Introduction

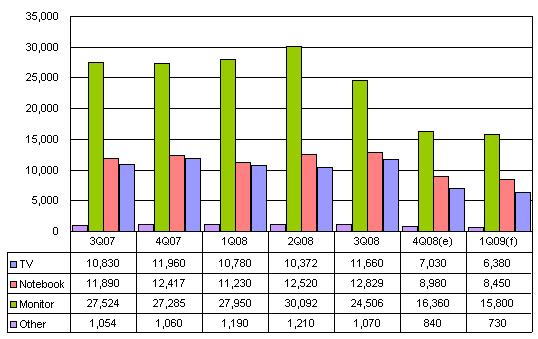

- Taiwan shipped 33.2 million large-size LCD panels in the fourth quarter of 2008, down 33.7% sequentially and down 37.0% from the same period one year earlier.

- Large-size LCD shipments will drop further in the first quarter of 2009 with a 5.6% sequential decline and a 38.7% on-year decline.

- Taiwan shipped 188.6 million large-size LCD panels in 2008, representing growth of 1.2% from 2007, and Taiwan's share of the global market dropped to 43.1%.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers

Chart 1: Large-size TFT LCD shipments, 3Q07-1Q09 (k units)

Source: Digitimes Research, January 2009

Industry watch

- In the first three quarters of 2008, Taiwan makers were still leading Korean rivals in large-size panel shipments. But Taiwan's market share plunged to 36.3% in the fourth quarter as orders chilled quickly amid the worsening economy, but Korea's share rose to 50.9%. The depreciating Korean currency gave the Korean makers a competitive edge in pricing. At the same time Taiwan makers, which had been heavily depending on orders from such big TV brands as Samsung, LGE, Sony, saw these clients suspending their orders and rely more on in-house production.

- Taiwan's LCD TV panel shipments were strong in the first three quarters. CMO even climbed to the top notch in worldwide TV panel shipments in the third quarter. But in the fourth quarter, Taiwan's TV panel shipments declined almost 40% sequentially, compared to Korea's drop of only 5.8% for the period. For the full year of 2008, Taiwan's TV panel shipments grew only 7.8% to 45.65 million units from 42.32 million units in 2007.

- For other applications, their 2008 shipments were even worse, with monitor and notebook panel shipments both seeing on-year declines. But the share of notebook panels in overall large-size shipments increased to 24.2% in 2008, as average notebook price dropped below US$1,000, accelerating the replacement of desktop PCs.

- In 2009, one major issue worldwide panel makers of large-size panels have to tackle is the slower growth in demand than in capacity. Global large-size panel production capacity is estimated to increase 11% in 2009, an estimation that has already taken into consideration of makers' moves to suspend new plant construction or delaying capacity expansion for their 5G, 7.5G, 8.5G or 10G lines. However, demand is estimated to increase by only 6% in 2009.

- While Taiwan makers AUO, CMO, and CPT are suspending capacity or delaying equipment installation at new plants in 2009, Korean makers will be expanding faster. Samsung plans to expand its 7G and 8G production lines, and LG Display (LGD) its 6G, 7.5G and 8.5G in 2009.

- Taiwan's capacity is estimated to increase only by 1.5%, while Korean capacity is estimated to increase by 23% this year. As a result, Taiwan's share of worldwide large-size panel capacity will shrink in 2009. Korean rivals' capacity share will increase to 51% in the fourth quarter of 2009.

Shipment breakdown

Breakdown by application

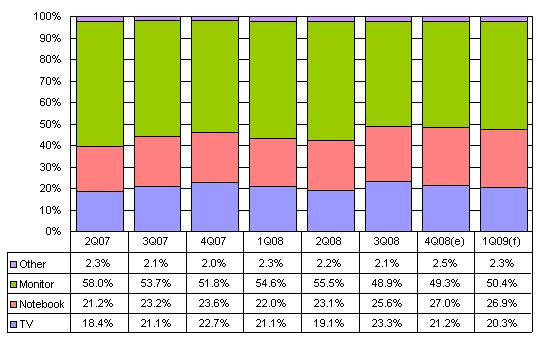

Chart 2: Shipments by application, 3Q07- 1Q09 (k units)

Source: Digitimes Research, January 2009

- Shipments dropped across all application categories in the fourth quarter, with the TV segment seeing the biggest decrease of 40%, followed by the monitor segment's 33% and the notebook segment's 30%.

- In the first quarter, shipments for all categories will continue dropping. But the monitor segment will see the slightest decline of 3%, followed by the notebook segment's 6% and the TV segment's 9%. With suppliers planning to raise monitor panel prices, clients are likely to place orders ahead of the price hikes.

