Global top-5 notebook brands, excluding Apple, saw shipment decline both on month and on year in November because of worsening global inflation and the fact that increasing interest rates have seriously undermined the economies of both mature and emerging markets.

Hewlett-Packard (HP) regained its position as the largest notebook brand worldwide in November thanks to increased orders from some channel retailers to replenish inventory.

Lenovo saw weaker shipments compared to those of HP, since the Chinese brand still suffered from high channel inventory.

Dell performed the worst among the top-3 vendors in November, as demand from the enterprise sector, its key market, experienced a major deceleration.

Introduction

Global top-5 notebook brands, excluding Apple, saw their combined shipments slip 6% on month and close to 50% on year in November because of worsening global inflation and the fact that increasing interest rates have seriously undermined the economies of both mature and emerging markets. (Note: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.)

Hewlett-Packard (HP) regained its position as the largest notebook brand worldwide in November thanks to increased orders from some channel retailers to replenish inventory. Lenovo saw weaker shipments compared to those of HP, since the Chinese brand still suffered from high channel inventory.

Dell performed the worst among the top-3 vendors in November, as demand from the enterprise sector, its key market, experienced a major deceleration.

The top-3 ODMs' combined shipments also went down 6% from a month ago in November, with Quanta Computer performing the best due to the steady orders from HP and increased orders from Chinese brands.

(Note: Digitimes Research treats detachable notebook products as tablets. Convertible notebooks with undetachable keyboards are considered notebooks.)

Top-5 notebook vendors

Chart 1: Worldwide top-5 vendor notebook shipments, November 2021-2022 (m units)

Source: DIGITIMES Research, December 2022

Seeing the economic downturn extend from October, global notebook shipments remained bleak in November. Although the overall notebook inventory has been dropping since the third quarter, rising global inflation and interest rates continue to undermine demand for notebooks from mature markets in Europe and North America.

Many brand vendors have halted their procurements of key components and also decelerated their order pull-ins from ODMs as sales at retail channels are far weaker than expected.

The top-5 notebook brands' combined shipments went down 6% on month to only 9.27 million units in November, almost hitting the lowest level of 2022 in April when China implemented COVID-19 lockdowns in several cities. The volumes also plunged 48% on year in the month, the worst monthly on-year decline in 2022 so far and also the lowest November shipment level since 2013.

With year-end holiday promotions kicking off, notebook inventory at the retail channel went down in early December, resulting in brand vendors resuming their order pull-ins from ODMs. Although notebook brand vendors are expected to see their shipment rise 10-15% on month in the final month of 2022, the volumes will still shrink more than 40% from the same month a year ago.

HP's November notebook shipments only dipped 1% from October, enabling the US-based brand to take back its number-1 title in the month. However, the volumes were only higher than those of number-2 Lenovo by less than 100,000 units.

HP's enterprise notebook orders in November were seriously undermined by the North America IT industry's layoffs and investment cutbacks by enterprises there, but the shipment decline was offset by increased orders for consumer models for the year-end holidays. Orders for inexpensive Windows notebooks and Chromebooks both went up from the retail channel, allowing HP to experience a much smaller on-month shipment drop than its competitors in November.

HP experienced a 45% on-year decline in November shipments as its inexpensive consumer notebook orders were only less than half of those in the same month a year ago, while shipments of its enterprise and mid-range to high-end consumer models shrank around 40% on year.

Lenovo's notebook shipments slipped 6% on month in November. The Chinese brand had a higher inventory level than its key competitors in the third quarter, leading it to turn conservative about its shipments in the fourth quarter. The company also suffered decreased orders from Europe's consumers and enterprises because of inflation. Although China has begun lifting its COVID-19 restrictions, the country's consumption is still weak and may require some more time to recover.

Lenovo experienced a 36% on-year decline in notebook shipments in November, performing the best among the top-5 brands thanks to the vendor's keen cultivation in emerging markets including Southeast Asia and India, and the fact that Lenovo's Japanese sub-brands NEC and Fujitsu only had a mild shipment decline in the month.

Dell witnessed an 18% on-month drop in November as the enterprise sector, which contributed over 60% of Dell's shipments, is experiencing a major deceleration with high interest rates and layoffs. Dell also has no strategy to quickly clear its enterprise product inventory as promotions are rarely used in the enterprise sector.

