Introduction

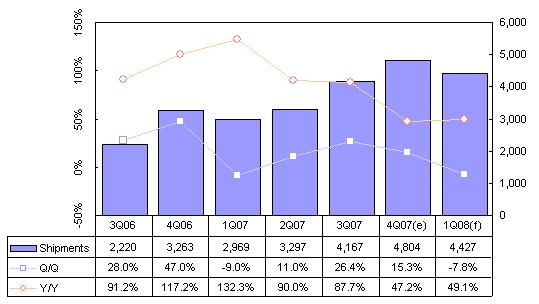

Taiwan shipped 4.8 million LCD TVs in the fourth quarter of 2007, up 15.3% sequentially and 47.2% from the same period one year earlier. LCD TV shipments will fall 7.8% in the first quarter of 2008, but will be up almost 50% from the same period in 2007.

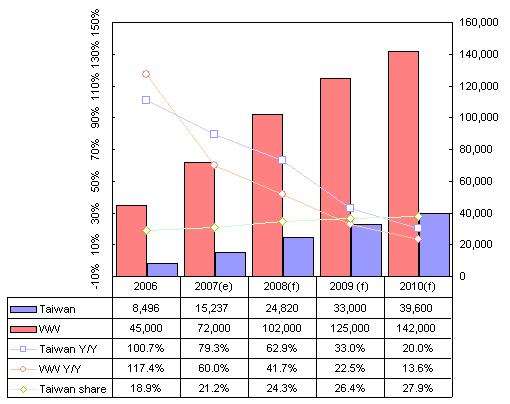

Taiwan shipped 15.2% million LCD TVs in 2007, up 79% from 2006, while the global growth rate was 60% to reach 72 million units. Taiwan will ship 24.8 million LCD TVs in 2008, representing growth of 63% from 2007 and outpacing the global growth rate of 42%.

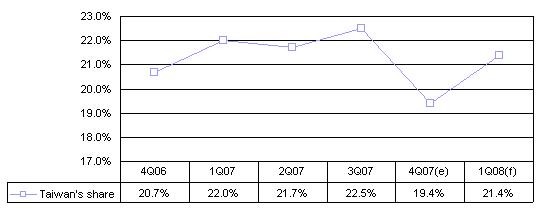

Taiwan accounted for 21.2% of the global LCD TVs market in 2007 and the share is forecast to increase to 24.3% in 2008.

Chart 1: Taiwan LCD TV shipments, 3Q06-1Q08 (k units)

Source: Digitimes Research, January 2008

Fourth quarter shipments totaled 4.8 million units and accounted for 32% of shipments in 2007.

With Taiwan makers expecting better LCD panel prices in the third quarter than in the fourth quarter, a number of vendors placed orders for their Black Friday inventory in the third quarter, and fourth quarter shipments did not reflect the holiday season as much as it had in previous years, so shipments were up only 15% in the fourth quarter.

Shipment growth in the fourth quarter was also constrained by the high shipment base in the third quarter, as many vendors moved up their shipments to the third quarter.

Shipments will drop 7.8% in the first quarter of 2008 as the market moves into the low season. Although shipments will be up 49% from the same period one year earlier, shipment growth will be constrained by heavy snow in China, a number of China-based TFT LCD module (LCM) plant were affected by heavy snowfall in late January and the beginning of February, which has constrained the level of LCD panel production, while also making logistics difficult at a number of production facilities.

Due to LCD panel supply running tight in 2008, prices for LCD panels in the first quarter of 2008 are not expected to drop as much as the first quarter of 2007. The price for 32-inch LCD panels is expected to reach about US$335 in the first quarter of 2008. However, less-known LCD TV makers may have to spend US$340-350 on 32-inch LCD panels.

Due to demand for 37-inch LCD panels not being strong in the first quarter, prices may remain at the US$440 level. However, supply for larger than 40-inch LCD panels is adequate, so prices may remain at US$545 or fall slightly to US$540.

