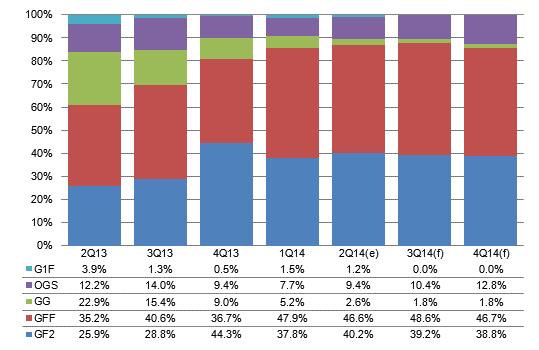

Chart 2: Shipments by product - iPad, non-iPad branded and white-box, 2Q13-4Q14 (m units)

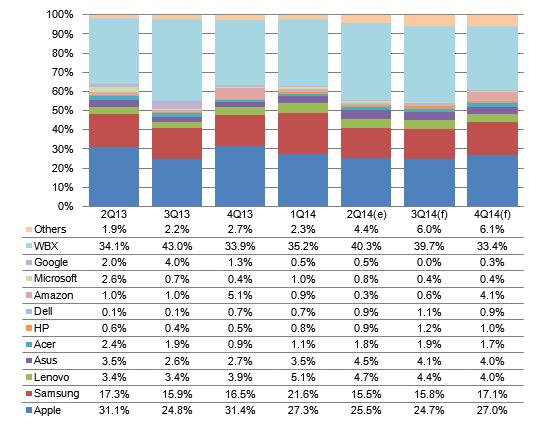

Chart 3: Shipment share by product - iPad, non-iPad branded and white-box, 2Q13-4Q14

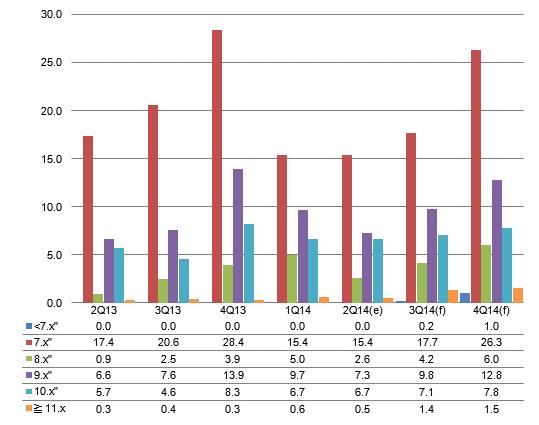

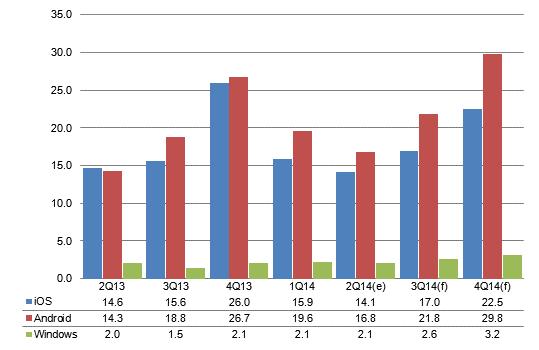

Chart 8: Shipments by touchscreen technology, 2Q13-4Q14 (m units)

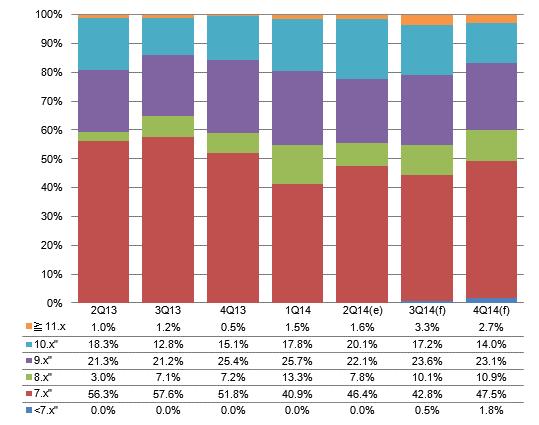

Chart 9: Shipment share by touchscreen technology, 2Q13-4Q14

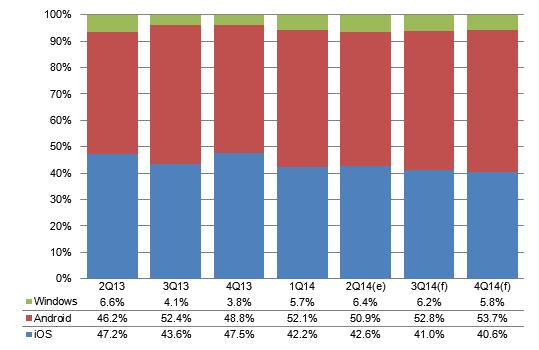

Chart 14: Shipments of detachable notebooks by OS, 2Q13-1Q14 (k units)

