Many say warriors can't choose their battlefield. But in the consulting service sector, analysts need to know how to choose their battlefield in order to survive. Normally we know more about the patterns of information, reasonable quotations, and usage patterns than our customers. Therefore, service providers must be confident in defining the market, selecting the market segments, developing pricing and service mechanism, which is key to the operation of the consultancy industry.

For instance, the cost of securing supply chain information is much higher than that of the market status. When Samsung sells mobile phones, they tell consumers the specifications of various products, application features, in order to attract their attention. But Samsung won't tell you that it wants to maintain handset sales of 300 million units a year but may end up with only 280 million units in 2021. Samsung won't tell you about the relationships between the S-Series, Note series, and foldable phones, let alone whether they come from factories in Vietnam or India, or which components come from Taiwan's MediaTek and Richteck Technologies.

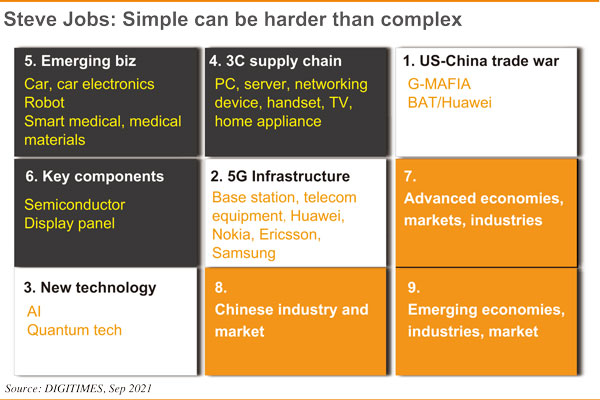

The cost of securing supply chain information is much higher than that of market information. Without proper pricing, the business is bound to be unsustainable, and enterprises need to spend more efforts to grasp the trends, which is a "lose-lose" scenario. Therefore, DIGITIMES offers services on paid subscriptions, rather than free information to attract impressions. Speed is an important factor in news coverage, while depth is the essence of research. With both we have constructed an enormous database of the electronics industry over the years. We have introduced new services of "Nine-Square Grid for Industry Analysis," "Apple Supply Chain" and others. This is a bit like the RSS (Rich Site Summary) concept. We are using industry research methodology to define the most efficient way for customers to access information.

We are more like a "hidden champion." We realize that the premium B2B market is defined by suppliers. Hidden champions are anything but price-driven businesses. Instead the CEO must have a comprehensive grasp of the entire business. Its employees must have the confidence to assert: "If we cannot do it, no one else can".

If you do industry research in China, you must focus on the market side. In Taiwan, you should dedicate to research on the supply chain. Taiwan is a small market where retail sales alone can't provide enough information for analyzing brand vendors' strategies and regional resource allocation models. But in-depth research on Taiwan's upstream supply chain not only captures key messages on the global level, but also shares them widely with different customer groups.

(Editor's note: This is part of a series by DIGITIMES Asia president Colley Hwang about industry research work.)