Review and outlook, 4Q 2007

Global market share

Due to Taiwan makers not having as strong an upstream (panel maker) presence as other international makers such as Samsung Electronics, Sharp and Sony, Taiwan makers are more influenced by panel price fluctuations. Therefore, Taiwan makers were more likely to move up their fourth quarter shipments to the third quarter. This could be seen in the spike in Taiwan's share of the global LCD TV market in the third quarter and the corresponding drop in the fourth quarter.

With Taiwan makers grabbing some new customers, Taiwan's global market share will rebound in the first quarter of 2008.

Chart 2: Taiwan worldwide market share, 3Q06-4Q07

Source: Digitimes Research, January 2008

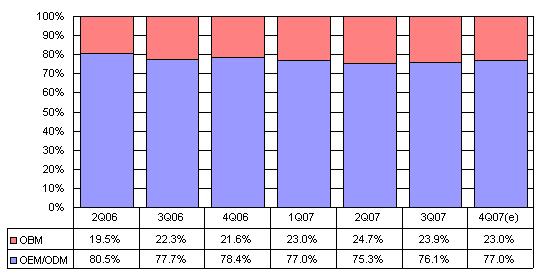

Production mode: OBM, OEM and ODM

With Qisda (formerly BenQ) spinning off the BenQ brand to a new company in September. 2007, the proportion of Taiwan's OEM/ODM shipments increased further in the fourth quarter.

When Qisda was first formed, its customer base was mainly focused on vendors from Taiwan and nearby markets, but the company has steadily looked to expand its customer base to European vendors and will continue doing so in 2008.

Amtran was the major player for Taiwan's own-brand LCD TV shipments in 2007, with its OBM shipments accounting for 90% of the company's total LCD TV shipments. The company's Vizio-brand is a Top-3 LCD TV brand in North America.

Chart 3: Taiwan LCD TV shipments by production mode, 2Q06-4Q07

Source: Digitimes Research, January 2008

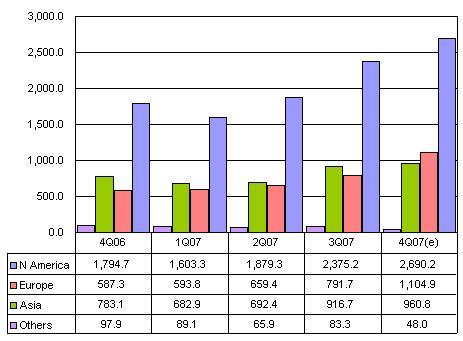

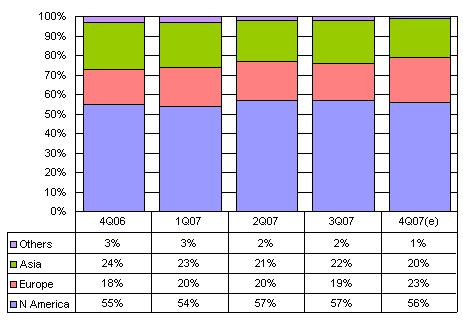

Geographic markets

Shipments to Europe were up 40% in the fourth quarter of 2007, with new orders for Qisda contributing to the growth. However, most of the increased shipments to Europe were for TVs sized 30-inches and smaller.

Shipments to North America were up 13% and the region maintained its position as Taiwan's top export market.

While Taiwan LCD TV makers are looking to expand their sales in Europe, Taiwan LCD TV makers still tailor their LCD TV lineups for the US market, as the vast majority of Taiwan's LCD TV makers adopt TV chips for use in the US market, which adopts the same standards as Taiwan, making it easier for many makers to easily expand their sales outside of the local Taiwan market.

