Hynix Semiconductor has announced Intel validation of 2Gb DDR3 DRAM chips using 40nm-class process technology. The chipmaker said it has begun mass producing the new chips, and expects the validation of RDIMMs to also be completed within before year's end.

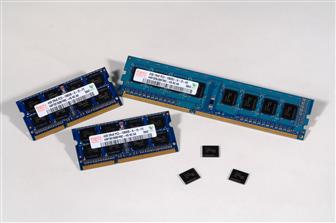

Hynix's newly-validated products are 2Gb DDR3 SDRAM component, 4GB DDR3 SO-DIMM and 2GB DDR3 unbuffered DIMM (UDIMM) with and operating speed of 1333MHz with 1.5V power supply, according to the company. The chips deliver a maximum data transfer speed of 1867MHz with 16-bit I/O and 3.7Gbps bandwidth.

Hynix said the productivity of its 40nm-class 2Gb DDR3 is increased by more than 60% over 50nm-class process technology.

In addition, Hynix noted its new 40nm-class 2Gb DDR3 chips reduce power consumption by 40% over the preceding products using 50nm class, about twice the industry average of reduction in terms of power consumption.

"The current mainstream density has been rapidly transferring from 1Gb to 2Gb for the higher performance servers market. We expect to secure the industry's best features of both 1Gb and 2Gb DDR3 products", said JB Kim, CMO of Hynix.

Hynix 40nm 2Gb DDR3

Photo: Company