Smartphone shipments to the China market amounted to 58.4 million units in the third quarter of 2022, falling 20.5% from a year ago to a new low since third-quarter 2020 amid China's lockdown restrictions and weakening market demand.

Looking into fourth-quarter 2022, as economic outlook and consumer confidence show no sign of recovery, most smartphone brands will keep making it a priority to lower their channel inventory level. As such, smartphone shipments to the China market are estimated to still show a more than 20% on-year decline in fourth-quarter 2022.

The top-4 Chinese brands - Oppo, Honor, Vivo, and Xiaomi - all experienced an on-year decline in third-quarter 2022 shipments, while Huawei's shipments in the quarter increased sequentially thanks to a low comparison base in the second quarter of 2022 and picked up more than 30% from a year ago.

Table 1: Key factors affecting 2H22 smartphone shipments in China – Supply

Table 2: Key factors affecting 2H22 smartphone shipments in China – Demand

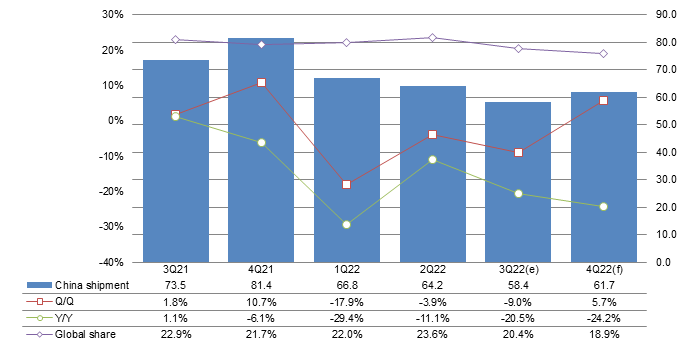

Chart 1: China smartphone market shipments, 3Q21-4Q22 (m units)

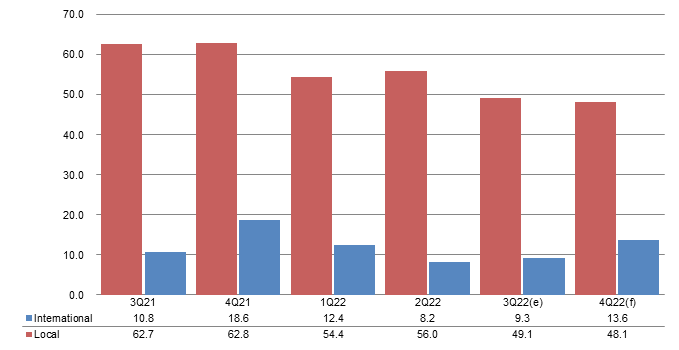

Chart 2: China smartphone market shipments - international and local brands, 3Q21-4Q22 (m units)

Chart 3: China smartphone market share - international and local brands, 3Q21-4Q22 (m units)

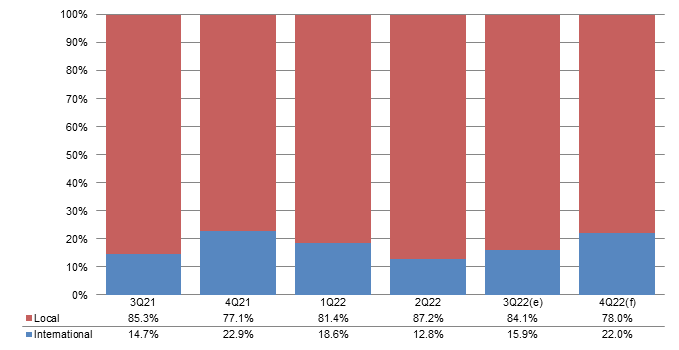

Chart 4: China smartphone market shipments, by China-based players, 3Q21-4Q22 (m units)

