Asustek Computer has launched the KFSN4-DRE series server board and RS161-E5 server system with advanced design guidelines and equipped with the latest Dual Dynamic Power Management and Dual Link technology for native quad-core performance, targeting at the high-performance computing (HPC) market and enterprise-class applications.

The KFSN4-DRE series are the first Dual Dynamic Power Management ready platform with front parallel-balance CPU and memory placement designed to increase thermal efficiency by up to 20-30%, claimed Asustek.

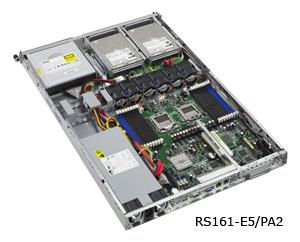

Along with the KFSN4-DRE server board, the upcoming RS161-E5 is Asustek's next-generation dual Opteron processor-based 1U server system. Featured with Asustek's Smart Fan 2 Technology to automatically adjust cooling conditions based on the system workload and ambient temperature.

| Asustek KFSN4-DRE server motherboard specification | |

| Item | Detail |

| Processor Support | Two quad-core AMD Opteron 2x00 series processors |

| Core Logic | Nvidia nForce Professional 2200 |

| Memory | 16 DDR2 533/667 up to 64GB |

| Storage | Built-in 4-port SATA |

| RAID Support | Four SATA Ports, RAID 0, 1, 10, 5 (Windows) |

| NIC | Two Broadcom BCM 5721 PCI-E GbE LAN |

| Onboard Gfx | XGI Z9s VGA Controller / 32MB DDR2 VRAM |

| Expansion | One PCI Express x16 (x16 link) or two PCI Express x16 (x8 link) with riser card |

Source: Company, compiled by Digitimes, September 2007

Asustek KFSN4-DRE server motherboard

Photo: Company

Asustek RS161-E5 server system

Photo: Company