China's advancement in semiconductor manufacturing will face a slowdown owing to US chip controls, followed by Japan and the Netherlands in imposing tough curbs on chipmaking machine exports. From the fourth quarter of 2022 onwards, China has observed a decline in the import of semiconductor equipment.

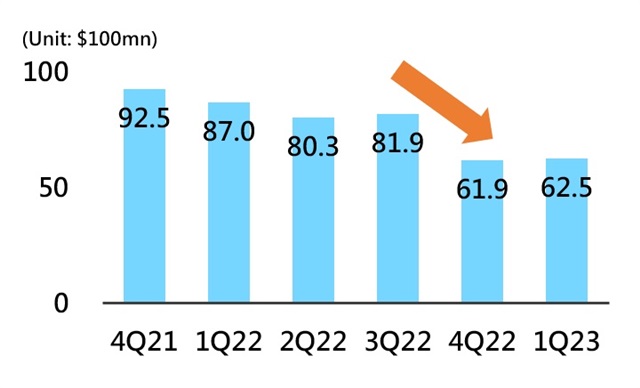

Chipmaking equipment imports to China declined

Source:ITC, China Customs, DIGITIMES Research, June 2023

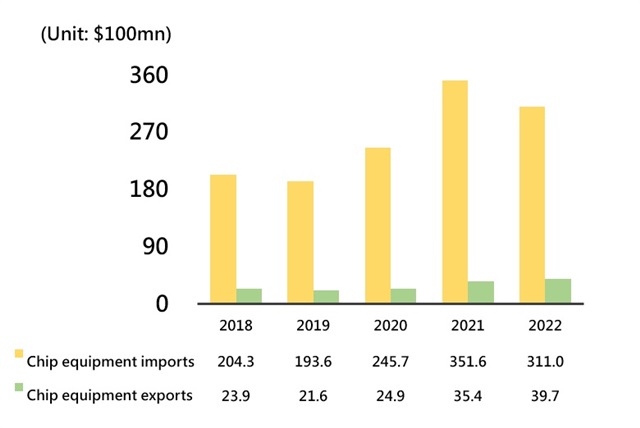

Based on data provided by the International Trade Centre (ITC), China heavily depends on foreign suppliers for its semiconductor manufacturing equipment, resulting in a trade deficit exceeding $27.1 billion in 2022. During the same year, China imported semiconductor equipment worth $31.1 billion, with Japan, the US, South Korea, tye Netherlands, Taiwan, and Singapore contributing to nearly 90% of the total imports. Among these countries, Japan holds the position of being China's largest equipment exporter, accounting for approximately 30% of the overall imports.

China's imports and exports of chip manufacturing equipment

Source:ITC, China Customs, DIGITIMES Research, June 2023

Following the sweeping export restrictions imposed by the US in October 2022, China experienced a 24.4% quarter-on-quarter decrease in the import of semiconductor equipment in the fourth quarter of that year. This decline further deepened in the first quarter of 2023, with a 28.1% drop compared to the same quarter in the previous year. The most modern machines being banned from China has led SMIC to announce the suspension of 14nm orders. The US-led western economic alliance is seeking to deprive China of the most advanced chips. Given the complexity of semiconductor manufacturing and the indispensability of critical equipment, the heavy dependence of makers on chip machines imports increases the risk of disruption in China's semiconductor industry.

According to analyst Jim Chien from DIGITIMES Research, the tech blockade will lead to a decrease in China's chip production, subsequently reducing the demand for silicon wafers. Consequently, the revenue of foreign suppliers of semiconductor equipment and materials will be impacted. Tokyo Electron, for example, heavily relies on the Chinese market as its primary source of revenue for semiconductor equipment business, while Japan serves as the main supplier of silicon wafers to China. The future direction of Japan's government policies regarding the export of semiconductors and chip equipment will play a significant role in influencing the chipmakers in both China and Japan.

Considering the geopolitical impact on reshaping the landscape of semiconductor supply chain, China proactively enacts measures such as funding, incentive policies, and tax breaks to support semiconductor self-sufficiency.

About the Analyst

Jim Chien received his B.S. and M.S. degrees in communication engineering. He engaged in academic research of advanced signal processing and smart phone development for many years. Now he focuses intently on semiconductor technology development and market trends, especially in the field of communication IC design and RF.