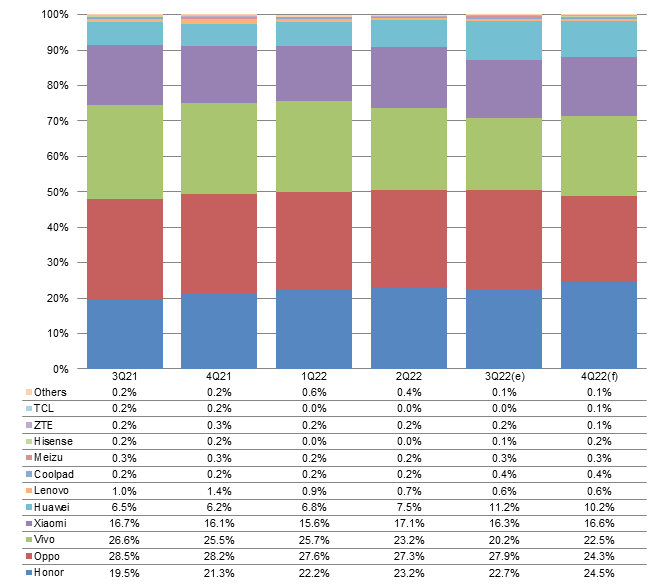

Chart 5: China smartphone market shipment share, by China-based players, 3Q21-4Q22

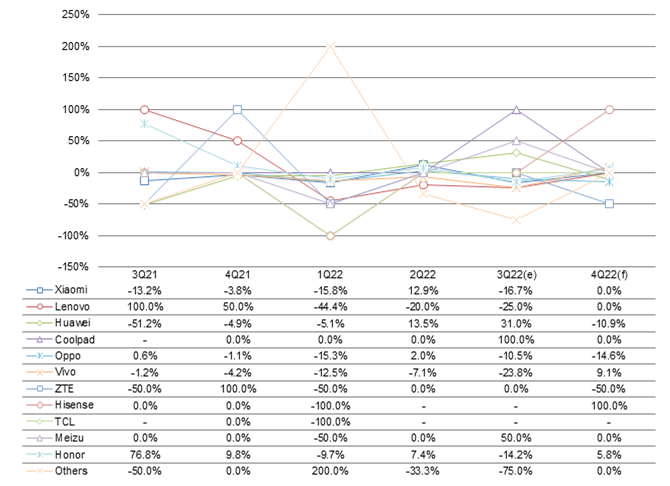

Chart 6: China smartphone market shipment growth by quarter by China-based players, 3Q21-4Q22

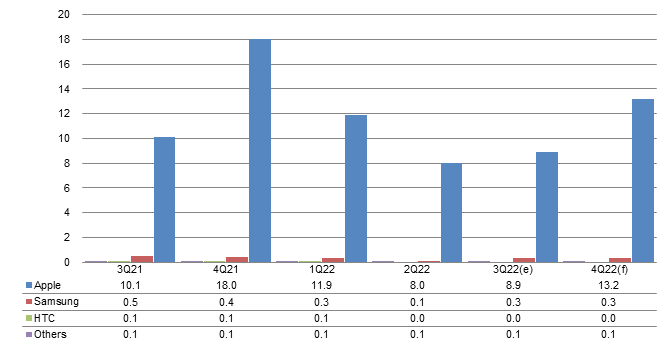

Chart 7: International brand smartphone shipments in China market, 3Q21-4Q22 (m units)

Chart 8: China smartphone market shipments by international brands, 3Q21-4Q22 (m units)

Chart 9: China smartphone market shipment share by international brands, 3Q21-4Q22

Chart 10: China smartphone market quarterly shipment growth by international brands, 3Q21-4Q22

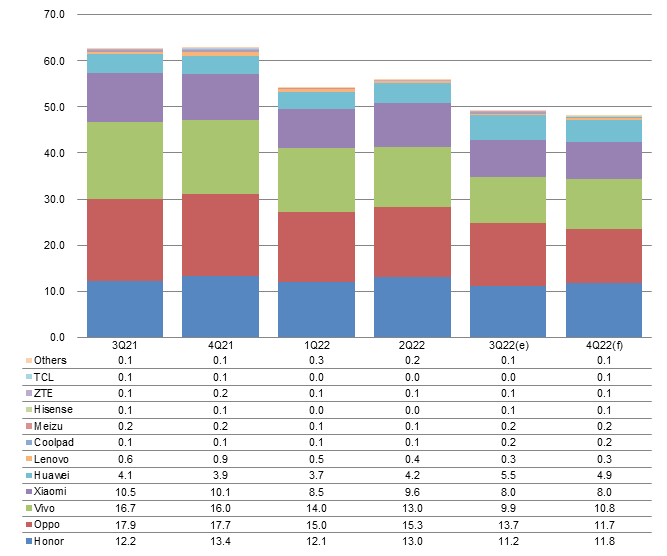

Chart 11: China smartphone market shipments by all vendors, 3Q21-4Q22 (m units)

