VIA Technologies and Systemax Manufacturing announced a new energy efficient Systemax desktop PC powered by a 1.5GHz VIA C7-D desktop processor and VIA motherboard for the US market.

The new PC features the VIA C7-D processor, which has a maximum power consumption of 20W, along with the low-power VIA pc2500 motherboard and VIA CN700 digital media chipset with an integrated VIA UniChrome Pro II graphics processor.

The new Systemax PC model is available at several US online retail stores in two versions, one with Microsoft Windows XP Home for US$299.99, while the other is available for US$399.99 with Microsoft Windows XP Professional.

| VIA pc2500G motherboard specification | |

| Item | Details |

| Processor: | 1.5GHz VIA C7-D desktop processor |

| Chipset: |

North Bridge: VIA CN700 Digital Media IGP chipset South Bridge: VIA VT8237R Plus |

| Graphics: | VIA UniChrome Pro II integrated 3D/2D graphics processor with hardware MPEG-2 decoding acceleration |

| Memory: | 512MB DDR2 533/400 memory up to 2GB |

Source: Company, compiled by Digitimes, August 2007

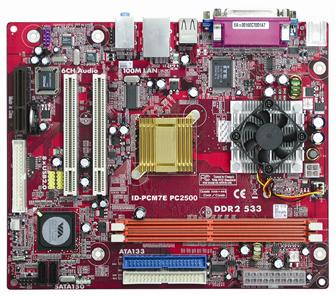

VIA pc2500G motherboard

Photo: Company