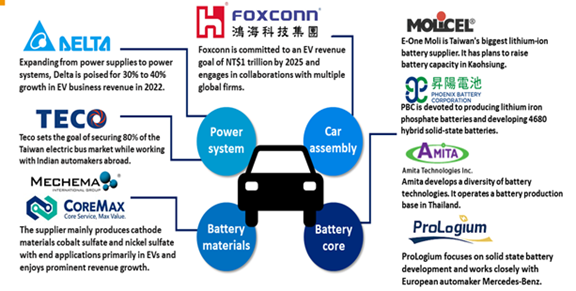

Among the Taiwan-based suppliers in these areas, Foxconn is the leading EV manufacturer. Leading power system makers include Delta and Teco. Leading battery suppliers include E-One Moli, Phoenix Battery Corporation (PBC), Amita and ProLogium while battery material suppliers including Mechema and CoreMax have a long-established presence.

After Foxconn acquired Haitec, a subsidiary of Yulon, and founded the MIH Consortium, it has become Taiwan's key EV manufacturer.

Not only has Foxconn engaged in collaborations with multiple global firms, but it is also committed to clear and definite KPIs for its EV business, including reaching a NT$1 trillion revenue, a 10% gross profit margin and a 750,000-unit shipment volume.

Introduction

In response to the automotive industry's trend to go electric, Taiwan-based manufacturers are stepping up efforts toward the electric vehicle (EV) sector. According to Digitimes Research's observations on the Taiwan EV supply chain developments, downstream EV manufacturing, midstream power systems and upstream battery materials are the areas with promising potential.

Among the Taiwan-based suppliers in these areas, Foxconn is the leading EV manufacturer. Leading power system makers include Delta and Teco. Leading battery suppliers include E-One Moli, Phoenix Battery Corporation (PBC), Amita and ProLogium while battery material suppliers including Mechema and CoreMax have a long-established presence.

After Foxconn acquired Haitec, a subsidiary of Yulon, and founded the MIH Consortium, it has become Taiwan's key EV manufacturer. Not only has Foxconn engaged in collaborations with multiple global firms, but it is also committed to clear and definite KPIs for its EV business, including reaching a NT$1 trillion revenue, a 10% gross profit margin and a 750,000-unit shipment volume.

Among power system makers, Delta forayed into the EV sector based on its technological strength in power supplies. Then, it further expanded into power systems and developed its four-in-one solutions. It serves a wide range of power system customers including 15 of the world's top 20 automakers. Teco, as a leading global industrial motor manufacturer, has recently introduced its T Power EV power systems, featuring a flexible modularized design. It mainly serves electric bus makers in Taiwan and works closely with Indian automakers abroad.

Taiwan-based battery suppliers mostly engage in small-scale production and go in different development directions. E-One Moli is the biggest lithium-ion battery supplier with a focus on producing NCA ternary lithium batteries. It has plans to raise its annual production capacity to 3.3GWh.

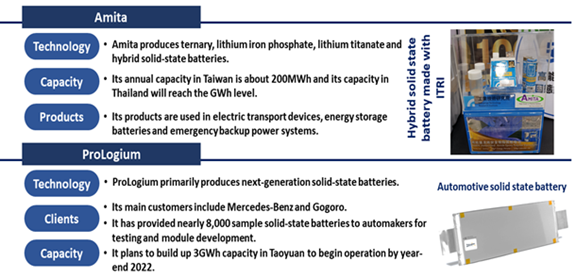

PBC is devoted to producing lithium iron phosphate batteries and has obtained technology transfer from Industrial Technology Research Institute (ITRI) to develop 4680 hybrid solid-state batteries. Amita develops a diversity of battery technologies. Its annual production capacity in Thailand will reach the GWh level. ProLogium is one of the few specialized solid-state battery developers in Taiwan and working closely with European automaker Mercedes-Benz.

