Introduction

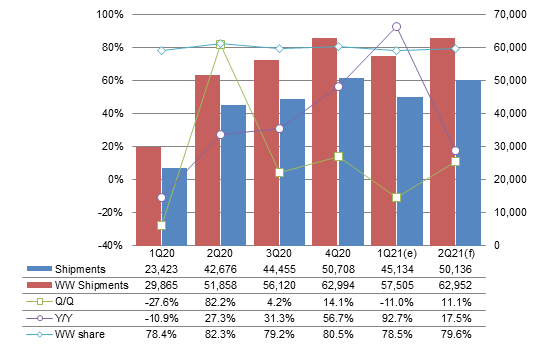

Chart 1: Notebook shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Taiwan's notebook shipments were worse than Digitimes Research's forecast made in January and slipped by more than 10% sequentially in the first quarter of 2021. But the volumes still went up 92.7% on year. (Note: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.)

More component items were in shortage than expected, leading to vendors having more difficulties finding compatible parts. As a result, ODMs' order fulfillment rates were weaker than anticipated in the first quarter.

Having a weaker performance than the global average, Taiwan saw its global share slip 2pp from a quarter ago to hit 78.5% in the first quarter. Samsung Electronics, which manufactures all its notebooks in house, enjoyed increased shipments in the first quarter, while Lenovo's supply from its in-house production lines had a smaller-than-average decline.

Taiwan's shipments are expected to climb more than 10% sequentially in the second quarter to return back to above 50 million units. Taiwan's global share will also rise 1.1pp from a quarter ago.

The shipment growth in the second quarter will be driven primarily by Chromebooks with Quanta Computer and Compal Electronics together to contribute over 80% of worldwide Chromebook shipments.

(Note: Digitimes Research treats detachable notebook products as tablets. Convertible notebooks with undetachable keyboards are considered notebooks.)

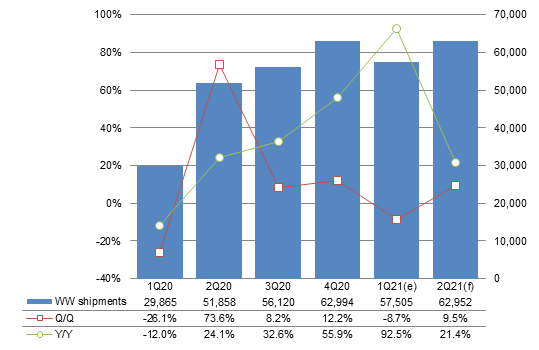

Chart 2: Global notebook shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Global notebook shipments were aligned with Digitimes Research's expectation, falling 8.7% sequentially, smaller than the average drop of around 15% in the past years, and up 92.6% on year to arrive at 57.51 million units in the first quarter of 2021.

Since demand from the stay-at-home economy has still not been fully satisfied so far, seasonality only had some minor effect on global notebook shipments in the first quarter.

Notebook shipments to the education and gaming segments in the first quarter maintained similar momentum to that in the fourth quarter of 2020, the traditional peak season.

Many orders originally placed for the fourth quarter of 2020, were deferred to the first quarter of 2021 due to constrained supply.

Component shortages and the difficulty in matching components both worsened in the first quarter as brand vendors, worrying that ongoing component short supply could prevent their shipments from meeting annual targets, have become keener on overbooking components.

Panel and notebook ICs shortages in the first quarter of 2021 were worse than the previous quarter due to the overbooking.

More components such as IC substrates, rigid PCBs, Wi-Fi chips and USB controller chips fell into tight supply in the first quarter.

Although the components issues will persist, global notebook shipments are expected to rise by 9.5% sequentially and by over 20% on year in the second quarter, to reach a level similar to that of the fourth quarter of 2020.

Demand from the education, enterprise and consumer segments will all be higher than a quarter ago thanks to the robust stay-at-home economy. Since most retail channels are still having low inventory, brisk replenishment demand is expected to benefit the consumer segment.

Panels, display ICs, audio codec ICs and GPUs are components that are expected to witness the worst shortages in the second quarter.

