GaAs solar material maker Alta Devices boasts solar cells with an efficiency of 28.8%, but perhaps even more astonishing is the fact it can produce GaAs cells that are only 1-micron thick, which opens up the possibility of a whole new field of lightweight, flexible, mobile solar applications. The efficiency combined with the super thin form factor means that anything that can be moved, carried, or worn can eventually incorporate the technology.

Digitimes had the opportunity to meet with Alta Devices at the Euroasia event hosted by Globalpress in Silicon Valley and then had a chat with company VP Rich Kapusta during his recent visit to Asia.

Q: You have an efficiency of 28.8% with your solar cells. Can you explain how you achieve this?

A: The material we use gives us our efficiency. We start with gallium arsenide (GaAs), which is known to be the highest energy density material on the planet. This is the material used for panels used by the space program and has always been the best solar material possible for single junction applications. However, working with GaAs has always presented challenges. It is extremely expensive and cells have typically been produced on a wafer that is rigid and thick, meaning not very flexible.

The innovation we've provided is to figure out a way to grow the cell in a form factor that is extremely thin, giving us plenty of flexibility and reducing the material costs. The end result is that our cells are only 1-micron thick.

Q: How do you achieve such a thin form factor? Is it the materials or process?

A: We grow the cells on a standard 4-inch square GaAs seed wafer, which we purchase from a traditional semiconductor technology company in China. The innovation is in the manufacturing process.

The first thing we do is grow what we call a release layer on top of the wafer. This is a super thin layer of aluminum arsenide where the crystals are perfectly matched to the gallium arsenide. On top of that is where we grow our gallium arsenide solar cells. These cells are only about 1-micron thick, compared to about 600-650 microns for typical solar cells. We also place a coating of metal and a layer of PET (polyethylene terephthalate) to protect the back side of the solar cell.

Another key innovation Alta has developed is a process where we go back to the release layer and etch away all the aluminum arsenide. Etching that layer away separates the 1-micron GaAs layer from the seed layer, allowing us to then reuse the wafer. This overall process is the reason we can achieve such low costs for a GaAs solar cell. A 1-micron thick solar cell uses so little of the material that we can simply keep reusing the original wafer.

Q: What does it mean when you say you can achieve low costs? Are you competitive with rooftop silicon-based cells in terms of dollar per watt?

A: We don't really disclose our cost numbers but I am referring to GaAs when I talk about low costs. GaAs cells used in space run about a couple of hundred dollars per watt. We are probably an order of magnitude less than that, meaning we are under US$20 now and we fully expect to be in the single digits in the near future. Our scale is still small but we do have models that show that as we continue to grow our manufacturing capability, we will eventually be competitive with traditional silicon solar, whose costs today are in the US$0.70 range.

But this is beside the point because commodity solar is not our main market. Our value-added is the efficiency that allows for dense, compact designs and our form factor which is lightweight and has virtually no thickness. Combined, these two qualities provide incredible possibilities in the mobile markets – where there is strong demand. In addition, we have no competition because nobody else can do what we do. This will allow us to not only scale our business but to be profitable every step along the way.

Right now we have a very small 2MW pilot line in Sunnyvale, which in the grand scheme of solar is nothing in terms of capacity. However, even with that small capacity we have enough material to go after some extremely high value markets.

Q: Such as...

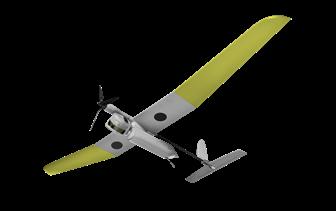

A: Military applications are our initial focus, in areas such as the UAV (unmanned aerial vehicle) market. For example, the US military has thousand if not tens of thousands of battery-powered UAVs. These UAVs are model-sized airplanes that are flown to basically set up a communications network or used in surveillance. Under the current system they fly for about an hour and then come back down to recharge. By applying our solar technology to the wing structure we've proven that we can essentially allow these UAVs to fly all day in the sun, changing the usage model from constantly recharging to launching one time in the morning and having soldiers going out to retrieve it in the evening.

This is a huge value proposition for the military. You can set up more complex communication networks that are more consistent and reliable and can be sustained for a longer period of time if you are not constantly trying to manage it with planes going up or down. Also, the UAVs can be damaged when landing. However, the key value for the military is in battle zones, where reducing the number of landings/take offs can significantly reduce the risk of life, because it means fewer times are needed for solders to go out to retrieve the UAVs from the field.

So this is a pretty decent sized market and we are the only one who can provide a solution.

UAVs also can be applied for civilian use in farming applications, border patrol applications, pipeline management and even can be used by the news media. UAVs will eventually be used to address any problem that is currently done by sending someone out into the field or sending out a helicopter. We will be able to enable these UAVs to be out in the field for a much longer period of time.

Q: Do you already have products deployed?

A: We are currently in the testing stage, having the military validate that our technology works.

Q: Do you have any other products being tested in the market?

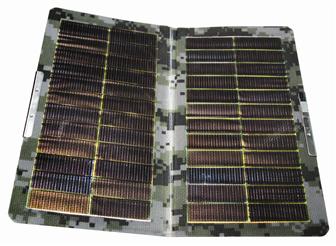

A: We are also working with the military on a charging mat. Soldiers out in the field can carry a mat that can be folded like a space blanket but can also provide 10W, 20W or 60W of power, depending on the size. This allows soldiers to carry less weight because they can use solar to recharge as opposed to having to carry additional batteries or to figure out how to carry a generator.

Q: What about other market segments, like the consumer space?