Chart 15: Shipment share of detachable notebooks by OS, 2Q13-1Q14

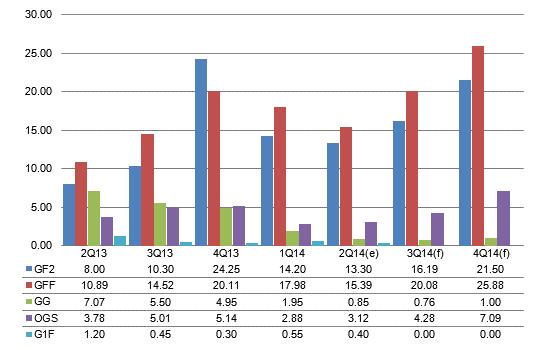

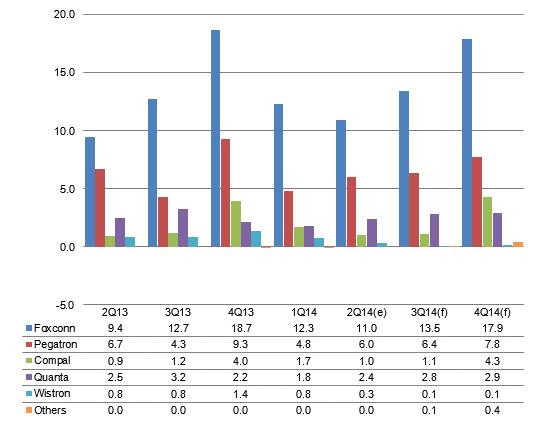

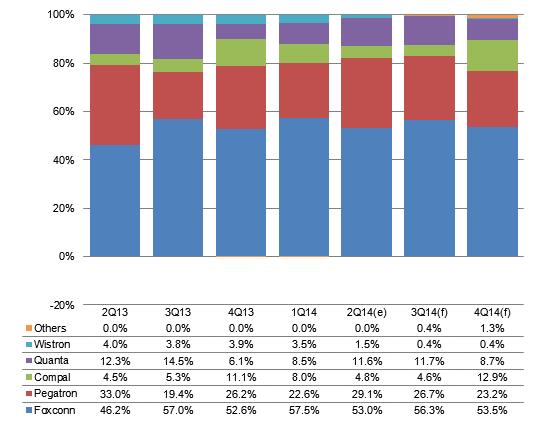

Chart 16: Shipments from Taiwan makers and share of global shipments, 2Q13-4Q14 (m units)

Chart 17: Taiwan tablet shipments by maker, 1Q12-2Q14 (m units)

Introduction

According to Digitimes Research, global shipment of tablets reached 55 million units in the second quarter of 2014, down 4.5% from the previous quarter and up 17.9% year over year. Major non-Apple brands that were expected to be market leaders failed to perform as forecasted in terms of new product shipment in the second quarter due to factors including market saturation of small-sized Wi-Fi tablets, low season effects, labor shortages within the supply chain, and low yields. Apple continued its sales slump while shipment of non-branded tablets increased despite the downward trend thanks to the growing market of phablets in emerging countries.

Samsung Electronics, Lenovo, and Asustek - major players among non-Apple brands - all failed to perform up to expectations, with Samsung showing the most significant decline. Samsung was unable to continue its momentum from the previous quarter in that its mid-range to high-end Android products did not stand out from the competitors, its attempt to penetrate the 8-inch market fell short, and its low-priced products did not have an effective C/P ratio. Lenovo revised down its numbers for the second quarter as its phablet sales in China failed to meet expectations, and there was a labor shortage for some of its products lines. Asustek remained in the struggle to shift its product focus to low-priced phablets. Overall shipments of non-Apple tablets reached a mere 18.96 million units in the second quarter, down 12.7% from the previous quarter.

Tablet shipment of market leader, Apple, continued to slide downward to 14.1 million units, declining by 10% quarter over quarter, with the sales focus turning to the iPad mini Retina. However, non-branded tablet shipments increased to 22.3 million units. In terms of sizes, the share of branded tablets with 10-inch or larger screens continued to increase for the fourth consecutive quarter. The share of tablets with 8.x-inch screens dropped below 10% again due to poor sales by Samsung.

As for shipments related to Taiwan ODMs for branded tablets, shipment of branded tablets by Taiwan manufacturers dropped below 20 million units in the second quarter, accounting for about 60% of total shipments. Pegatron and Quanta Computer increased their shares in the second quarter with respect to ODM shipments thanks respectively to increased sales of the iPad mini Retina and orders from Asustek for its top-selling products.

2H14 forecast

Digitimes Research predicts that in the second half of 2014, non-Apple tablet suppliers that had to combat adversities in terms of both supply and demand in the second quarter, resulting in second quarter results below expectations, but there will be a rebound in the third quarter. In addition, as Apple's iPad Air 2 is to move into an inventory preparation schedule and white-box manufacturers are expected to maintain similar growth from the same period last year, Digitimes Research forecasts third quarter tablet shipment will reach 68.51 million units, up 23.8% from the second quarter. However, looking forward to the fourth quarter, Digitimes Research sees a mere 0.5% yearly increase in fourth quarter 2014 global tablet shipments as the overall tablet market reaches saturation despite the stimulation from the new Android L with significant updates, the explosive growth in low-priced, large-sized Windows tablets, as well as the steady expansion of phablet shipments in emerging countries.