Shipments breakdown

Clients

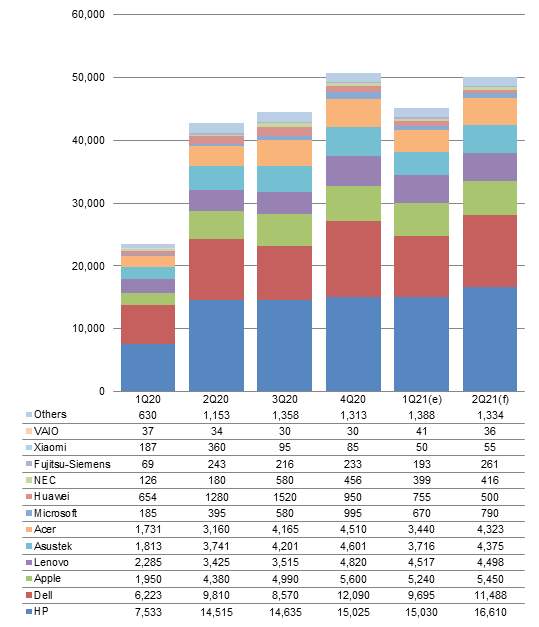

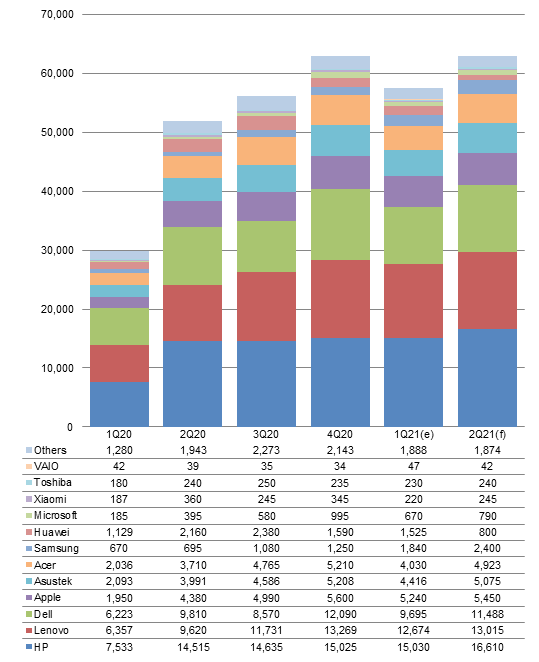

Chart 3: Shipments by major client, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Microsoft's shipments dropped in the first quarter as the company was ready to unveil a new device to replace the existing Surface Laptop 3, while demand for the Surface Laptop Go also slipped sequentially.

HP's first-quarter shipments remained flat from a quarter ago, while its Chromebook shipments went up nearly one million units sequentially.

Microsoft's Surface Laptop 4 launched in April began volume production in the second quarter and will boost the company's shipments to 790,000 units.

Dell's shipments will also pick up in the second quarter and benefit its Taiwanese ODM partners. Acer's increased Chromebook shipments in the second quarter are also fully manufactured by Taiwanese ODMs.

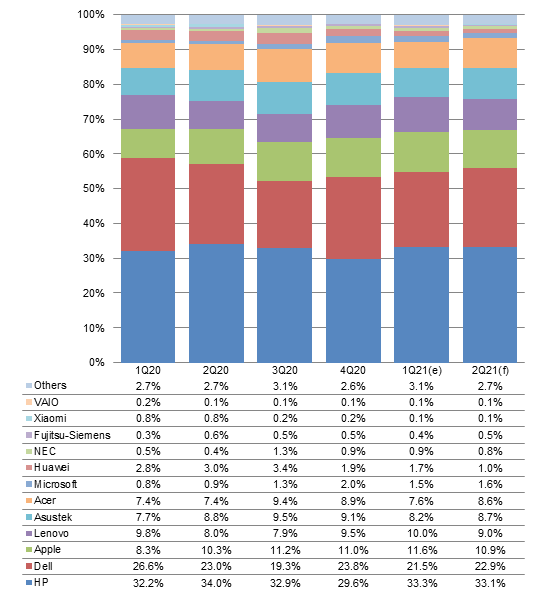

Chart 4: Shipment share by major client, 1Q20-2Q21

Source: Digitimes Research, April 2021

Chart 5: Global shipments by major vendor, 1Q20-2Q21 (k units)

*Note: Shipments of NEC and Fujitsu-Siemens are included in Lenovo's volumes.

Source: Digitimes Research, April 2021

Samsung Electronics' notebook shipments rose 47% sequentially in the first quarter since the Korea-based vendor has significantly raised its shipment goal for 2021 and is treating Chromebooks as well as the Europe and North America markets as key growth drivers.

HP maintained its notebook shipments at above 15 million units in the first quarter, which allowed its shipment share to pick up 2.3pp from a quarter ago. HP was able to keep its shipments up in the quarter due to stronger education notebook shipments and more stable component supply.