Chart 12: China smartphone market shipment share by all vendors, 3Q21-4Q22

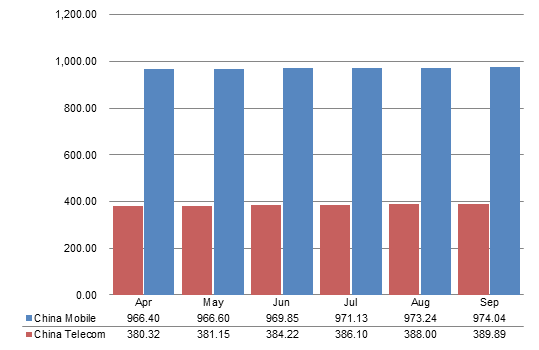

Chart 13: China telecom carriers' overall subscribers, Apr-Sep 2022 (m users)

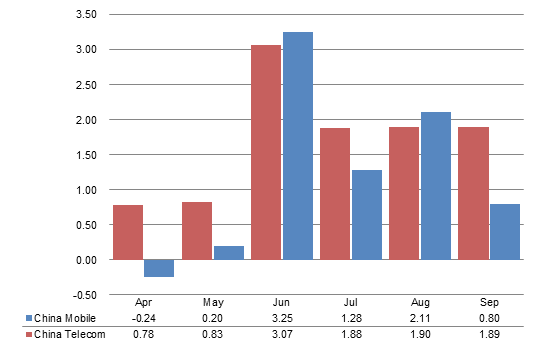

Chart 14: China telecom carriers' increased subscriber, Apr-Sep 2022 (m users)

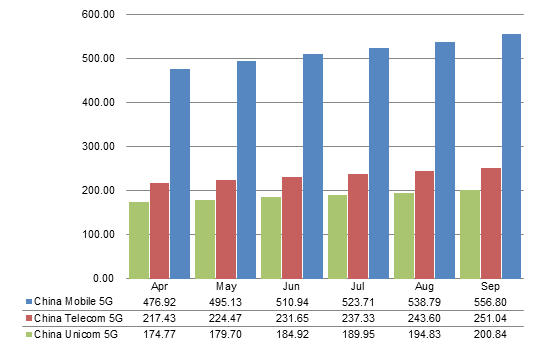

Chart 15: China telecom carriers 5G subscribers, Apr-Sep 2022 (m users)

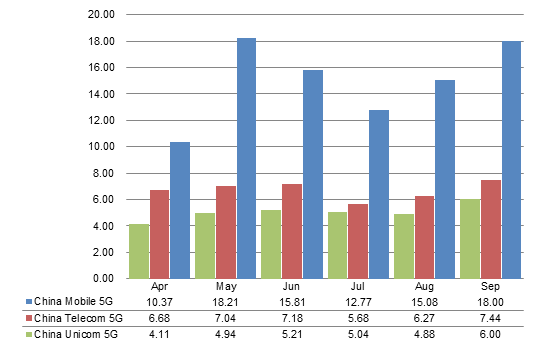

Chart 16: China telecom carriers' increased 5G subscribers, Apr-Sep 2022 (m users)

Introduction

According to DIGITIMES Research's surveys and analyses, third-quarter 2022 smartphone shipments to the China market amounted to 58.4 million units, falling 20.5% from a year ago to a new low since third-quarter 2020 amid China's lockdown restrictions and weakening market demand.

Looking into fourth-quarter 2022, as economic outlook and consumer confidence show no sign of recovery, most smartphone brands will keep making it a priority to lower their channel inventory level. As such, smartphone shipments to the China market are estimated to still show a more than 20% on-year decline in fourth-quarter 2022.