Shipments of iPad in the third quarter are anticipated to resume growth. However, as there is no plan to launch new 7.85-inch iPad in the second half of 2014, on top of factors including declining demand from mature markets and the substitution effect from the iPhone, fourth quarter shipments are expected to drop by more than 10% from the same period in 2013. Samsung Electronics will show a slight increase in its third quarter shipments and will attempt to boost numbers in the fourth quarter high season by enhancing its tie-inch sales and price-slashing strategies. Lenovo and Asustek will both concentrate firepower on low-priced phablets and Windows two-in-one products in the second half of the year. Shipments from platform suppliers including Amazon, Microsoft, and Google will continue their downward trend.

The share of branded tablet shipments by Taiwan suppliers will stop sliding in the second half of 2014 after a slump starting from 2013. Among those, Foxconn is expected to show higher growth thanks to new orders for the iPad Air 2 and Xiaomi tablets. Compal will surpass Quanta in the fourth quarter owing to orders from Amazon.

Key factors affecting tablet shipments in 2H14 forecast

Supply side

Digitimes Research concluded that the tablet market in the second quarter of 2014 faced adverse conditions in terms of both supply and demand. The most significant factor on the supply side was Samsung's second quarter numbers failing to meet expectations. The growth momentum the company had previously seen in all its tablet lines was unable to be carried on to the second quarter.

This is mainly because its mid-to-high priced Android products have no outstanding difference from either the iPad or its own prior generation products. Samsung originally expected to increase its 8.x-inch market share but still failed to break the 20% mark. Its low-priced phablets could also not overcome its premium pricing in emerging markets.

Lenovo and Asustek also performed below expectation in the second quarter due to a number of factors. The cost/performance ratio for Asustek's Wi-Fi tablets were not much better compared to last year, and its product focus has not yet completely shifted to the Fonepad.

Lenovo's main phablet products were impacted by low-cost, large-screened smartphones from other manufacturers, and supply of its big-sized tablets was limited by problems of labor shortages.

Demand

The demand side also suffered some unfavorable conditions. In addition to the second quarter being the low season, the iPad and small-sized Android tablets originally leading market demand both encountered market saturation.

Apple iPad products and Samsung's promotional power both failed to effectively stimulate market demand.

Note: The more stars, the higher the influence.↓indicates negative influence, ↑indicates a positive influence.

Source: Digitimes Research, July 2014

Key factors affecting tablet shipments in 2H14

Supply side

Favorable factors on the supply side in 2H14 are mostly due to brand suppliers focusing power to boost shipments in the high season.

Inventory preparation for the iPad Air 2 is scheduled for August. As such, third quarter shipments are expected to resume to past yearly growth rates, casting away the shadow of the past six months.

The launch of the second generation iPad mini Retina is likely to be postponed to 1Q15. The large-sized iPad will be available in small quantities in December, 2014.

Growth of Lenovo 7-inch phablets is slowing down due to substitution effects from large-screened smartphones and the influx of other brands into the market.

However, low-priced 8-inch and 10-inch products that strike a good balance between CP ratio and brand awareness are expected to show further increase in shipment after supply resumes.

Moreover, the launch of second-generation Yoga Tablet and new high-end 8-inch products are planned in the second half so fourth quarter growth is anticipated.

In terms of Windows tablets, the focus will be shifted away from 8-inch high-end business Windows models to low-cost, large-screened products lines. Other PC brand suppliers are beginning to penetrate into the market with similar products. However, Windows tablets remain a major driving force in Asustek's 2H14 shipments.

Asustek started to move its Android sales focus to low-priced phablets in the first half of 2014 and will continue to enhance its cooperation with telecom operators and sales channels in emerging markets in the second half of the year.

It is feared that the MeMo Pad will not be able to sustain the growth of the Nexus brand. In addition, the 7-inch Wi-Fi tablet market is reaching saturation and that will also affect demand in the traditional high season.

Acer phablets joined the game later, and supply chain adjustments and a shortage of parts will also affect its shipment schedule. Although the Switch 10 will bring 200,000 units in quarterly shipments in the second half of the year, this will not be able to make up for the decline in Android tablets.

Note: The more stars, the higher the influence.↓indicates negative influence,↑indicates a positive influence.

Source: Digitimes Research, July 2014

Another supply issue will come from Intel, which invested a great deal of capital and labor into the CTE project, which will bear fruit in the white-box Android market in the second half of the year. However, shipments are only expected to show limited growth.

For Windows products, as the T100 has presented impressive sales and prices of Windows tablets are more attractive, shipments of both branded and white-box Windows tablets will rise in the second half of the year.