Dell's shipments plunged to below 10 million units in the first quarter, down nearly 20% sequentially, due to weak Chromebook shipments, as a result of component shortages. The US-based brand's enterprise product shipments also suffered a sharp decline.

However, Dell will see its shipments pick up 18% sequentially in the second quarter, as it will resume momentum in pushing into North America's education segment and the global enterprise market.

Acer's shipments are expected to increase 22% sequentially in the second quarter, thanks primarily to its robust Chromebook output, which will account for more than half of the volumes.

Huawei will see its shipments continue to shrink, as it is unable to obtain supply for some components, due to expanded US trade sanctions. Huawei's shipments are primarily relying on the company's component inventory.

CPUs

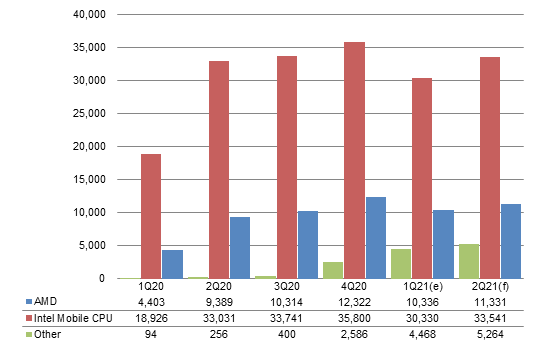

Chart 6: Shipments by CPU, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Shipments of Arm-based notebooks (Other) grew more than 70% sequentially to reach around 4.5 million units with the shipment proportion almost hitting 10%.

Chromebooks powered by MediaTek's Arm solutions enjoyed robust demand in the first quarter with shipments reaching more than 1.5 million units, while Apple's MacBooks that use in-house developed Arm-based M1 processor also had better-than-expected shipments.

Shipments of AMD-based notebooks decreased 16% sequentially in the first quarter due to CPU shortages as the chip developer had insufficient support from wafer foundries and also experienced short supply of IC substrates.

Arm-based notebooks' shipments will grow another 18% sequentially to top five million units in the second quarter. Their shipment share will reach above 10%.

Shipments of AMD-based notebooks will pick up 9.6% sequentially in the second quarter, but will still not reach the level of fourth-quarter 2020 as its CPU shortages will persist.

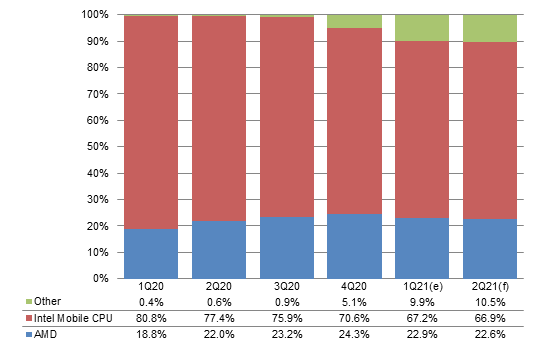

Chart 7: Shipment share by CPU, 1Q20-2Q21

Source: Digitimes Research, April 2021

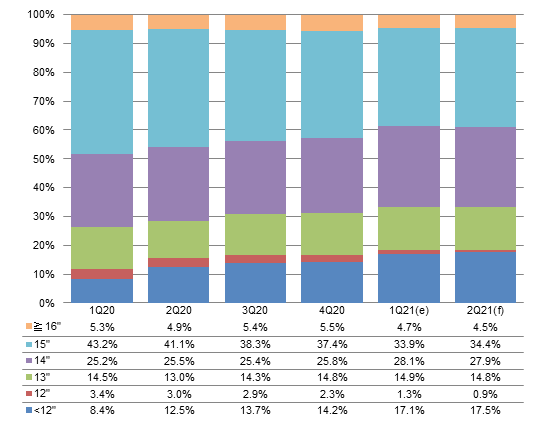

Screen size

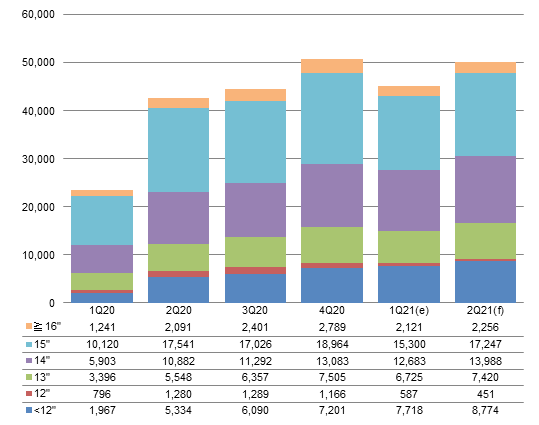

Chart 8: Shipments by screen size, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Shipments of notebooks with sub-12-inch displays continued rising in the first quarter of 2021 as supply of 11.6-inch TN panels used in education notebooks was stronger than expected.

