Facing a funding shortage for local IC manufacturers, the China State Council published the "National Integrated Circuit Industry Development Guidelines" in June 2014 to strengthen government support for China's semiconductor industry, while stating the short-, mid-, and long-term goals for the related industry supply chains through 2030.

In addition to continuing the tax benefits mentioned in the State Council Document 4 (2011) document for IC design houses and foundries, the tax benefits have expanded to testing firms. This means the testing firms also enjoy benefits on corporate income, value-added, and operation taxes.

The central government also plans to set up a national industry investment fund of CNY120 billion (US$19.3 billion). The fund will mainly focus on investing the construction of advanced process capacity, semiconductor firm reorganization, and mergers.

Digitimes Research believes through the investment fund support, China will increase its capabilities for advanced processes on 12-inch wafers. In addition, there will be more China-based semiconductor firms merging and more acquisitions of international firms by China-based firms. This Digitimes Special Report examines how the revised Central Government guidelines and various local government policy implementations will affect China's the semiconductor manufacturing, IC design, packaging & testing and materials industry.

Chart 1: China semiconductor industry output, 2009-2014 (CNYb)

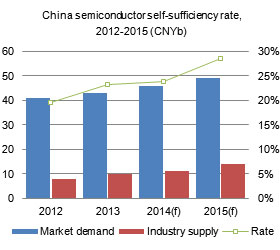

Chart 2: China semiconductor self-sufficiency rate, 2009-2015 (CNYb)

Chart 4: Taiwan and China IC design industry output, 2009-2014 (US$m)

Table 1: Top-10 China IC design companies by revenues, 2010-2013

Chart 5: Consolidation and joint ventures have become the trend in China's semi industry

Table 2: Government support in the second part of 12th Five-Year Plan

Chart 6: Central government support policies in the latter part of the 12th Five Year Plan

Chart 7: Local government support policies in the latter part of the 12th Five Year Plan

Chart 8: In 2014, the 02 Project shifted IC fab subsidies upstream to the materials industry

Ministry of Industry and Information Technology's four major goals

Chart 9: Four major policy goals of MIIT to support semiconductor industry

Chart 10: NICIDG guidelines have goals laid out for semi industry through 2030

Table 3: China semiconductor industry sub-sector goals as planned out in NICIDG

Table 4: NICIDG growth and support policies for the semiconductor industry

Chart 11: Semiconductor industry growth and support fund details

Chart 12: Beijing City Government policy-based support for the semiconductor industry

Chart 13: Shandong Province policy-based support for the semiconductor industry

Chart 14: Top-10 China cities for semiconductor output value, 2012-2013 (CNYb)

Chart 15: Wuhan City Government policy-based support for the semiconductor industry

Chart 16: Hefei City Government policy-based support for the semiconductor industry

Chart 17: Tianjin City Government policy-based support for the semiconductor industry

Chart 18: Shenzhen City Government policy-based support for the semiconductor industry

Chart 19: Shanghai City Government policy-based support for the semiconductor industry

Chart 20: Supportive policies from NSID Summary for China's semiconductor industry

Chart 21: Using equity funds to purchase shares become a major support policy for China

Chart 22: Development goals in the latter part of the 12th and the 13th Five-Year Plan