Biostar has released its T-Series TF560 A2+ motherboard which supports AMD's upcoming socket AM2+ CPUs. Although socket AM2+ CPUs will not launch until later in the year, the socket is backwards compatible and is able to support both AM2 and AM2+ CPUs, according to the company.

The TF560 A2+ adopts the Nvidia nForce 560 media and communications processor (MCPs) which includes support for MediaShield RAID 0, 1, 0+1 or 5 configurations, FirstPacket network optimization technology, and nTune system performance and optimization manager, noted Biostar.

The TF560 A2+ will be available in the US on June 29 and in Europe at the beginning of July with a price of US$80, according to the company.

| Biostar TF560 A2+ specifications | |

| Item | Description |

| Chipset | Nvidia nForce 560 |

| Socket | AM2+/AM2 |

| PCI Express x16 | 1 |

| PCI Express x 1 | 2 |

| PCI | 3 |

| LAN | Realtek RTL8110SC - Integrated 10/100/1000 Transceiver |

| SATA 3Gb/s | 4 |

| RAID | 0, 1, 0+1, 5 |

| Integrated Audio | Realtek ALC888 8+2-Channel HD Audio |

Source: Company, compiled by Digitimes, June 2007

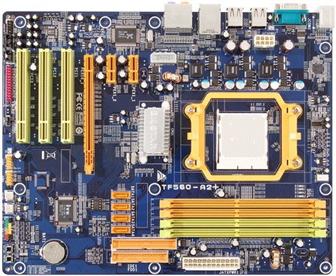

Biostar TF560 A2+

Photo: Company