Costs of Windows tablets have decrease compared to 2013 as Microsoft has reduced license fees and optimized its operating system, and Intel has lowered processor spec requirements and increased subsidies.

Demand

On the demand side in the second half of the year, although traditional high season effects will fuel demand and phablet markets in emerging countries will continue to grow, the global tablet market in the second half will still suffer from demand saturation in small-sized Wi-Fi tablets and a decline of iPad sales in mature markets.

Furthermore, shipments in the second half will also be subject to influence from factors including US$249 notebook computers taking a bite out of the market of similarly-priced tablets, the 5.5-inch iPhone 6 crowding out the iPad mini from its own family, and wearable devices bought as holiday season gifts taking away from budgets that may have gone to tablets.

Note: The more stars, the higher the influence.↓indicates negative influence,↑indicates a positive influence.

Source: Digitimes Research, July 2014

Shipment breakdown

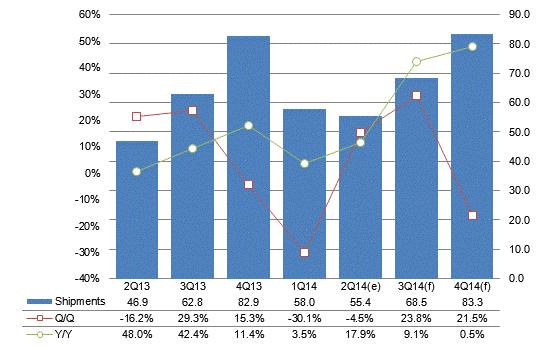

Chart 1: Global tablet shipments 2Q13-4Q14 (m units)

Source: Digitimes Research, July 2014

Based on statistics from Digitimes Research, global shipment of tablets reached 55 million units in the second quarter of 2014, slightly down 4.5% from the previous quarter and down double digits from the same period the previous year.

Shipments fell short of expectation by 10%, mainly because of numbers not reaching expectations from major non-Apple brand products.

2H14 forecast

The global tablet market in 2014 will face a significant decline as demand for high-end consumer tablets in mature markets is weakening, there is little about the iPad to look forward to in the second half of the year, and growth in white-box tablets is coming to a halt.

White-box tablets will show almost zero growth in the third quarter compared to the same period in 2013, causing the yearly increase of third quarter shipments to drop back to single digits.

Branded tablets will show obvious growth in the third quarter due to inventory preparations for the high season. However, shipments of mainstream white-box tablets will only maintain at the same level as 2013 as the product specs and prices are similar to those in the first half of the year.

Fourth quarter shipments will only increase by 0.5% from the same period in 2013, setting the record for the lowest quarterly growth for the fourth quarter since Digitimes Research began covering the market.

iPad will see a tremendous decline in high season effects in the fourth quarter while white-box tablets can merely sustain similar shipment levels.

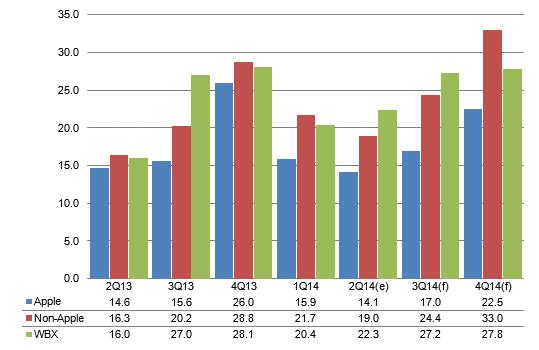

Shipments by product

According to Digitimes Research, among shipments by the major three groups of tablet suppliers, iPad and non-Apple brands both showed quarterly declines of more than 10% while non-branded tablets grew against the downward trend.

Shipments of non-Apple brands reached 18.96 million units, down 12.7% from the previous quarter but up 16.1% from the same period last year. The original forecast expected non-Apple brands to grow by 10%.

However, non-Apple brands underperformed in the second quarter as major players including Samsung, Lenovo, and Asustek all presented below-expectation numbers.

Shipments of the iPad reached 14.1 million units, down 10% from the previous quarter and slightly down 3.4% from the same period last year, due to market saturation and the second quarter being the slowest season of the year.

Shipments of the 9.7-inch iPad were 7.3 million units, accounting for 51.8% of total shipments, down 9.1 percentage points from the previous quarter. This is mainly because Apple increased its shipments of the iPad mini Retina and launched the iPad 4 in place of the iPad 2, but market demand for these products did not rise as a result.

Shipments of the iPad Air were 6.5 million units, remaining the top-selling single product. Shipments of 7.85-inch iPad were 6.8 million units, accounting for 48.2% of total shipments. Shipments of the iPad mini Retina was 4.4 million units, and iPad mini reached 2.4 million units.

As opposed to the decline in the branded tablet market, non-branded tablets maintained single-digit quarterly growth and expanded by 37.5% compared to the same period last year, benefiting from the booming low-priced phablet market in emerging countries.

