Wintec Industries, a US-based third-party ODM/OEM DRAM module supplier, announced that it will manufacture a Wi-Fi-supported SecureDigital (SD) card, for Eye-Fi.

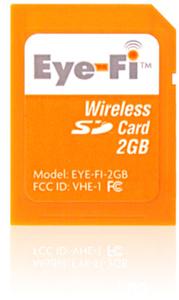

Eye-Fi unveiled its Wi-Fi SD card on October 30. The SD card that supports Wi-Fi connectivity has a 2GB memory density and is now available only in the US with a suggested retail price of US$99.99.

According to the companies, the connectivity range is 90+ feet outdoors and 45+ feet indoors. The card works with 802.11g, 802.11b and backwards-compatible 802.11n wireless networks. This Wi-Fi SD card currently does not support connection to "hot spots," but instead is limited only to home networks or other open or network password based networks.

The companies highlighted that photos can be uploaded wirelessly to PCs, and online photo galleries such as Flickr, Facebook and Picasa. The card can be used in digital cameras that support the SD memory standard.

No more cables required when uploading pictures

Photo: Company