-generation AMD Epyc processors is expected to drive growth in the data center business. Moreover, in the server CPU market, Intel and AMD's x86 architecture CPUs still reign supreme. Both companies are introducing new products in 2023, while Nvidia is entering the server CPU competition with its Arm architecture, with a focus on energy efficiency. Expectations point to heightened competition in the server CPU market in the future.

In 2023, capital expenditures by the four major North American cloud service providers are predicted to decrease compared to 2022. They are scaling back their investment plans in response to unfavorable economic conditions, with only Microsoft increasing its capital expenditure. DIGITIMES Research estimates that Microsoft's capital expenditure in 2023 will exceed US$33 billion. Given the demand for large language models (LLMs), cloud service providers prioritize the acquisition of AI servers. However, there exists a significant price gap between AI servers and general-purpose servers, with AI server prices being over 10-15 times higher. Consequently, cloud service providers, constrained by budget limitations, are experiencing a substantial drop in demand for general-purpose servers.

About the Analyst

Eric Chen is an Analyst and Project Manager at DIGITIMES Research. Chen received his Master's degree in International Business from Taiwan's Soochow University. His research focuses on foundry industry as well as IC assembly & packaging industry.