South Korean OLED materials developer Lordin plans to seek a technology-special listing in the first half of 2027, with a US$25 million fundraising round targeted for completion in 2026, as it advances commercialization of its blue phosphorescent emitter technology and expands operations into India.

Excellence Optoelectronics reported a new monthly revenue high of NT$606 million (approx. US$19.31 million) for February 2026, a 7.38% increase from January and a 31.58% rise year-over-year, continuing momentum after the group's return to profitability in 2025.

Touch panel maker GIS Holding said it has completed key processes and established strategic partnerships for optical and AI/AR device applications and expects some customers' microLED AR glasses to reach mass-production milestones in the second half of 2026.

LED equipment manufacturer FitTech announced it has filed compulsory enforcement applications with local Chinese courts to recover more than US$43.29 million and CNY30.37 million (approx. US$4.42 million) from two subsidiaries of Sanan Optoelectronics, saying the move follows unpaid arbitration awards.

Facing price competition pressure from China, Taiwan's display panel industry is encountering growing operational challenges. However, the surge in AI chip demand for advanced packaging has opened a transformation opportunity based on existing panel technology foundations.

Apple has launched an updated Studio Display and an all-new Studio Display XDR, expanding its external monitor lineup with higher brightness, faster refresh rates, and Thunderbolt 5 connectivity. The new models target users ranging from everyday Mac customers to professional creators and medical specialists.

The global flat-panel TV market continues to see shifting sales shares, with Samsung Electronics and LG Electronics maintaining overall leadership. However, Chinese brands like TCL and Hisense are rapidly closing the gap, breaking into the top five TV sellers worldwide.

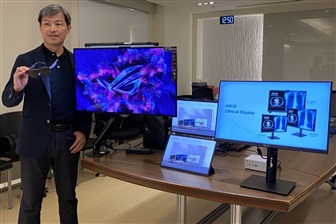

Backlight module supplier Radiant Optoelectronics has invested over NT$10 billion (US$318.16 million) in acquisitions under company chairman Yu-Chao Wang's leadership while advancing three new business lines targeting future growth. Despite a 40% profit decline in 2025, the company remains committed to innovation and expects to ramp up new ventures through 2027 toward significant revenue contributions by 2028.

Daxin Materials achieved strong gains in semiconductor materials in 2025, expanding its product lineup to 12 items. The company plans to introduce three to five new products in 2026, aiming for high double-digit growth in semiconductor material sales. Meanwhile, sales from display materials are expected to remain flat in 2026, while key raw materials could see annual revenue growth surpassing 30%.

Affected by a downturn in its display materials business and the appreciation of the New Taiwan dollar against the US dollar, BenQ Materials fell into losses in 2025. Its medical business, impacted by exchange rate fluctuations, grew only 5%. Chairman Z.C. Chen said that demand across all medical product lines is currently solid, and the company expects to return to double-digit growth in 2026.

China's leading panel maker BOE Technology Group has expressed cautious optimism about the LCD TV panel market in the first half of 2026, announcing accelerated progress on AMOLED and advanced packaging projects, according to Chinese media outlets Sina Finance and Jiwei.com.

More coverage