Chart 3: Shipment proportion by application, 2Q07-1Q09

Source: Digitimes Research, January 2009

- Monitor applications remained the top segment in the fourth quarter. But the share of shipments, despite a slight rise, was below 50% for the second quarter in a row.

- During the fourth quarter monitor panel shipments from Chunghwa Picture Tubes (CPT), HannStar Display, and Innolux Display dropped 32%, 52%, and 40% respectively compared to the third quarter.

- In the first quarter, monitor panels' share may rise back above 50% because of the segment's slightest shipment drop among all panel categories.

Application by size: Monitor panels

Chart 4: Monitor panel shipment proportion by size, 3Q07- 4Q08

Source: Digitimes Research, January 2009

- Monitors of new sizes (15.6-inch widescreen, 18.5-inch widescreen, and 21.x-inch) had yet to be able to drive growth for the overall market in the four quarter.

- Besides the 22-inch widescreen, the two new sizes, 21.5-inch widescreen and 21.6-inch widescreen, helped drive up the proportion of the 20-inch-and-larger segment by 5.5 percentage points.

Application by size: Notebook panels

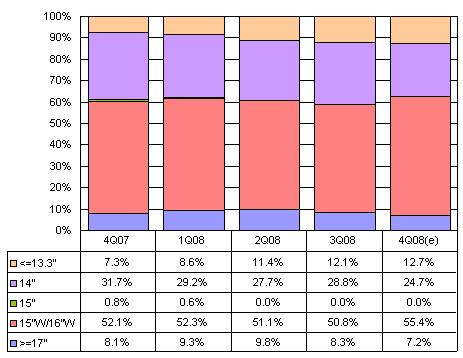

Chart 5: Notebook panel shipment proportion by size, 4Q07- 4Q08

Source: Digitimes Research, January 2009

- The 15.4-inch widescreen remained the mainstream sharing 49.9% of the total notebook panel shipments in the fourth quarter.

Application by size: TV panels

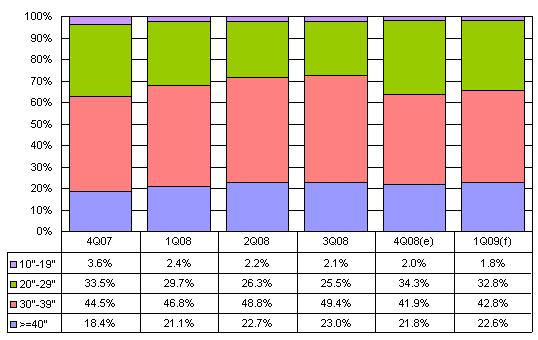

Chart 6: TV panel shipment proportion by size, 4Q07- 1Q09

Source: Digitimes Research, January 2009

- Shipments to the 30-39-inch and 40-inch-and-larger segments dropped as Samsung Electronics and LG Electronics (LGE) reduced orders for 32-inch, 40-inch and 42-inch panels and relied more on in-house production for them instead.

- AU Optronics (AUO) and Chi Mei Optoelectronics (CMO) saw their 32-inch panel shipments lag behind Sharp, who used its 8G production lines to process 32-inch panels in the fourth quarter.

- The shipment proportions for 22-inch and 26-inch panels were 7.8% and 26.6% respectively, while the proportion of 46-inch panels dropped to 2.8%.

- The shipment proportions in the first quarter 2009 will not have significant changes.

Outlook till 2011

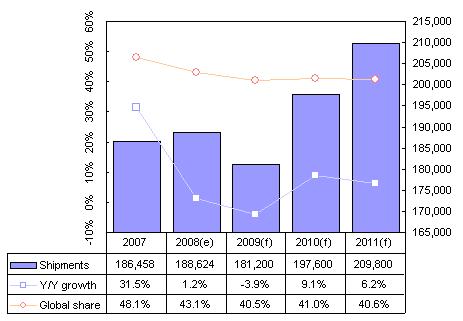

Chart 7: Taiwan large-size panel shipments and global market share, 2007-2011

Source: Digitimes Research, January 2009

- Taiwan panel makers' capacity increase will lag global average, as they put on hold their expansion plans amid the ongoing economic downturn, which is hitting Taiwan panel makers harder than their Korean rivals. Shipments for 2008 are estimated to have grown only slightly, and shipments for 2009 will decline, as the global economy is unlikely to improve much.

- Taiwan panel makers will see their global market share drop in 2009 as closer cooperation between their foreign competitors and their first-tier TV clients will weaken the Taiwan makers' relationship with those clients.