The top-4 Chinese brands ? Oppo, Honor, Vivo, and Xiaomi ? all experienced an on-year decline in third-quarter 2022 shipments, while Huawei's shipments in the quarter increased sequentially thanks to a low comparison base in the second quarter of 2022 and picked up more than 30% from a year ago.

With all vendors included, the top-5 brands in terms of smartphone shipments to China in the third quarter were Oppo, Honor, Vivo, Apple and Xiaomi. Compared to the prior quarter, Apple's and Xiaomi's rankings were switched with the top-5 brands together representing 88.5% of the China smartphone market, a drop from a quarter ago since Huawei has continued enjoying an increased share and was ranked at the sixth place.

Going into fourth-quarter 2022, Apple is expected to return as the number one smartphone brand in China with shipments driven by robust iPhone 14 Pro and Pro Max demand.

Key factors affecting the China smartphone market

Supply

China's smartphone market demand went into a deep freeze after the 618 shopping festival promotions ended. The smartphone brands, therefore, made conservative shipments in third-quarter 2022 to cut their inventory level.

Apple's overall third-quarter 2022 shipments exhibited an uptick, buoyed by brisk sales of the new iPhone 14 series (including the Pro models).

Huawei's new Mate 50 flagship series and its affordable 4G phones entering the market hoisted the vendor's shipments to exceed five million units.

Honor's share that it can snatch from other brands in the domestic market is hitting its limit. To prevent an excess channel inventory, Honor started to decelerate the momentum of its shipments in third-quarter 2022.

Facing weak market demand, Xiaomi reduced its shipments to lower its channel inventory level.

Oppo and Vivo continued to scale back their shipments as the market had shown no sign of recovery.

The market demand is expected to remain weak going into fourth-quarter 2022 so most China-based smartphone brands will generally stick with making conservative shipments as did in third-quarter 2022.

Source: DIGITIMES Research, December 2022

Demand

Amid the crackdown from the government, China's after-school education, Internet, gaming and entertainment sectors were going through layoffs and hiring freezes, leading to rising youth unemployment. Other sectors were also in crisis with frequent news of abandoned construction projects and bank cash flow problems. As a result, consumer confidence remained in a slump.

With the penetration of 5G phones among smartphone shipments to China at 70-80%, phones only featuring 5G capability could hardly drive 4G users to make an upgrade.

To compensate for the added costs of 5G support, vendors offered 5G phones in the low-to-mid price ranges with reduced features or specs. Rather than making such 5G phones more appealing, this made consumers turn to purchase a 4G phone with a similar price range. The share of 4G phones among overall smartphone shipments, therefore, showed an increase in third-quarter 2022.

The China government's series of control measures over the flow of people and goods as well as factory production in response to COVID-19 resurgences extending into early December not only set back its economic development but also dampened consumer spending on goods other than daily necessities. However, China is bracing for a massive wave of COVID infections that can last for months, following the dismantling of its zero-COVID controls, which is set to hurt its domestic market demand.

Source: DIGITIMES Research, December 2022

Chart 1: China smartphone market shipments, 3Q21-4Q22 (m units)

Source: DIGITIMES Research, December 2022

According to DIGITIMES Research's statistics, third-quarter 2022 smartphone shipments to the China market amounted to 58.4 million units, declining 9% from a quarter ago and 20.5% from a year ago. The share among global smartphone shipments slid to 20.4%, lower than the 22.9% seen in the corresponding period of 2021.

Smartphone sales from July to September returned to a slump after the 618 shopping festival promotions ended. In general, smartphone brands made conservative shipments to China in third-quarter 2022 in an effort to lower their channel inventory.

Going into fourth-quarter 2022, the vendors will be preparing inventory for Singles' Day promotions as well as the Lunar New Year holidays in late January 2023. As such, fourth-quarter 2022 smartphone shipments to China are expected to exhibit moderate sequential growth but a more than 20% on-year decline.