Hewlett-Packard (HP) CEO Enrique Lores' visit to Taiwan in early March earned the company two million units of extra panel supply for education notebooks from Taiwan-based panel makers in the first quarter.

Shipments of 14-inch notebooks only had a 3% sequential drop in the first quarter as brands turned to adopt 14-inch panels, which were priced similar to 11.6-inch ones, for their education models to satisfy some of the orders.

With the education segment remaining the key market for brand vendors, shipments of sub-12-inch notebooks will climb further to 8.77 million units, the size sector's record in volume with shipment share also hitting a new high at 17.5%.

The shipment share of 15-inch notebooks had slipped for four consecutive quarters. With brand vendors releasing their new mainstream notebooks for 2021, the share will rise back slightly from a quarter ago in the second quarter.

The drop in the 15-inch notebook shipment share was a result of a trend in the notebook market: brand vendors tend to adopt 11.6- and 14-inch panels for entry-level notebooks and use 13.3-inch and above 16-inch panels for high-end models.

Chart 9: Shipment share by screen size, 1Q20-2Q21

Source: Digitimes Research, April 2021

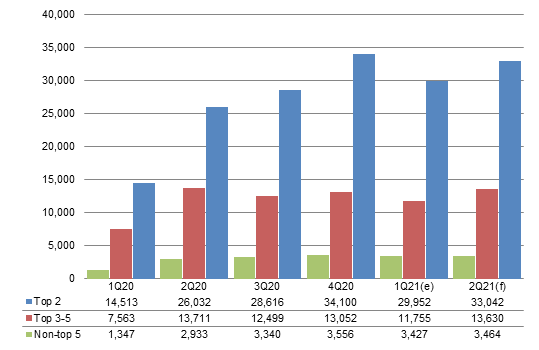

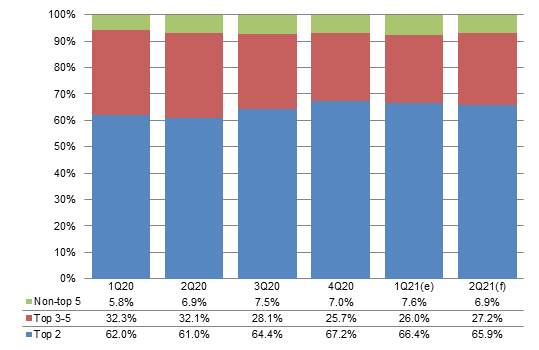

Makers

Chart 10: Shipments by maker tier, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Foxconn became the fifth largest notebook ODM in the first quarter of 2021, surpassing Pegatron, but it will drop out the top-5 in the second quarter.

Taiwan's non-top-5 notebook makers together only had a less than 4% sequential decline in the first quarter as Micro-Star International (MSI) and Clevo that primarily focus on gaming models saw their notebook shipments increase from a quarter ago.

Chart 11: Shipment share by maker tier, 1Q20-2Q21

Source: Digitimes Research, April 2021

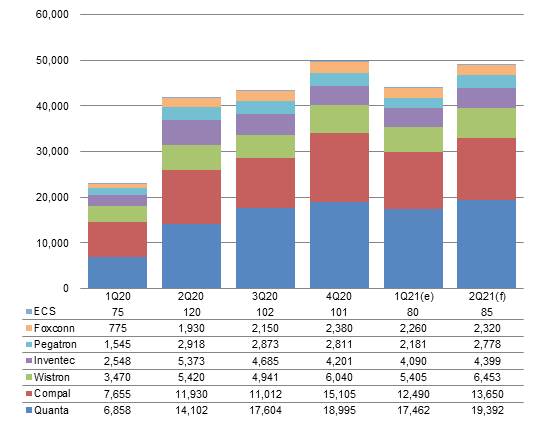

Chart 12: Top makers' shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Quanta's shipments only had an 8% sequential decline in the first quarter of 2021 thanks primarily to HP raising its orders and Apple's stable volumes.

Inventec only witnessed a less than 3% sequential drop in first-quarter shipments with HP only cutting its orders slightly and Asustek placing more orders.