In addition, profitability was not affected by currency devaluations in emerging markets as previously anticipated.

2H14 forecast

The three major groups of tablet suppliers will all see shipment increases quarter after quarter in the second half of the year. However, only non-Apple suppliers are expected to show double-digit growth for two consecutive quarters.

Major non-Apple suppliers encountered supply problems for some products in the second quarter, resulting in second-quarter shipments coming in below expectations, so they are taking actions to make sure inventory is replenished for the high season in the third quarter.

Platform providers, traditionally major driving forces in fourth quarter numbers, will see growth slowing down compared to previous years.

The new Android L with an enhanced user interface and efficiency in addition to the launch of more affordable consumer Windows tablets targeting the notebook replacement market will push fourth quarter shipments to a new high for branded hardware manufacturers.

Shipments of the iPad are expected to resume quarterly and yearly growth in the third quarter, but the fourth quarter will show declines for the first time.

In the third quarter, mass production of the iPad Air 2 will begin one month earlier than the schedule in 2013, which will bring third quarter shipments back to growth and the share of 9.7-inch iPad to 57.6%, up 5.8 percentage points.

Besides declining demand for the iPad in mature markets, the launch of the 5.5-inch iPhone 6 and iWatch in the fourth quarter will negatively affect shipments of the 7.85-inch iPad.

White-box suppliers will start preparations of inventory for the high season in emerging markets in July and August. Fourth quarter shipments will maintain the same level as the third quarter, almost no increase from the first half of 2013.

Chart 2: Shipments by product - iPad, non-iPad branded and white-box, 2Q13-4Q14 (m units)

Source: Digitimes Research, July 2014

Chart 3: Shipment share by product - iPad, non-iPad branded and white-box, 2Q13-4Q14

Source: Digitimes Research, July 2014

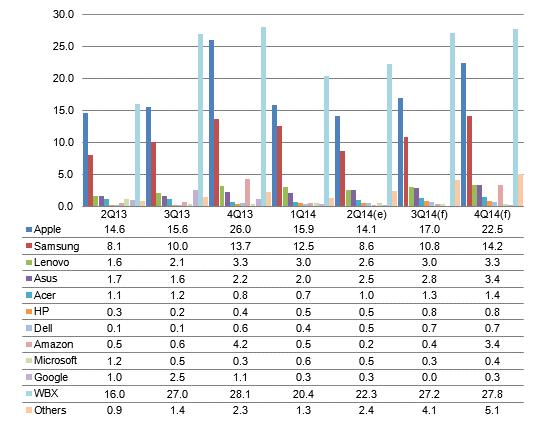

Shipments by vendor

The rankings of the top five brands in terms of shipments remained the same in the second quarter as the previous quarter.

However, Samsung's numbers declined by a greater extent than Apple, further separating the two companies apart in terms of their shares in overall global shipments. The market share of Samsung dropped below 20% in the second quarter.

Lenovo and Asustek became closer in terms of their shares as shipments of one company increased while the other decreased.

Shipments of 12.2-inch high-end products did not show improvement even after a price reduction of US$100 in the second quarter.

Shipment of the most complete line of 8.x-inch products, originally targeted to boost up to over 40% of total shipment in the second quarter, ended up falling short of 20%.

Specifications of the affordably-priced Galaxy Tab 3 Lite 7.0 equipped with 1024x600 TN screen and dual-core processors could not compete with similarly-priced counterparts equipped with a 1280x800 IPS screen and quad-core processor.

Lenovo maintained its third place position, with its share slightly dropping by 0.4 percentage points from the previous quarter as it suffered a poor performance in the China market and problems of supply chain labor shortage.

Asustek, ranked 4th with its share increasing by 1 percentage point from the previous quarter, started shipping 2014 new products in the second quarter. It was expected that Asustek would be able to beat Lenovo as it launched the line of Android products in the second quarter.

However, the C/P ratio of Intel's new Wi-Fi processors was not better than last year's. In addition, the Wi-Fi Android tablet market has reached maturity. Asustek' penetration into the low-priced phablet market started to bear some fruit but it still fell short of expectations.

Fifth place Acer launched its Switch 10 in the second quarter and entered the phablet market. Acer showed a market share increase of 0.7 percentage point from the previous quarter.

2H14 forecast

Samsung is expected to see a slight rebound in the third quarter from the previous quarter. In addition to launching a new Android for Work product, Samsung will enhance its promotion power with tie-inch sales and price reductions to stimulate high season sales in the fourth quarter.

Samsung KNOX provides security protection in Android for Work, giving Samsung an edge over competitors in terms of KNOX software updates and integrated hardware protection.

Amazon's new 6-inch and 7-inch low-priced tablets as well as its new 8.9-inch product are scheduled to begin shipping in August. Shipments for the year will still concentrate in the fourth quarter but will not be comparable to numbers in the same period last year.

