This Digitimes Research Special Report focuses on global notebook shipment forecasts for 2014, product characteristics and trends, and future developments for Taiwan's ODM industry. Topics such as whether the notebook market will continue to suffer from the impact of tablets and whether products such as touchscreen notebooks and 2-in-1 devices - pushed aggressively by Microsoft, Intel and brand vendors - can attract consumers.

This report also examines how Lenovo's strategy of increasing its in-house notebook production will impact Taiwan's ODM industry and analyzes first-tier brand vendors' outsourcing strategies for 2014.

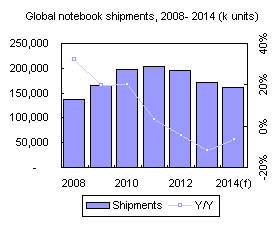

Although the notebook market has been suffering from shipment declines since 2011, it still maintains a scale above 150 million units each year, and remains a significant device category in the enterprise market. Digitimes Research estimates that global notebook shipments in 2014 will see a lower on-year drop than that of 2013, with new market developments, new product opportunities, and changes in the major players' strategies all playing critical roles in the IT industry's future trends.

Device types defined by form factor, not hardware specifications

Chart 2: Key factors that will affect notebook market demand in 2014

Chart 4: Global notebook shipment share per year and sequential growth, 1Q10-4Q13

Chart 5: Notebook development leans toward 2-in-1, impacting enterprise notebooks

Chart 9: Touchscreen notebook shipments and market share, 2012-2015 (k units)

Chart 10: Convertible notebooks shipments and market share, 2012-2015 (k units)

Chart 11: Chromebook shipment and share scenarios, 2012-2015 (k units)

Chart 12: Notebook shipments by top-10 vendors, 2011-2014 (k units)

Top-2 ODMs will land the majority of global notebook orders in 2014

Chart 14: Taiwan and worldwide notebook shipments, 2010-2014 (k units)

Chart 15: Lenovo shipments and in-house production, 2013-2014 (k units)

Chart 18: Taiwan notebook shipment shares by tier, 2010-2014

Chart 19: Quanta notebook shipments by brand clients, 2012-2014 (k units)

Chart 20: Compal notebook shipments by brand clients, 2012-2014 (k units)

Chart 21: Wistron notebook shipments by brand clients, 2012-2014 (k units)

Chart 22: Pegatron notebook shipments by brand clients, 2012-2014 (k units)

Chart 23: Inventec notebook shipments by brand clients, 2012-2014 (k units)