In the second quarter, Wistron is expected to enjoy a 19% sequential increase in shipments with orders from Dell and Lenovo both rising from a quarter ago.

Pegatron, seeing its orders from Asustek and Microsoft picking up more than 20% sequentially, will enjoy a 27% on-quarter growth in second-quarter shipments.

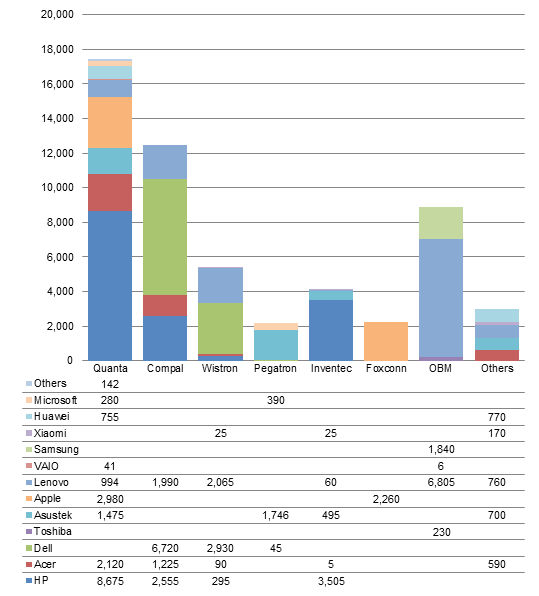

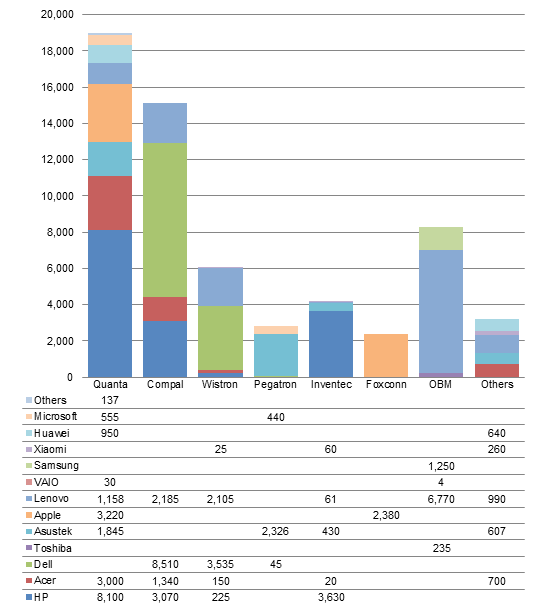

Chart 13: Vendor-maker partnership, 1Q21 (k units)

Source: Digitimes Research, April 2021

Chart 14: Vendor-maker partnership, 4Q20 (k units)

Source: Digitimes Research, April 2021

Chromebooks

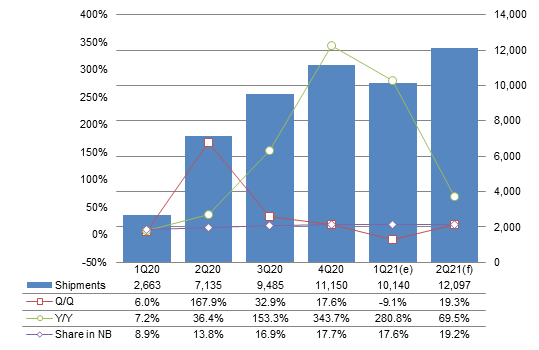

Chart 15: Chromebook shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chromebook shipments worldwide reached 10.14 million units in the first quarter of 2021, down 9.1% sequentially, but up 280.8% on year.

Japan's GIGA School project contributed around two million units in first-quarter Chromebook shipments. Although the pandemic has started to ease in North America, demand from the education segment in the region remained robust in the first quarter.

HP was the largest Chromebook brand in the first quarter, shipping four million units worldwide. Lenovo was in second place with volumes of nearly 1.7 million units in the first quarter thanks to the final batch of shipments to the GIGA School project.

Acer shipped nearly 1.6 million Chromebooks in the first quarter, surpassing Dell to become the third largest vendor worldwide as it had orders from both procurement and consumer segments, allowing its shipments to see a milder decline. Dell only had less than 1.5 million in unit shipments in the first quarter due to unsatisfactory results in the procurement segment. The decision to not develop models powered by MediaTek's solutions also put the US-based brand in disadvantage against competitions.

Samsung and Asustek both expanded Chromebook shipments in the first quarter, delivering over 500,000 units each.