Dell's November notebook shipments more than halved on year because of a high comparison base in the same month a year ago as many enterprises began to demand workers to return to offices with the easing of the COVID-19 pandemic worldwide and are procuring more enterprise notebooks to satisfy the return-to-office demand

Asustek Computer enjoyed an on-month shipment growth of 17% in November shipments, making the company the only top-5 brand with a positive performance in the month. Asustek significantly reduced its notebook delivery and stopped the production for some old products in a bid to effectively digest its high inventory in October.

However, compared to November 2021, Asustek's shipments plummeted by 58% as demand from the consumer sector was weaker than expected, while Asustek's gaming product shipments were also more than halved on year since the company is currently in the middle of a transition to new-generation gaming devices

Acer had an on-month shipment decline of 5% in November, the company's lowest monthly level in 2022. Acer's Chromebook shipments went down nearly 10% on month, while Windows-based consumer notebook shipments dipped almost 5%.

Acer's shipments nosedived 67% on year in November. Compared to Acer's November volumes in the years prior to the COVID-19 pandemic, Acer's November 2022 notebook shipments were also short by 30-40%.

Top-3 notebook ODMs

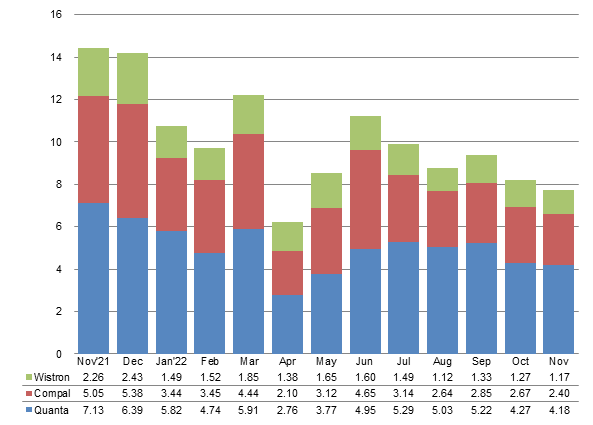

Chart 2: Worldwide top-3 ODM notebook shipments, November 2021-2022 (m units)

Source: DIGITIMES Research, December 2022

Global top-3 ODMs – Quanta, Compal, and Wistron – together shipped only 7.75 million notebooks in November, a level lower than the volume of 8-9 million units in November of the years before the COVID-19 pandemic (2016-2019). Compared to October 2022, the volumes only went down 6%, a performance similar to that of the top-5 notebook brands.

Quanta's November shipments only dipped 2% on month. Although the company's second-largest client Apple began to cut its orders, the company only witnessed a small decline since its orders from the largest client HP were stable, while those from the third-largest client Huawei still increased.

Quanta's shipments slipped 41% on year. Although orders from Taiwanese brands went down more than 70%, orders from HP, Apple, and Huawei only had a decline of around 30%.

Compal had a 10% on-month decline in November shipments. Despite increased orders from Lenovo, its orders from the largest client Dell dropped over 20% on month. Compal suffered an on-year decline of 53% in November as its orders from Dell and HP both more than halved.

Wistron witnessed an on-month shipment decrease of 8% in November. The company had increased orders from Lenovo, but major clients Dell and HP both slashed their orders by around 10% from a month ago. Wistron's shipment shrank 56% from a year ago as its largest client Dell cut nearly 60% of its orders to Wistron.

Inventec's notebook shipments slipped 14% on month in November due to orders from HP and Asustek slumping over 10%. Compared to November 2021, Inventec's shipments decreased by 61% as HP, its largest client, cut over 60% of its orders.

Pegatron's November shipments experienced an on-month growth of 34%, making the ODM the only top-5 ODM to see shipment growth in the month. The company's orders from the largest client Asustek increased by over 30%. Pegatron saw November shipments slip 38% with orders from Microsoft continuing to rise.

The top-3 ODMs' combined shipments suffered an on-year decline of 48% in November with the volumes only better than those of April, when China began implementing COVID-19 lockdowns. The top-3 ODMs had experienced a double-digit on-year drop for nine months straight. If including Inventec and Pegatron, the top-5 ODMs' notebook shipments also slipped 48% on year, the largest monthly decline in 2022.