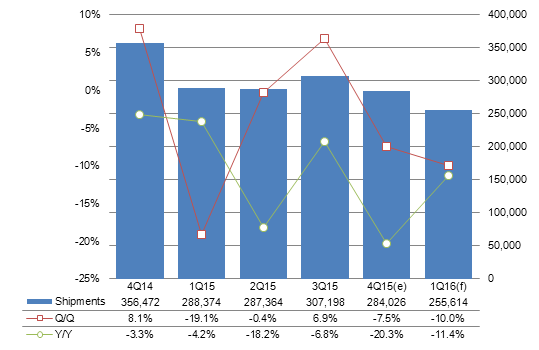

Chart 1: Small- to medium-size LCD shipments, 4Q14-1Q16 (k units)

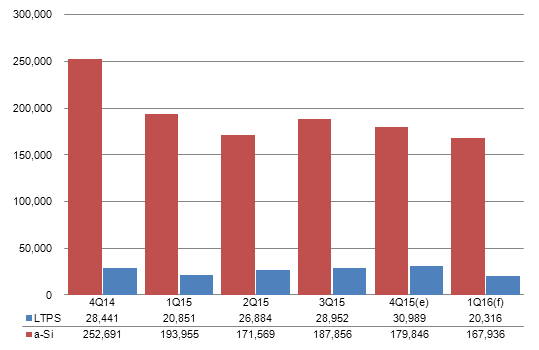

Chart 6: Handset panel shipments by technology, 4Q14-1Q16 (k units)

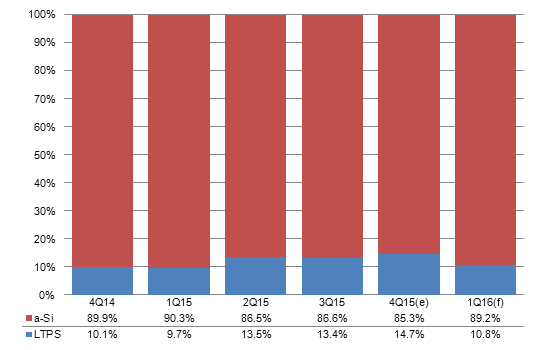

Chart 7: Handset panel shipment share by technology, 4Q14-1Q16

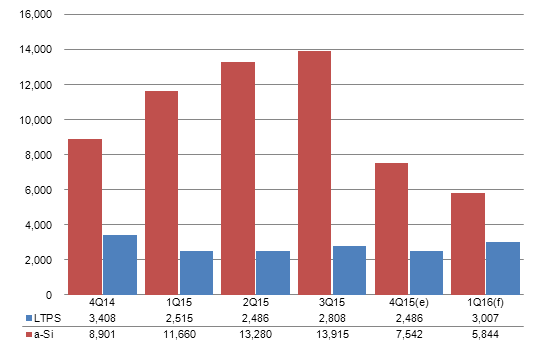

Chart 8: DSC panel shipments by technology, 4Q14-1Q16 (k units)

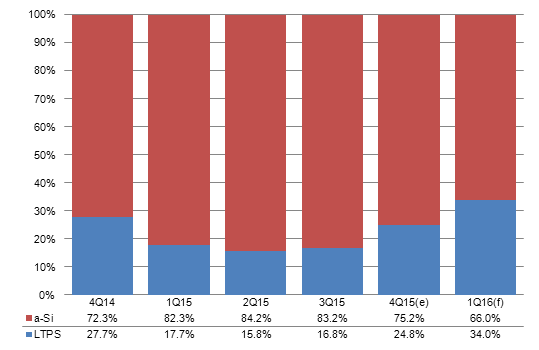

Chart 12: Small- to medium-size LCD shipments and global share, 2013-2018 (k units)

Introduction

- Taiwan's small-to-medium-size LCD panel shipments dropped 7.5% sequentially and 20.3% on year to reach 284.03 million units in the fourth quarter of 2015 due to seasonality, competition from China-based makers and unstable demand for feature phone panels.

- Because of seasonality, most applications saw sequential shipment declines in the fourth quarter of 2015 except for the tablet segment, which benefited by CPT's tablet panel orders from Amazon. Shipments for the segment also surpassed those of the car-use displays and returned to being the second largest segment.