The rise in Prime membership charges and a reduction in bundle offers for Kindle are unfavorable for growth of the Kindle Fire. The added Prime Music streaming service is available on both iOS and other Android devices.

Although Asustek's third quarter growth is not expected to beat its main competitors, it will lead Lenovo by a small step in the fourth quarter.

The product lines in the second half include detachable Windows tablets, phablets, and Wi-Fi tablets. The new metal model and cost down version of T100 will help maintain shipment levels in the second half of the year. The price of the new 8.9-inch model will be below US$300.

Moreover, the company's joint promotion with JD.com in China was successful. The progress in phablet sales made up for the decline in Wi-Fi tablets. Its performance in the Middle East and SE Asia markets were below expectations.

The contribution from Wi-Fi tablets will be more obvious in the fourth quarter.

The sales strategy for its Nexus tablets will turn to mid-range to high-end large-screened models. Shipment of new products will significantly slide in the fourth quarter from the levels of previous years. The production of the second-generation Nexus 7 halted in July. The 8.9-inch Nexus running Android L and launched with HTC will be shipping at the end of October.

Chart 4: Shipments by vendor, 2Q13-4Q14 (m units)

Note: Google and its brand vendor partners' jointly developed tablets are included in Google's shipments

Source: Digitimes Research, July 2014

Chart 5: Shipment share by vendor, 2Q13-4Q14

Note: Google and its brand vendor partners' jointly developed tablets are included in Google's shipments

Source: Digitimes Research, July 2014

Shipments by panel size

Samsung, the leader in shipments of 8.x-inch tablets in the first quarter, was unable to continue to increase its 8.x product shipments. Hence, its market share of 8.x tablets dropped below 10% again in the second quarter.

Shipments of 10-inch tablets did not decline along with the downward trend of overall tablet shipments, but instead increased compared to the previous quarter, with the share rising to 23.7%.

Shipments of 7-inch tablets regained the top position in terms of its share of total shipments.

As Apple turned its sales focus from iPad Air to iPad mini Retina in the second quarter, the share of its 9.x-inch products dropped by 3.6 percentage points.

2H14 forecast

The market share of tablets with 10-inch or larger screens in the second half of 2014 will see a less shrinking effect due to a shipment boost of low-cost small-sized tablets in the high season and the segment will be able to take more than 20% of the market in the third quarter.

This is mainly because low-priced Windows tablets and Android for Work will help push the sales of large-sized tablets. Although the share of 10.x-inch tablets is decreasing quarter after quarter, shipments still keep growing.

The market share of 11-inch or larger tablets is expected to increase to 3% in the second half. The market share of 8.x-inch tablets is expected to increase above 10% again in the second half.

In addition to existing 8-inch tablets, major hardware brand suppliers will invest in 8.9-inch and 8.4-inch new products.

Chart 6: Shipments by panel size, 2Q13-4Q14 (m units)

Source: Digitimes Research, July 2014

Chart 7: Shipment share by panel size, 2Q13-4Q14

Source: Digitimes Research, July 2014

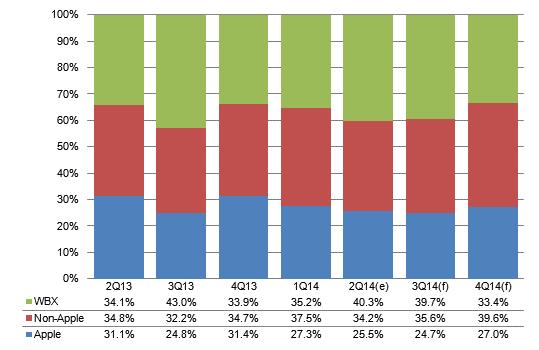

Shipments by touchscreen technology

Samsung's shipments in the second quarter were below expectations causing the market share of GFF technology adopted by Samsung to decline for the first time.

The share of OGS increased by 1.7 percentage points from the previous quarter thanks to a rise in large-sized tablet shipments.

2H14 forecast

G1F will exit the market after production of the Surface Pro 2 and Surface 2 halts.

Shipments of OGS tablets will increase quarter after quarter in the second half thanks to growth in large-screened Windows tablets.

Chart 8: Shipments by touchscreen technology, 2Q13-4Q14 (m units)

Source: Digitimes Research, July 2014

Chart 9: Shipment share by touchscreen technology, 2Q13-4Q14

Source: Digitimes Research, July 2014

Shipment by OS

The market share of iOS in the second quarter remained about the same level, 42.6%, as the previous quarter.

Android accounted for 50.9%, slightly down 1.2 percentage point from the previous quarter.

The share of the Windows operating system grew consecutively for the second quarter attributing to the availability of affordable detachable tablet products.

2H14 forecast

The market share of Windows tablets will significantly rise in the second half of 2014 compared to 2013. In terms of shipments, Windows tablets will set records for new highs consecutively in the third and fourth quarters.

Major PC brands including Asustek, Lenovo, Acer, and Hewlett Packard (HP) have already launched or will launch low-priced Windows tablets in the second half of the year.

