Biostar has announced the launch of its TA770 A2+ motherboard based on the AMD 770 chipset.

The TA770 A2+ supports the upcoming AMD Phenom series multi-core processors, which support dual-channel DDR2-1066, bigger L3 cache and offer optimized overclocking ability.

The TA770 A2+ features HyperTransport 3.0 technology and PCI Express 2.0, which offers data transfer speeds of 5GT/s, noted Biostar.

The TA770 A2+ has a recommended retail price of US$90 and will be available in China near the beginning of November and in the US and Europe by mid-November, according to the company.

| Biostar TA770 A2+ specifications | |

| Item | Details |

| Name | TA770 A2+ |

| CPU support | Supports AMD Phenom Series/Athlon 64 X2/64/FX/Sempron processors |

| Chipset | AMD 770 + SB600 |

| Socket | AM2+/AM2 |

| PCIe x16 2.0 | 1 |

| PCIe x1 2.0 | 2 |

| PCI | 3 |

| LAN | Gigabit Ethernet |

| SATA 3.0Gb/s | 4 |

| eSATA | 2 |

| RAID | 0/1/10 |

| USB 2.0 | 10 |

| Integrated audio | 8+2 channel HD audio |

Source: Company, compiled by Digitimes, November 2007

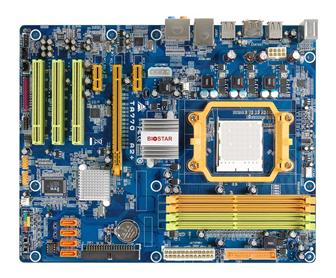

Biostar TA770 A2+ motherboard

Photo: Company

Article edited by Ricky Morris