- Seasonality will continue to affect Taiwan's small-to-medium-size panel shipments and without the benefit from the delayed orders, the volume will drop 10% sequentially in the first quarter of 2016.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

Chart 1: Small- to medium-size LCD shipments, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

- Although both Chunghwa Picture Tubes (CPT) and Innolux postponed orders for smartphone panels from the third quarter of 2015 and CPT also received panel orders for Amazon's entry-level tablet, Taiwan's small-to-medium-size LCD panel shipments still dropped 7.5% sequentially and 20.3% on year to reach 284.03 million units in the fourth quarter of 2015 due to seasonality, competition from China-based makers and unstable demand for feature phone panels.

- Because of issues related to capacity allocation, some of CPT and Innolux's smartphone panel orders originally for the third quarter of 2015 were delayed to the fourth quarter of 2015.

- Seasonality will continue to affect Taiwan's small-to-medium-size panel shipments and without the benefit from the delayed orders, the volume will drop 10% sequentially in the first quarter of 2016.

4Q review and 1Q forecast

Product breakdown by application

Chart 2: Shipments by application, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

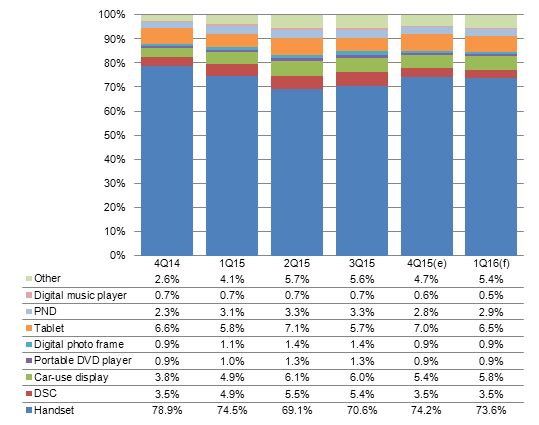

Chart 3: Shipment share by application, 4Q14-1Q16

Source: Digitimes Research, February 2016

- Because of seasonality, most applications saw sequential shipment declines in the fourth quarter of 2015 except the tablet, which was benefited by CPT's tablet panel orders from Amazon. The shipments for the application also surpassed those of the car-use display and returned the segment to the second largest overall.

- Shipments for handsets only had a sequential decline of 2.8% in the fourth quarter of 2015 because of CPT and Innolux's delayed smartphone panel orders from the third quarter. The other applications all had over 10% sequential declines.

- Shipments for non-major application panels (Other) dropped 23% sequentially in the fourth quarter of 2015 because clients had placed large orders for smartwatch panels in the second and third quarters of 2015 and reduced their orders in the fourth quarter due to seasonality.

- Seasonality will continue to impact most application's shipment performances in the first quarter of 2016. However, with smartwatch panels having less influence on shipments for non-major applications (Other), the volume will enjoy a 3.5% sequential growth in the quarter as demand for most of the other non-major applications such as industrial control, education and printer panels is not easily affected by seasonality.

- Compared to other applications, the car-use display and PND will only see 3.9% and 5.2% sequential shipment declines, respectively in the first quarter of 2016 as their inventory was already low because of the sharp sequential drops in their fourth-quarter-2015 shipments.

Product breakdown by technology

Chart 4: Shipments by technology, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

Chart 5: Shipment share by technology, 4Q14-1Q16

Source: Digitimes Research, February 2016

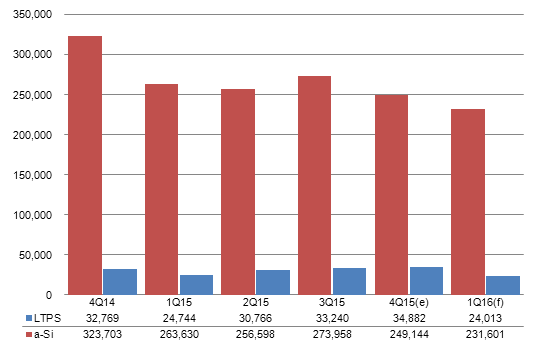

- CPT and Innolux's delayed smartphone panel orders were mostly for high-end models and boosted Taiwan's LTPS-based panel shipments in the fourth quarter of 2015.