The Surface Pro 3, the top-selling Microsoft tablet over the years, will still perform well in the second half of the year.

Chart 10: Shipment by OS, 2Q13-4Q14 (m units)

Source: Digitimes Research, July 2014

Chart 11: Shipment share by OS, 2Q13-4Q14

Source: Digitimes Research, July 2014

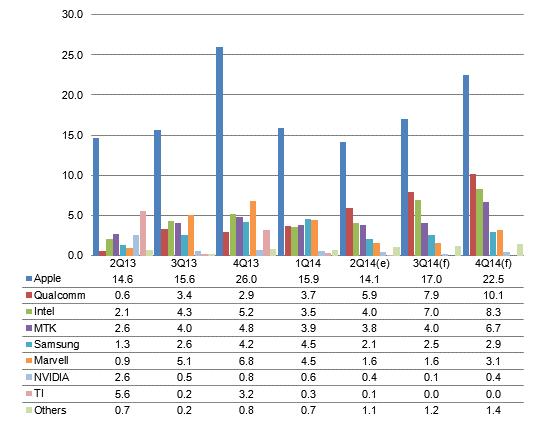

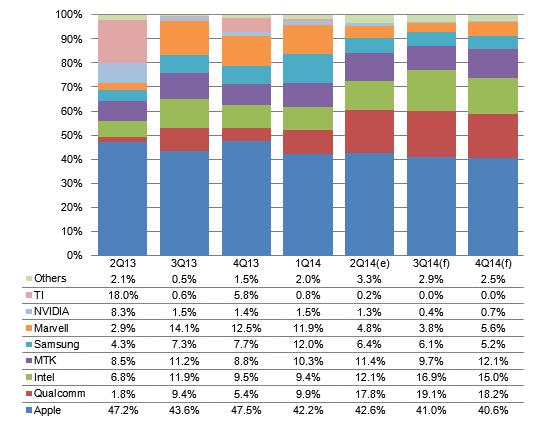

Shipments by AP supplier

The ranking of branded tablet processors in the second quarter in terms of market share was as originally expected. Apple secured its leading position while Qualcomm, Intel, and MediaTek, respectively adopted by Samsung, Asustek, and MediaTek, took the 2nd to 4th places.

The Snapdragon 400 from Qualcomm adopted in Samsung Galaxy Tab 4 was expected to boost the share of Qualcomm processors to above 20%. However, as Samsung's shipments dropped, Qualcomm's share was only able to reach 17.8%.

Intel's share was able to reach 12.1% in the second quarter thanks to Asustek as well as other major PC brands launching new Android and Windows tablets. Intel shipped 10 million tablet processor chips in the second quarter, which shall power third quarter shipments by its end-product customers.

2H14 forecast

The rankings of processors in terms of market shares are about the same as the second quarter, with Intel showing an obvious increase in its share, benefiting from Asustek's shipments for the high season and sales of low-priced Windows tablets.

Intel announced second quarter shipment of tablet processor chips reached 10 million units in the second quarter, which will mainly power its end customers' product shipment in the third quarter and help Intel secure its third place position.

Amazon's low-cost model, the fourth-generation Kindle Fire, will use processors from MediaTek, causing Texas Instruments to exit the market in the third quarter and driving MediaTek's fourth quarter shipment to go over 6 million units.

Chart 12: Shipments by AP supplier, 2Q13-4Q14 (m units)

Source: Digitimes Research, July 2014

Chart 13: Shipment share by AP supplier, 2Q13-4Q14

Source: Digitimes Research, July 2014

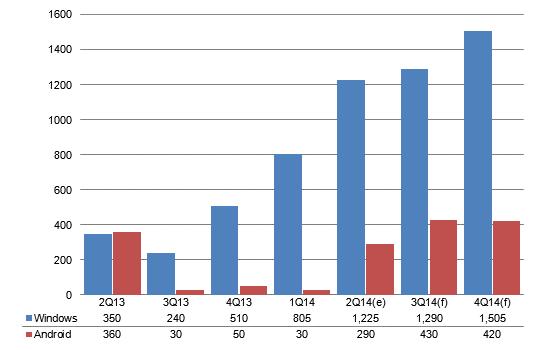

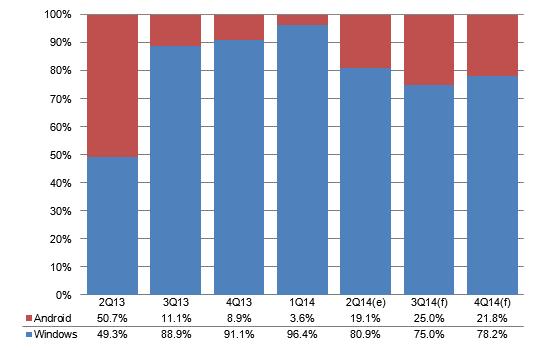

Shipments of detachable notebooks by OS

Shipments of detachable tablets will reach 1.515 million units in the second quarter, 80% of which use the Windows operating system. Digitimes Research has revised its shipments of Windows tablets from 1.46 million units to 805,000 units in the first quarter.