Chart 4: Taiwan LCD TV shipments by region, 4Q06-4Q07 (k units)

Source: Digitimes Research, January 2008

Chart 5: Taiwan LCD TV shipment share by region, 4Q06-4Q07

Source: Digitimes Research, January 2008

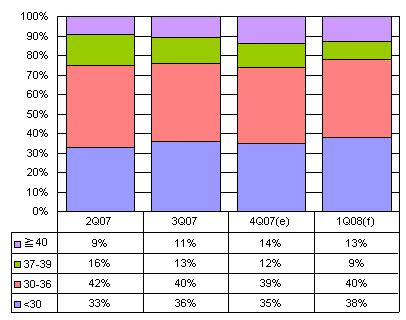

Screen size

Shipments of LCD TVs smaller than 30-inches were up 12% in the fourth quarter amid first-time shipments to European vendors. In addition, although overall shipments will drop in the first quarter of 2008, shipments to the smaller than 30-inch segments will remain flat.

Shipments of 40-inch class LCD TVs were e up 47% in the fourth quarter of 2007, with Amtran and Kolin driving demand, as those two vendors account for about 50% of the shipments to the segment.

Shipments to the over 40-inch segments will drop 14% in the first quarter.

Chart 6: Taiwan LCD TV shipment proportion by screen size, 2Q07-1Q08

Source: Digitimes Research, January 2008

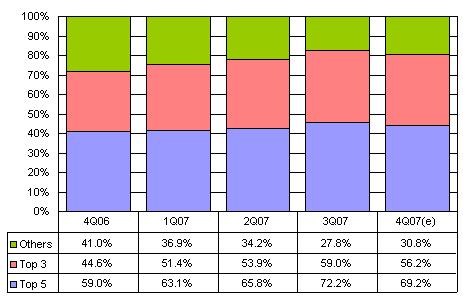

Shipment concentration

The Top-5 makers in the fourth quarter were TPV Technology, Amtran, Proview, Wistron, and Kolin. Proview was ranked Number 3 in the fourth quarter, down from Number 2 in the previous quarter. Kolin moved up one position from the previous quarter to Number 4.

Proview's relatively negative results in the fourth quarter affected the overall share of the Top-3 and Top-5 makers in relation to overall shipments from Taiwan. Proview's fourth quarter results were mainly due to the company pushing forward its holiday season shipments to the third quarter.

In the first quarter of 2007, Quanta Computer was the Number 5 LCD TV maker in Taiwan, but the company has gradually closed the book on its LCD TV business.

Chart 7: Taiwan LCD TV shipment concentration, 4Q06-4Q07

Source: Digitimes Research, January 2008

Industry watch

LCD TV prices continue falling

The retail prices for mainstream sized LCD TVs did not drop more than 10% in the fourth quarter of 2007, even though prices in the fourth quarter of 2006 fell by more than 10%. However, since prices reached a sweet spot in the market, consumption was not strongly affected by the smaller price reduction.

LCD TV panel price and supply forecast

Demand for LCD TV panel capacity in 2008 is expected to grow by 28%, while actual LCD TV panel capacity is expected to increase only by 23%. To avoid tight supply during the relative high seasons, LCD TV makers will advance their third quarter orders to the second quarter, building up their inventory. As a result, LCD TV panel prices will start increasing in the second quarter, with pricing in the 32-inch segment showing the highest growth in the second quarter.

After the second quarter, some segments will see a price drop, but the situation will not last long as supply will be tight in the second half of the year. However, in the larger than 40-inch segments, prices are expected to drop slightly this year.

With supply expected to be tight this year, those LCD TV makers that do not have solid TFT LCD panel sources may begin using LCD monitor panels for some LCD TV segments.

Another way makers may remedy insufficient LCD panel supply, especially in the32-inch segment, is turning to PDP panels. Digitimes forecasts that the 32-inch LCD TV segment will account for 30% of global LCD TV shipments in 2008. However, TFT LCD panel markers do not see much profit in the segment so they may be unwilling to increase their related production. This in turn may have TV makers looking at PDP panels.

