The Taiwan International Lighting Show is one of my favourite shows. The reason is because the show participants always find new ways to combine lighting with interior design. This year, the show's focus is on LEDs, of course, and many firms have shown their creativity by displaying various types of LED lighting.

Jan Cheng Lighting decorative LED lighting

Photo: Jackie Chang, Digitimes, March 2013

LED lighting are no longer just for industrial purposes. It can be used for growing plants, decorating houses, and saving energy. The brightness efficiency has been increasing significantly over the years due to continuous effort from the firms.

Epsitar LED lighting for growing plants

Photo: Jackie Chang, Digitimes, March 2013

One of the most interesting things that caught my eyes was the candle lamps. Firms such as Epistar, Everlight, and Edison Opto showcased candle lamps combined with designs such as chandeliers and table lamps. In 2012, the LED candle lamp penetration rate in the LED lighting market was less than 5%, but Epistar believes the penetration rate is likely to reach close to 10% in 2013.

Epistar LED candle lamps

Photo: Jackie Chang, Digitimes, March 2013

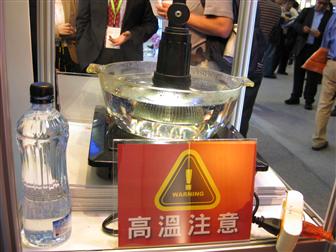

Lextar showcased many types of LED ceiling lamps including tube, panel and down lighting. Aeon Lighting had an interesting display of putting a LED light bulb in boiling water to show that the product can withstand high temperature. Aeon Lighting also showcased LED light bulbs with various colours and shapes. Everlight displayed four LED street lamps in front of its booth, showing its strength in outdoor lighting, while Delta Electronics displayed many LED light bulbs from 8-10W.

Everlight LED street lamps

Photo: Jackie Chang, Digitimes, March 2013

Aeon Lighting LED lighting in boiling water

Photo: Jackie Chang, Digitimes, March 2013

My favourite booth was the Edison Opto booth. Half of the booth was a café, and it looked like a real café. Buyers were able to sit down and observe the different use of LED lighting. The café had a counter and two chalkboards with menus on them. The lighting was carefully designed to make you feel like you were in a Starbucks somewhere.

Edison Opto cafe

Photo: Jackie Chang, Digitimes, March 2013

This year's show had no surprises but firms did show that they put a lot of creativity into combining LED lighting with interior design and different applications. As for improvements in brightness efficiency, It is hard to determine with the naked eye, I have to say.