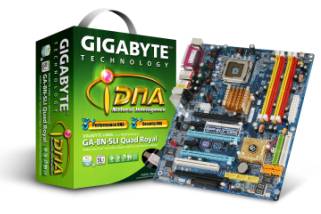

Gigabyte Technology recently introduced the GA-8N-SLI Quad Royal, claimed as the world’s first SLI-enabled motherboard equipped with four PCI Express (PCIe) x16 slots, with volume shipments to kick off from the end of this month, according to the company.

The availability and suggested retail price for the GA-8N-SLI Quad Royal are still undisclosed, but the board is expected to hit the Japan market in early December, said the company.

Designed for gamers and enthusiasts, the GA-8N-SLI Quad Royal is based on the Nvidia nForce4 SLI and nForce 4 SLI Intel Edition chipsets and supports two full-bandwidth 16-lane PCIe links, delivering twice the PCIe bandwidth of x8 SLI solutions, claims the company.

Accommodating Intel’s LGA-775 Pentium 4 and Pentium D processors, the GA-8N-SLI Quad Royal has four 240-pin DIMM sockets that can support 8GB of DDR2 memory, according to the motherboard maker. Built-in USB 2.0 and IEEE 1394 functionalities connect to all the latest high-speed peripherals and multimedia devices, said Gigabyte, adding that an embedded post code debug LED display and up to seven fan connectors provides instant information from the motherboard and the best thermal solution for ultimate gaming experience.

|

Gigabyte’s GA-8N-SLI Quad Royal specifications | |

|

Item |

Detail |

|

CPU |

Intel Pentium Extreme Edition/ Pentium D/ Pentium 4/ Celeron |

|

Chipset |

NVIDIA nForce 4 SLI Intel Edition and NVIDIA nForce 4 SLI |

|

FSB |

1066/800/533MHz |

|

Memory |

DDR2 667/533, four 240-pin DIMMs (up to 8GB) |

|

Expansion slot |

Four PCIe x16, two PCIe x1, one PCI 2.2 |

|

Network |

Dual Gigabit LAN, three IEEE 1394 |

|

Audio |

8-channel Audio |

|

SATA connector |

Four SATA 3Gb/s, RAID 0/1/0+1/5 |

|

Photo |

|

Source: Company, compiled by DigiTimes, November 2005

Photo: Company