Second quarter shipment of detachable Windows tablets, with the exception of the T100, continued the momentum to jump by 52.2% from the previous quarter with Switch 10 shipments reaching almost 200,000 units.

Growth of Android tablets was mainly due to the launch of Asustek new product TF103.

2H14 forecast

The second half of 2014 will see more and more detachable models of Windows tablets entering the market quarter by quarter as a result of continuing investment by PC brands. The 2014 total for shipments is expected to reach 4.83 million units.

There will be an increase in the number of suppliers, tablet models, as well as size choices in the second half of the year. The sales focus is expected to concentrate on 10.1-inch models with a moderate size and low price.

Detachable 12.x-inch tablets powered by IntelCore M processors will only begin to contribute to the numbers in 2015.

Chart 14: Shipments of detachable notebooks by OS, 2Q13-1Q14 (k units)

Source: Digitimes Research, July 2014

Chart 15: Shipment share of detachable notebooks by OS, 2Q13-1Q14

Source: Digitimes Research, July 2014

Shipments of x86-based tablets

As Asustek, major brand of Android tablets powered by Intel processors, performed below expectations in the second quarter, shipments of AOI (Android on Intel) tablets were only 2 million units, leading WOI(Windows on Intel) tablets by merely 180,000 units. AOI and WOI each accounted for about half of the market share in the second quarter

2H14 forecast

Taking advantage of subsidies from Intel and dual OS options, new suppliers will adopt Intel solutions in Android tablets in the second half of the year, therefore raising the share of AIO products (Android on Intel) in the second half.

According to Digitimes Research, in addition to Asustek, Acer, and Dell already switching to Intel processors for their major Android tablet products, there will be new heavyweight players joining the game in the second half of 2014.

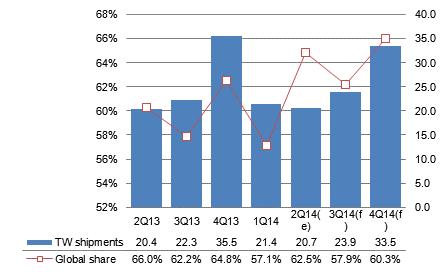

Shipments from Taiwan makers

Tablet shipments by Taiwan makers expected to drop to 19.67 million units, down 8.3% from the previous quarter and down 3.7% from the same period in 2013.

However, the market share of Taiwan makers slightly increased to 59.5% as shipments by Samsung significantly declined from the last quarter.

2H14 forecast

The market share of Taiwan makers will drop to 57.9% in the third quarter, but shipments will increase. This is mainly because the share of Samsung will rise and Lenovo's new second-generation Yoga Tablet is manufactured by Lenovo itself or other local China makers.

The market share of Taiwan makers will increase again to 60% in the fourth quarter thanks to the high season effects for the iPad, Amazon, and Asustek tablets, with shipments declining by 5.8% from the same period in 2013.

Chart 16: Shipments from Taiwan makers and share of global shipments, 2Q13-4Q14 (m units)

Source: Digitimes Research, July 2014

Chart 17: Taiwan tablet shipments by maker, 1Q12-2Q14 (m units)

Source: Digitimes Research, July 2014

Chart 18: Taiwan tablet shipment share by maker, 2Q13-4Q14

Source: Digitimes Research, July 2014

As shipments of the iPad Air showed signs of slowing, shipments by Foxconn decreased to 9.95 million units, dropping by 2.37 million units from the previous quarter.

Pegatron shipments increased by 1.17 million units to 6.01 million units owing to the launch of the 7.85-inch iPad and Asustek Wi-Fi products. Quanta Computer, the OEM for Asustek's main products, the T100 and Fonepad, was therefore able to show second quarter shipment growth to 2.39 million units.

Compal Electronics shipped only 1 million units, down by 710,000 units from the previous quarter, as Acer turned to OEM in China, a labor shortage for Lenovo tablets remained a problem, and iPad production was still in pilot run mode.

Wistron's shipment dropped to 320,000 units as it has lost orders from Acer and Asustek is transferring its orders to other OEMs.

2H14 forecast

The market share of Foxconn will obviously increase in the third quarter attributing to early shipments of the second-generation iPad and the addition of new customer, Xiaomi. Its share in the fourth quarter will slide, but shipments will remain the highest in the year, to reach 17.9 million units.

The market share of Pegatron will drop in the second half of the year as Apple will not launch a new generation iPad mini.

Compal will regain its third place position in the fourth quarter owing to Amazon launching new products and the iPad mini shipping in small quantities.

Shipments of the 8.9-inch Nexus outsource manufactured by HTC is expected to only reach 25 thousand units in the fourth quarter.

The market share of Wistron will drop significantly in the second half as it has lost orders from two major customers, Acer and Asustek.