Shipment breakdown

Chart 2: China smartphone market shipments - international and local brands, 3Q21-4Q22 (m units)

Source: DIGITIMES Research, December 2022

Chart 3: China smartphone market share - international and local brands, 3Q21-4Q22 (m units)

Source: DIGITIMES Research, December 2022

China-based smartphone vendors

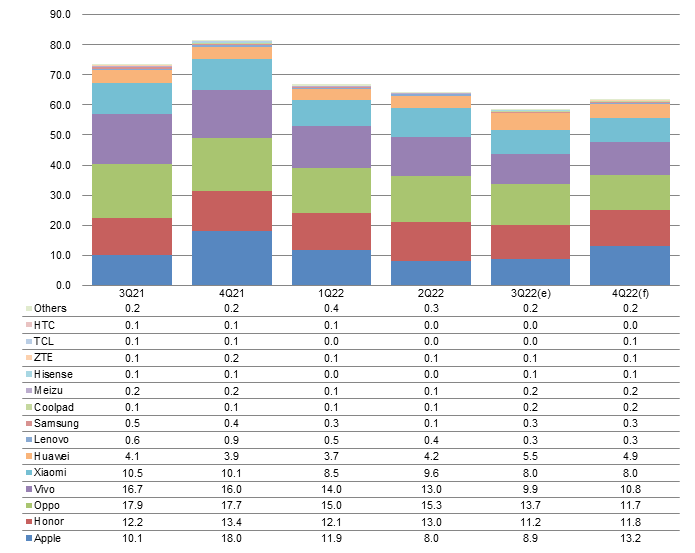

Chart 4: China smartphone market shipments, by China-based players, 3Q21-4Q22 (m units)

*Note: Shipments of Huawei and Honor are counted separately starting 1Q21.

Source: DIGITIMES Research, December 2022

The rankings among China-based brands in terms of their smartphone shipments to China showed no change between third-quarter 2022 and second-quarter 2022. The top-5 vendors were Oppo, Honor, Vivo, Xiaomi and Huawei.

Huawei's shipments increased to 5.5 million units, representing a more than 30% on-year growth because of a low comparison base.

Honor's shipments declined to 11.2 million units, down 8.2% from a year ago.

Oppo, Vivo, and Xiaomi shipped 13.7 million, 9.9 million, and 8 million smartphones to China, falling 23.5%, 40.7%, and 23.8% on year, respectively.

Most of the top-5 brands will continue to experience a double-digit on-year decline in their shipments to China going into fourth-quarter 2022 as the market demand shows no sign of recovery.

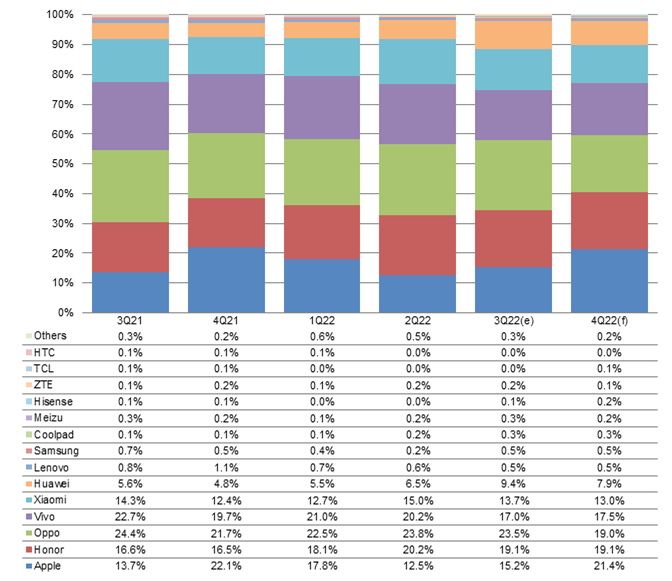

Chart 5: China smartphone market shipment share, by China-based players, 3Q21-4Q22

Source: DIGITIMES Research, December 2022

Chart 6: China smartphone market shipment growth by quarter by China-based players, 3Q21-4Q22

Source: DIGITIMES Research, December 2022

The top-4 China-based brands each exhibited a double-digit sequential decline in their third-quarter 2022 smartphone shipments to the local market.

