Intel and Micron Technology have jointly introduced a 25nm NAND flash production process technology, which provides a more cost-effective path for increasing storage capacity in today's consumer gadgets including smartphones and personal music and media players (PMPs), as well as SSDs.

Manufactured by their joint venture IM Flash Technologies, the 25nm process produces 8GB of storage in a single NAND device. It measures 167mm-square.

The new 25nm 8GB device reduces chip count by 50% compared to previous process generations, allowing for smaller, yet higher density designs and greater cost efficiencies, according to their joint statement. For example, a 256GB SSD can now be enabled with just 32 of these chips (versus 64 previously), a 32GB smartphone needs just four, and a 16GB flash card requires only two.

The flash alliance expects to begin mass production of the 25nm, 8GB device in the second quarter of 2010.

Intel and Micron formed IM Flash in 2006 and started production with a 50nm process, followed by 34nm in 2008.

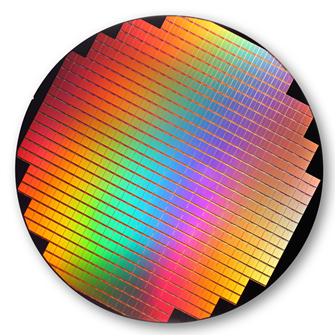

25nm NAND flash wafer

Photo: Company