- However, LTPS panel shipments will drop 31.1% sequentially in the first quarter of 2016 because of seasonality.

Product breakdown by technology: Handsets

Chart 6: Handset panel shipments by technology, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

Chart 7: Handset panel shipment share by technology, 4Q14-1Q16

Source: Digitimes Research, February 2016

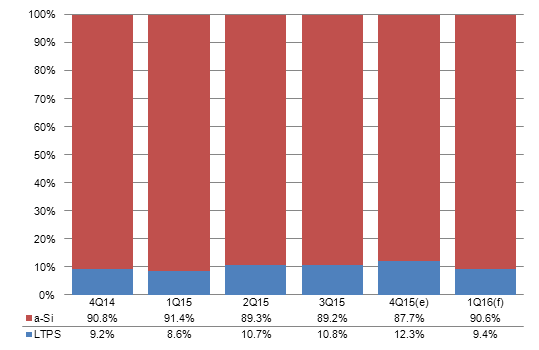

Product breakdown by technology: DSC

Chart 8: DSC panel shipments by technology, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

Chart 9: DSC panel shipment share by technology, 4Q14-1Q16

Source: Digitimes Research, February 2016

Makers

Chart 10: Top-3 makers' shipments, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

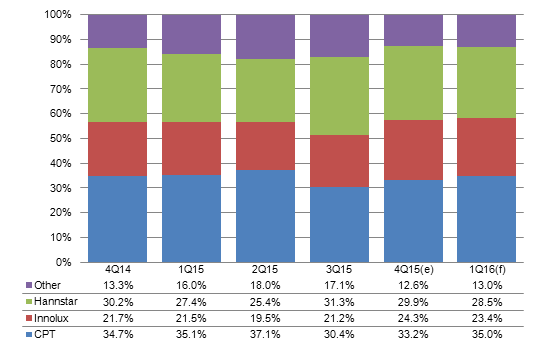

Chart 11: Top-3 makers' shipment share, 4Q14-1Q16

Source: Digitimes Research, February 2016

- CPT and Innolux both enjoyed sequential growth in shipments in the fourth quarter of 2015 mainly because of delayed orders for smartphone panels. CPT had growth of 0.9%, while Innolux had 6%.

- Because of unstable orders for feature phone panels and seeing fierce competition in the smartphone panel market, HannStar’s shipments dropped 11.7% sequentially in the fourth quarter of 2015.

- The top-3 makers will all suffer sequential shipment declines in the first quarter of 2016 because of seasonality. Since CPT has rather stable orders for the quarter, the maker will only see a sequential decline of 5%, while Innolux and HannStar will both had over 10% drops.

Beyond 2015

Global position

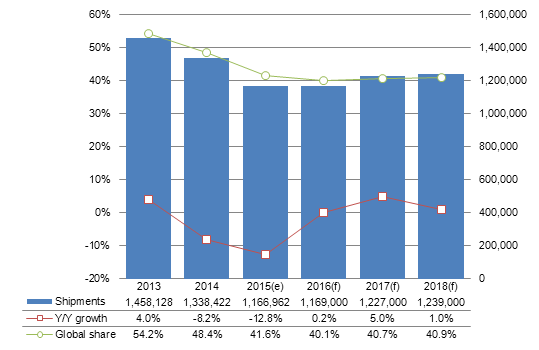

Chart 12: Small- to medium-size LCD shipments and global share, 2013-2018 (k units)

Source: Digitimes Research, February 2016

- China-based panel makers are gradually expanding their LTPS panel capacities and will together have six 6G LTPS LCD and AMOLED panel production lines in 2016-2018 to compete for the mid-range to high-end smartphone panel market.

- With China's smartphone market gradually reaching saturation, more China-made white-box smartphones are supplied to emerging markets, causing more feature phones to be replaced by smartphones.

- AUO and Innolux's new 6G production lines are expected to enter mass production in 2016 and Taiwan's small-to-medium-size panel shipments are expected to have a chance to grow in 2016. Taiwan's share of worldwide shipments is also expected to start recovering in 2017.