Oppo, Honor, Vivo and Xiaomi made conservative shipments amid weak market demand with their shipments falling 10.5%, 14.2%, 23.8% and 16.7% on quarter, respectively.

Huawei enjoyed brisk sales of its Mate 50 series on top of the launch of affordable 4G phones, fueling its shipment momentum. Its third-quarter 2022 shipments soared nearly 30% sequentially thanks to a low comparison base.

The top-5 brands will deliver varying performances in their fourth-quarter 2022 shipments to China, with some showing a sequential growth and others a sequential decline.

Oppo and Huawei will exhibit a sequential decline while Honor and Vivo will present a sequential growth. Xiaomi's four-quarter 2022 shipments will be similar to the prior quarter level.

International vendors

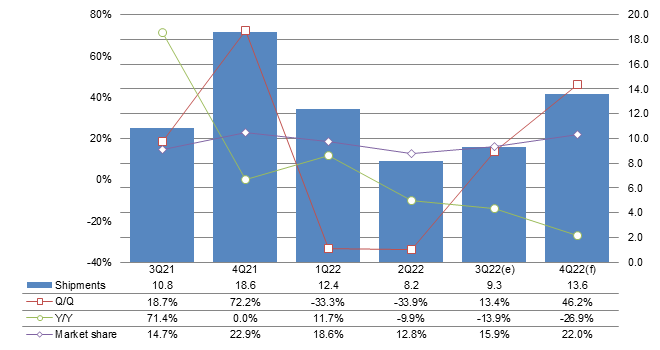

Chart 7: International brand smartphone shipments in China market, 3Q21-4Q22 (m units)

Source: DIGITIMES Research, December 2022

International brands shipped a total of 9.3 million phones to the China market in third-quarter 2022, increasing 13.4% sequentially but decreasing 13.9% from a year ago.

Apple's phone sales bucked the trend and showed sequential growth, buoying international brands' share of smartphone shipments to China to 15.9%, exceeding the level seen in the corresponding period of 2021.

Going into fourth-quarter 2022, international brands' shipments to China are expected to soar more than 40% sequentially.

However, on a year-over-year basis, international brands' shipments to China will exhibit a large decline as China's market demand significantly weakens compared to the corresponding period of 2021 and Apple sustains the impact from its supplier Foxconn's turmoil in China.

Chart 8: China smartphone market shipments by international brands, 3Q21-4Q22 (m units)

Source: DIGITIMES Research, December 2022

Apple shipped a total of 8.9 million phones to China in third-quarter 2022, down 11.9% from a year ago but up 900,000 units from a quarter ago. Samsung's third-quarter 2022 shipments to China increased 200,000 units from the prior quarter level but decreased 200,000 units from the prior year level.

Looking into fourth-quarter 2022, Apple and Samsung will continue selling the new iPhone series and the new foldable Galaxy Z Flip 4 and Z Fold 4. Apple is expected to show a large sequential growth in its fourth-quarter 2022 shipments.

Foxconn workers revolted as its Zhengzhou factory was hit by a COVID-19 outbreak from October through November. This set back iPhone 14 Pro and Pro Max production. Their supply could not keep up with market demand so overall fourth-quarter 2022 iPhone shipments will fall significantly below the level seen in the corresponding period of 2021.

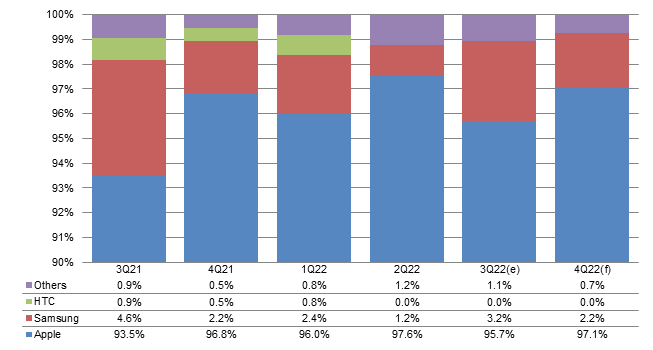

Chart 9: China smartphone market shipment share by international brands, 3Q21-4Q22

