San Diego, September 1, 2010 - Continuing to provide book lovers with the most natural, immersive digital reading experience, Sony today announced the launch of its beautifully-designed new line of Reader digital books, including the new Reader Pocket Edition, Reader Touch Edition and, in the US, the wireless Reader Daily Edition. The new line of Readers features a host of new design and technology enhancements that make them the perfect device for any reader's lifestyle.

"Today, we're excited to announce not just the availability of the Reader Touch Edition and Pocket Edition in the countries we already serve but also plans to expand the Reader line to previously untapped markets," said Steve Haber, president of Sony's digital reading business division. "We take a thoughtful approach to country expansion, including Italy, Spain, Australia, Japan and China, working with local bookstores to ensure content is compatible, relevant and in the appropriate language for each market."

The new Reader models bring a fresh level of flare to e-reading with colorful, elegant aluminum designs and all new, highly responsive touch screens. In addition to the new devices in the US, Sony announced development of a set of applications for iPhone and the Android Marketplace to extend the Reader experience across multiple portable devices.

"The success of our previous line of Readers illustrates book lovers' demand for feature choices and full touch screens on their digital reading devices," said Phil Lubell, VP of digital reading at Sony Electronics. "Today, we're answering their call by providing an entire line of stylish, full touch screen devices with a variety of features and price points."

What's new

The new generation of Readers builds on the popularity of last year's line. For 2010 Sony has restyled all three of the devices, reduced their size and weight, and made new, innovative touch screens available across the entire line.

Touchscreen for everyone

Based on the popularity of the full touch screen on its previous Reader Touch Edition and Daily Edition models, Sony equipped the entire line of new Readers with improved, optical touch screen technology designed specifically for digital reading. The new, first-to-market technology enhances ease of use and increases reading clarity, creating an immersive reading experience for consumers. Book lovers can now escape into their favorite books with the lightest swipe of a finger or stylus pen.

Improved E Ink displays

All three devices utilize E Ink Pearl electronic paper displays, which delivers a paper-like display that is readable in direct sunlight. The screens offer a high contrast ratio with 16 levels of grayscale, ensuring that text and images are crisp and easy to read.

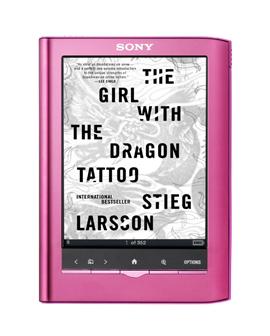

A Reader Pocket Edition that will wow you

The new Reader Pocket Edition sports a 5-inch, full touch screen and a smart, lightweight design that is easy to slip into a purse or jacket pocket for convenient, on-the-go reading. It is available in chic colors, including silver and pink. It has 2GB of onboard memory, which lets you carry up to 1,200 of your favorite books, and retails for about US$179.

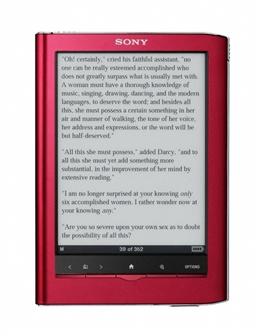

A new Reader Touch Edition: More of everything readers love

The new Reader Touch Edition features a 6-inch full touch screen and an intuitive design with 2GB of onboard memory. In addition, it offers dual expansion slots for up to 32GB of additional memory and the ability to play MP3 and AAC audio files. It is available in black or red for about US$229.

A Reader Daily Edition that adds Wi-Fi and new web features

The Reader Daily Edition provides a wireless connection to Sony's Reader Store from most of the US via AT&T's 3G network. Now, it will also provide Wi-Fi and basic Web browsing capability on its large, 7-inch full touch screen.

"The eReading space is doing very well and the Daily Edition has been a great performing product in this popular connected devices category," said Glenn Lurie, president of AT&T emerging devices. "We're looking forward to connecting Sony's next generation wirelessly connected eReader on the nation's fastest mobile broadband network."

A host of pre-loaded practical and reading-based URLs will provide direct access to optimized, text-based sites to add a new dimension to the reading experience. The Reader Daily Edition also includes 2GB of memory and expansion slots for additional memory (up to 32GB). It comes in silver and will sell for about US$299.

Additional new features across the entire line

New features allow for easier reading of PDF or personal documents. Intuitive content zoom, adjustable contrast and brightness control, as well as automatic multiple page creation will make documents designed for a standard sheet of paper easier to read on a smaller screen. Also, personalized standby screen options will allow users to use their favorite photos as a screen saver and the collections functionality will allow them to group their favorite reads.

In addition, the new Reader line is more global than ever, offering users the ability to look up words and phrases with the built in New Oxford American Dictionary, Second Edition and Oxford Dictionary of English eDictionaries, as well as 10 translation dictionaries in languages such as French, German, Spanish, Italian and Dutch. Wordsmiths across the globe can now create "word logs" to track the words they've looked up per dictionary, book or periodical in chronological order, while quickly switching between dictionaries.

More content on more devices

In addition to announcing a new generation of Readers, Sony has also made several changes and improvements to Reader Store. More than 1.2 million titles are available in the US via the store. Sony remains committed to providing an extensive offering of newspaper and magazine content for single issue purchase or subscription within the newsstand area of the store. Soon to be available titles include The Harvard Business Review, The Wilson Quarterly and Dell Magazines' highly regarded fiction magazines: Alfred Hitchcock's Mystery Magazine,Ellery Queen's Mystery Magazine, Asimov's Science Fiction, and Analog Science Fiction and Fact. The store's Library Finder application continues to provide easy access to local public libraries to borrow eBooks for free. To make choosing a book easier, the New York Times Bestsellers list will be featured alongside the Reader Store's bestsellers. By next month, integration with Goodreads will also permit the inclusion of reader reviews from that site onto the Reader Store.

With Reader Desktop Edition (formerly Reader Library) for Apple's Mac OS X and Microsoft Windows and Reader Mobile Edition for Apple iPhone and Google Android-based smartphones, users will be able to synchronize their reading among multiple devices. These free applications, available later this year, will offer an intuitive digital reading experience with an elegant interface and access to Sony's Reader Store for browsing and purchasing content. Reader Desktop Edition also includes the ability to easily manage content for the non-wireless Reader models.

The new Reader Pocket Edition and the new Reader Touch Edition are available immediately, and the new Reader Daily Edition is expected to be available this in time for the holidays. The Reader Pocket Edition and Touch Edition, as well as available accessories such as AC adaptors, cases and covers with reading lights, are available now at SonyStyle.com and SonyStyle stores.

Sony e-book reader, PRS-950 Daily Edition

Photo: Company

Sony e-book reader, the PRS-650 Touch

Photo: Company

Sony e-book reader, the PRS-350 Pocket Edition

Photo: Company