Prices for 32-inch PDP panels, included filter, is currently around US$280, which is lower than the US$330-335 price for 32-inch LCD TV panels. Although the resolution (852x480) of 32-inch PDP TV panels is lower than that (1366x768) of 32-inch LCD TV panels, makers still see an opportunity to increase their sales in some regions such as China, as Chinese consumers do not place a strong value on resolution, since replacing CRT TVs is their priority. The retail price for 32-inch PDP TVs in the beginning of 2008 was around US$632 in the China market, while the price for the same-size LCD TV is about US$830.

Proview and Amtran Technology clearly stated that they are looking to develop their 32-inch PDP TV business in 2008, and Proview is scheduled to ship 42- and 50-inch PDP TVs this May, in addition to 32-inch PDP TVs.

However, Amtran is not taking an overly aggressive approach to entering into volume production of 32-inch PDP TVs. It will wait until it sees a severe shortage of 32-inch LCD TV panels. The company is expected to enter into volume production in the latter half of 2008.

Shipments by maker

Due to Qisda securing its LCD TV panels from AU Optronics (AUO) and seeing increased shipments to Europe in 2008, the company expects to increase its LCD TV shipments by 500%, from 400,000 units in 2007 to 2.4 million units in 2008. In addition, due to increased Toshiba OEM orders, Compal Electronics is expected to ship one million LCD TVs in 2008.

Despite TPV Technology accounting for 4.9% of the global LCD TV market in 2007, the company did not achieve its shipment goal of 4.5 million units. TPV is expected to ship 3.55 million LCD TVs in 2007, lower than its expectations, due to its major partner Philips not meeting its market expectations in 2007.

However, TPV is looking to partner with other international LCD TV vendors in 2008 and increase orders, especially in the US retail channel. The company aims to ship 7.5 million units in 2008 and increase its global market share to 7.4%.

Chi Mei Optoelectronics (CMO) and TPV Technology last September entered into a memorandum of understanding (MOU) to form a stronger tie-up in the TFT LCD production chain. The alliance provides CMO a stable outlet for its panel output and TPV a sustainable long-term supply of key components.

In addition, for the purpose of integrating its LCD TV chip supply, TPV Technology and Chi Mei Optoelectronics (CMO) in January invested in Himax Media Solutions, a HDTV and LCD monitor chip designer that was spun off in October 2007 from Himax Technologies.

To try to better compete with TPV, Proview has adopted its open-cell production mode. The company purchases cells, unfinished modules, from TFT LCD makers, so it can lower its cost compared to its rivals. However, it is difficult for LCD TV makers – except for Proview, Vestel, and Funai Electric – to adopt this type of business. These three companies have enough vertical integration, which exceeds 80% of self-production from Open cell to Module, and they can also afford the increased price of purchasing open cells from TFT LCD panel makers.

Amtran Technology, on the other hand, is looking to grow its business by expanding beyond the US market. Amtran will still focus on the US market but the company is looking to explore European, Latin American, and Chinese markets in 2008. However, shipments in these new markets will not account for a large proportion of Amtran's total LCD TV shipments in 2008.

Amtran is expected to be the Number 3 Taiwan LCD TV maker in 2008, following behind TPV and Proview, in that order.

2008 and beyond

Taiwan shipped 15.2 million LCD TVs in 2007, up 79% from the previous year. In 2008, Taiwan will ship 102 million units in 2008 and increase its global market share to 24.3%, as Qisda will grab an increased number of orders.

Proview's manufacturing process has a cost advantage over its competitors and its processes cannot be easily copied, so the company should be able to extend its sales network through low pricing and increase its shipments to 8.5 million units by 2010.

Chart 8: Taiwan LCD TV shipment forecast , 2006-2010 ( k units)

Source: Digitimes Research, January 2008

NOTE: Unless otherwise indicated, figures and tables refer to output from Taiwan makers.