A: I believe the CE market is going to be a really big opportunity for us. For example, we have prototypes of phone covers that can be put on a typical smartphone. These covers can provide 1.3W of energy (literally) inside an office. With that amount of energy, a smartphone's battery life can be extended by about 10%. That doesn't sound like much but then again, think about how much R&D is being done in the semiconductor industry, display industry and battery industry to reduce power and extend the life of smartphones. We can do it simply by adding solar to the back of the phone and we can do it at a reasonably low cost. Moreover, this example is for someone who is inside the office all day. If you are spending more time outdoors, that number goes up dramatically for extending the battery life.

For a typical tablet, the added surface area provides for about 10W of space, which is the same as plugging the device into a wall. Think about it, having the smartphone or tablet beside you while at lunch or at Starbucks would give you a charge for the rest of the day.

We can uniquely enable these types of applications because of the thinness of our cells. We add basically no thickness to the phone itself because we can directly integrate into the case of the device. And there is no added weight because our solar cells probably weigh less than the plastic they are replacing. So with very little added cost and no change to the form factor, we can uniquely enable the ability to charge on the go.

Then there are a whole range of mobile charging possibilities in developing nations where electricity for charging is much harder to come by than is coverage for mobile devices.

These are examples of markets that people have tried to go after in the past but they never succeeded because the technology and prices points have never been that suitable.

The other big opportunity for us is the automotive market. Think about solar embedded in car rooftops, which is something we expect will happen over the next five years. With our density we can get over 400W on top of a small car.

Q: That's a lot of demand for a 2MW facility to take care of. What are your capacity expansion plans?

A: We break ground on a new factory this year and that factory will be in production at the end of 2014. Capacity will initially be approximately 40MW but we will be able to scale it to about 200MW. When we get to that point, which is still not huge capacity, it will give us a cost structure that will allow us to go after these bigger markets. I expect related products to be available in the CE market first, simply because that market moves so quickly. The automotive market tends to be a little slower but we will be able to address all the markets we are targeting with capacity from our first factory.

Q: I know you mentioned that you don't talk about costs per watt, but how much can we expect to pay for some of these consumer devices such as covers for a smartphone? A solar tablet cover would make a nice present, but not at US$200.

A: We expect that these products will in the few dollars per watt range in terms of price – not cost but price. So, as a consumer you can expect to pay US$3-4 for the amount of solar you are putting on the smartphone.

Q: So a US$50 iPad cover that eliminates the need for charging is not out of the question?

A: It makes sense. And if someone were to integrate that into the tablet, it would be an interesting way to differentiate a product. Therefore we are currently talking to both OEMs and ODMs to gauge interest.

Q: In terms of efficiency, what is your roadmap?

A: We are currently at 29% for single junction cells but we have already demonstrated the ability to grow dual junction cells. We should be able to get to 33% this year with dual junction and when we scale our production facility, we fully expect that it will be dual junction cells that are mass produced.

We also have the ability to grow triple junction cells and we expect those to be in the 38% range. They are a little more expensive to make and a little more complicated from a process standpoint. However, when we can produce them in quantity, it does open up the satellite market for us, if that's where we want to be. But we expect that dual cells at 33% will service the majority of our demand.

Q: What are the origins of the company? You appear to be a solar company but a lot of your staff have a semiconductor background.

A: The company is five years old. It was started by two professors who are very famous in the area of photonics and are well-known by everyone in the solar industry – Harry Atwater and Eli Yablonovitch. Eli has been doing what is called epitaxial lift-off (ELO) for years but he was doing it on postage stamp sized substrates. The challenge for the company was how to make it work on a 4-inch square wafer. So development and R&D has been focused around how to turn this concept into something that can be manufactured. That meant bringing in a lot of people involved with semiconductor equipment and manufacturing. So a lot of the know-how in the backend concerning how to make a factory that works reliably with good yields, that came from the semi world

Q: How much of the manufacturing equipment is custom?

A: We have 16 steps in the manufacturing process and three of them are custom. So we do have a lot of off-the-shelf tools that you can find in either the semiconductor industry or in the solar industry. But the three steps that are unique to us are the ability to grow the cell quickly, the ability to etch the release layer reliably, and the ability to stitch the results together in sheets of any size or shape. These custom tools involve more than 77 patents on the related technologies. In addition, the volume of trade secrets makes it highly unlikely our process can be reverse engineered. We are talking about very high barriers to entry from a technology standpoint.

Q: How about licensing the technology to someone who feels they have manufacturing expertise?

A: We are looking at that but there are no official plans. If there are people out there who want to build a 10GW factory in China somewhere, we can certainly enable them to do that. But we are not going to do that right now. We are taking this one step at a time.

Q: You mentioned being profitable on your way to growth, can you tell me a bit about your financial status?

A: We are currently in the midst of (series) D-Round financing. We have already raised US$120 million over three previous rounds, and we are now looking to raise US$40 million more. Our current lineup of investors includes tier-one silicon valley VC firms such as KPCB, August Capital and Crosslink Capital, as well as a strong mix of corporate strategic investors. The interesting thing is that we plan to become cash-flow positive in 2014, so we expect that this round will be the last equity needed for the company, which is pretty incredible – breaking even on a US$160 million investment with only 2MW of capacity.

Alta Devices VP Rich Kapusta

Photo: Company

Solar charging mat

Photo: Company

Flexible solar cell

Photo: Company

Solar handset case

Photo: Company

epitaxial lift-off (ELO) tool

Photo: Company

Solar powered UAV

Photo: Company

Solar-powered tablet

Photo: Company