The global Chromebook volumes will pick up 19.3% sequentially and 69.5% on year to over 12 million units in the second quarter, a new high since the fourth quarter of 2020.

Demand for between 3-5 million notebooks for remote learning from elementary and junior high schools in the US is still unfulfilled at the moment and the US government is set to spend US$1.8-2.3 billion from its 1.9 trillion stimulus package announced in March to fill the gap.

Most countries in Europe are still suffering from the pandemic and their demand for education notebooks is expected to stay strong in the second quarter.

Many countries in the emerging markets and Asia are suffering from worsening pandemic and may start placing large-scale procurement orders for Chromebooks in the second quarter.

Brand vendors' Chromebooks powered by MediaTek's 8183C processor are expected to see shipments break two million units in the second quarter.

Important factors

Component shortages

Components such as panels, ICs and substrates are seeing worsening shortages in the second quarter of 2021 as demand from brand vendors remains brisk and clients' overbooking grows more serious.

Although brand vendors are keen on pushing their second-quarter shipments to the level of fourth-quarter 2020, they are unlikely to achieve that, since their remaining component inventory and upstream component supply will not be sufficient.

Entry-level HD-quality TN panels are having the worst shortages in the second quarter, due to shortages of display driver ICs, timing controllers (T-CON) and power management ICs (PMICs). Glass substrates, IC substrates and PCBs are also in tight supply.

For ICs used in notebook motherboards, supply of audio codec ICs and PMICs are currently both 10% short of demand and is expected to worsen going further into the second quarter as competitions from automotive applications will become fiercer.

Automakers' strong demand is prompting wafer foundries to devote more capacity to cater to the car sector, potentially impacting the supply of notebook ICs.

AMD's CPUs and Nvidia's GPUs will continue to suffer from insufficient support from foundries and IC substrate shortages in the second quarter.

Annual shipments

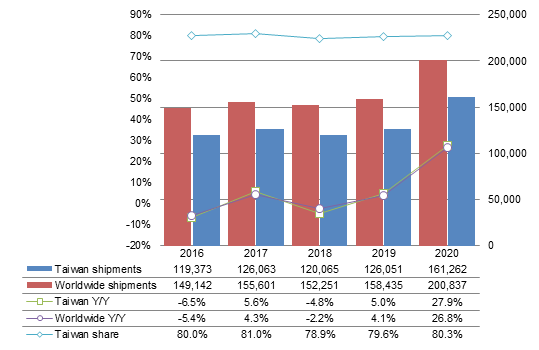

Chart 16: Taiwan and Global notebook shipments, 2016-2020 (k units)

Source: Digitimes Research, April 2021

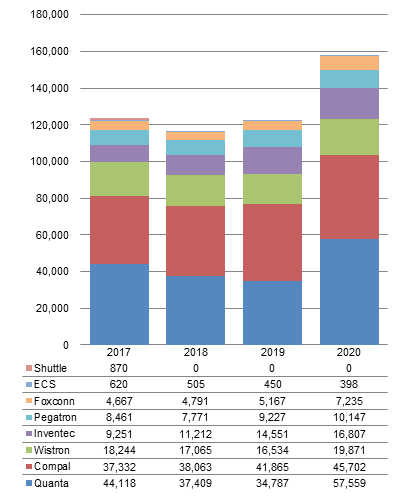

Chart 17: Top maker shipments, 2017-2020 (k units)

Source: Digitimes Research, April 2021

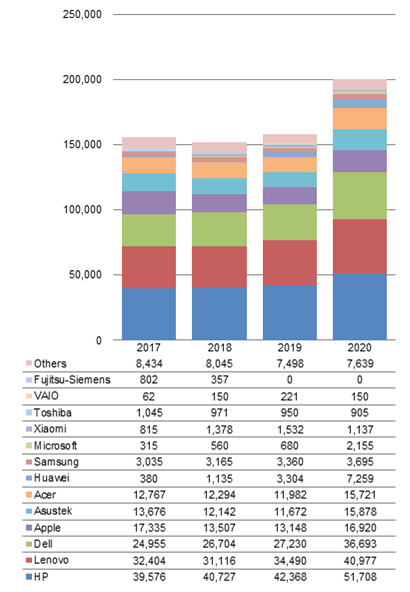

Chart 18: Global shipments by major vendor, 2017-2020 (k units)

Note: Starting 2019, Fujitsu-Siemens' shipments are included in Lenovo's volumes as the Chinese brand had completed the acquisition of Fujitsu's PC business.

Source: Digitimes Research, April 2021