Semiconductors are hitting a big time. The revenue of publicly listed semiconductor companies in Taiwan reached US$166.9 billion in 2021, with a remarkable growth rate of 33.1%. Nicky Lu, chairman of Etron, has said he sees "multi trillions" in the semiconductor industry. We are witnessing a new era approaching, when the density of transistors per square millimeter will exceed one trillion and the semiconductor market size is expected to surpass US$1 trillion dollars. TSMC has disclosed that the capital expenditure in 2022 will exceed US$40 billion dollars. We can also estimate in which year, the accumulated capital expenditure of the semiconductor industry will go over US $1 trillion in the 2020s, under the active expansion momentum of the leading foundries.

Undoubtedly, TSMC is to "rout" competitors in the process nodes of 7nm and 5nm. TSMC even plans to ramp up mass-production of 3nm processes in the second half of 2022. Apparently, it might be a short-cut for Samsung to acquire TSMC's customers particularly in the automotive semiconductor sector to shorten the development schedule and challenge TSMC's global leadership.

TSMC is confident that 3nm will be the major process node of the industry at least until 2025. Strategic moves among TSMC, Intel and Samsung will be the most intriguing part of the 3nm-race before the 2nm-race starts. Aggregated revenues of Samsung's non-memory System LSI division are equivalent to 1/3 that of TSMC's, while Samsung's revenues generated by its foundry business is about 1/7 that of TSMC's. If TSMC's revenues exceed US$70 billion in 2022 with growth rate of 25% as expected, TSMC's R&D expenditure will go over US$6 billion. Besides massive capital expenditure, how to build a competitive R&D team is also a tough challenge for Samsung in its battle against TSMC.

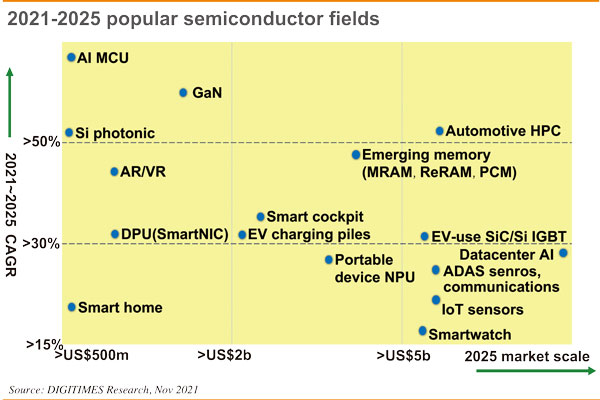

But behind the business opportunity of US$1 trillion, which areas would be the most important driving forces for the development of the semiconductor industry? According to DIGIMIES Research, automotive chips will be second to none as the fastest-growing area among the market segments of more than US$5 billion during 2021-2025, followed by AI chips of data centers and various sensors supporting IOT systems.

The growth rate of semiconductors adopted by self-driving cars and EV-related areas like smart cockpits and charging piles is estimated at 30-50%. Despite relatively high growth rate, the power semiconductors like GaN, silicon photonic components and AR/VR special chips can barely drive growth for the semiconductor industry due to its limited market size. In addition, chips applied to sectors of smart home, smart watch and portable NPUs also have certain growth potential.

Among the wide range of chips, the third type semiconductors that come to be hot a topic in Taiwan recently are still in their inception, and the business model of the segment has yet to be set. Although Win Semiconductors occupies 80% of the market share in the contract manufacturing of GaAs, it is too early to tell who the final winner will be.