Source: DIGITIMES Research, December 2022

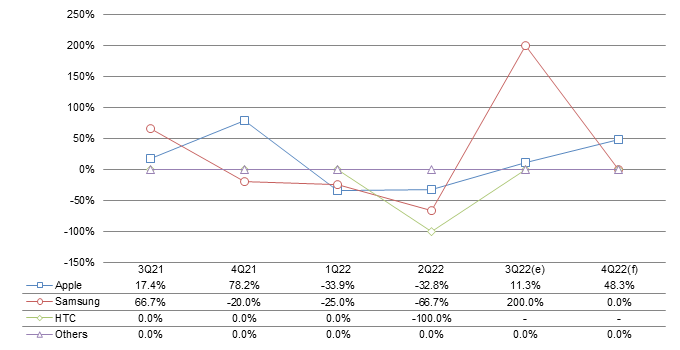

Chart 10: China smartphone market quarterly shipment growth by international brands, 3Q21-4Q22

Source: DIGITIMES Research, December 2022

The iPhone 14, 14 Pro and 14 Pro Max launched in mid-September spurred an 11.3% sequential increase in Apple's third-quarter 2022 shipments to China.

Samsung's third-quarter 2022 shipments doubled from the low second-quarter 2022 base period, driven by the launch of the new foldable Galaxy Z Flip 4 and Z Fold 4.

Going into fourth-quarter 2022, Apple's shipments will surge 48.3% sequentially, boosted by continuingly brisk sales of the entire iPhone 14 series. However, the sequential growth will pale in comparison to that seen in the corresponding period of 2021 amid Foxconn's turmoil at its Zhengzhou factory.

Shipments and market share of all vendors

Chart 11: China smartphone market shipments by all vendors, 3Q21-4Q22 (m units)

Source: DIGITIMES Research, December 2022

Taking into account third-quarter 2022 smartphone shipments by international and China-based brands to the China market, the top-5 vendors were Oppo, Honor, Vivo, Apple and Xiaomi with them together representing 88.5% of the China market, falling from 91.8% a quarter ago as Huawei at number six continued to see a rising market share.

Apple's share rose 2.7pp from a quarter ago and increased 1.5pp from a year ago, thanks to brisk sales of iPhone 14 Pro and Pro Max following the launch of the new iPhone 14 series in mid-September.

Oppo's share slid 0.3pp, Honor 1.1pp, Xiaomi 1.3pp and Vivo 3.2pp sequentially.

Going into fourth-quarter 2022, thanks to the hot-selling iPhone 14 series, Apple can expect to regain the number-1 spot with a more than 20% share of the China market as in the fourth quarter of years past.

Chart 12: China smartphone market shipment share by all vendors, 3Q21-4Q22

Source: DIGITIMES Research, December 2022

China telecom carriers

Chart 13: China telecom carriers' overall subscribers, Apr-Sep 2022 (m users)

Source: DIGITIMES Research, December 2022

As of September 2022, China's 5G service market had more than 1.008 billion users, up about 81 million users from the second quarter of 2022, resulting in China's Single-quarter new 5G user recruits continuing to fall short of 100 million.

China Mobile had 45.9 million new 5G subscribers in the third quarter, buoying its total 5G users to approximately 557 million. The increase was moderately larger than that in the prior quarter.

China Unicom had 15.9 million new 5G subscribers in the third quarter, buoying its total 5G users to approximately 201 million. The increase was moderately larger than that in the prior quarter.

China Telecom had 19.4 million new 5G subscribers in the third quarter, buoying its total 5G users to approximately 251 million. The increase was moderately smaller than that in the prior quarter.

Chart 14: China telecom carriers' increased subscriber, Apr-Sep 2022 (m users)

Source: DIGITIMES Research, December 2022

Chart 15: China telecom carriers 5G subscribers, Apr-Sep 2022 (m users)

Source: DIGITIMES Research, December 2022

Chart 16: China telecom carriers' increased 5G subscribers, Apr-Sep 2022 (m users)

Source: DIGITIMES Research, December 2022