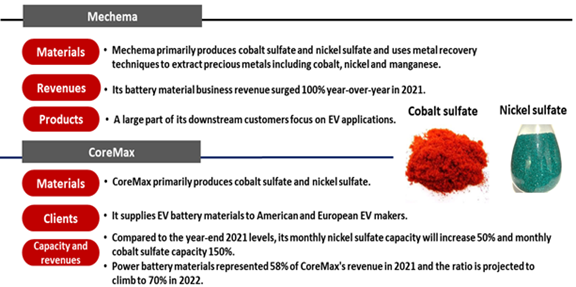

Among Taiwan's battery material suppliers, Mechema and CoreMax have a longer development history and mainly produce cathode materials cobalt sulfate and nickel sulfate. Both are supplying products to leading EV manufacturers and showing prominent revenue growth in their battery material business thanks to surging EV battery demand.

Taiwanese EV component maker status

According to Digitimes Research's observations on the Taiwan EV supply chain developments, midstream and downstream suppliers with promising potential include whole-unit EV manufacturer Foxconn and power system makers Delta and Teco mainly because the three companies' EV business units all have clear objectives and established partnerships.

Although Taiwan-based upstream battery cell and material suppliers operate on a small production scale, they each have their area of expertise. Battery material suppliers Mechema and CoreMax mainly produce cathode materials cobalt sulfate and nickel sulfate with end applications primarily in EVs and enjoy prominent revenue growth driven by downstream demand.

Table 1: Taiwanese EV component maker status

Source: Companies; compiled by DIGITIMES Research, June 2022

Maker breakdown

Foxconn

After Foxconn acquired Haitec, a subsidiary of Yulon, and founded the MIH Consortium, it has become Taiwan's key EV manufacturer.

Foxconn set the KPIs of reaching a NT$1 trillion revenue, a 10% gross profit margin and a 750,000-unit shipment volume by 2025.

With respect to critical component R&D, Foxconn focuses efforts on EV-related semiconductor devices.

According to Foxconn, its semiconductor investments are made to sustain EV demand. It invested in a SiC-based semiconductor design firm in 2022.

Its automotive semiconductor planning takes a vertical integration approach. By working with partners, it looks to build a one-stop silicon carbide (SiC) supply chain ecosystem based on its own production capacity to produce SiC devices that withstand high temperature, high voltage and high current.

With respect to batteries, because battery cell safety hinges on manufacturer experience, Foxconn with limited experience in battery materials chose to work with material suppliers but still produces battery modules by itself.

Source: Foxconn, Digitimes Research, June 2022

Foxconn has formed partnerships with multiple global suppliers with definite timelines. The one with Lordstown is particularly engaging.

Lordstown's Ohio factory becomes Foxconn's key EV production base in North America after the acquisition.

Lordstown owns motor and battery technologies which will be supplied through to the MIH platform.

Foxconn will supply electronic components to Lordstown as the top priority in addition to some leading automakers. Other components such as stamping and plastic parts will be supplied by MIH members.

Apart from the overseas partnerships, Foxconn has also made progress on its own EV production.

It is set to ship more than 100 electric buses in Taiwan in 2022.

The 2023 shipments of its affordable EV Model C are projected to be 5,000 to 10,000 units.

Source: Foxconn, Digitimes Research, June 2022

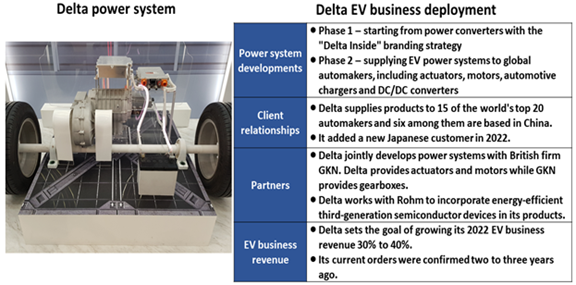

Delta

Delta expanded into the EV sector longer than a decade ago and now supplies EV power systems to many global automakers.

Delta forayed into the EV sector based on its technological strength in power supplies and then expanded into power systems. It has engaged in EV power supply solutions for 13 to 14 years.

Delta's power systems transitioned from two-in-one to four-in-one solutions, which began volume production in 2021.

Its two-in-one power system combines an on-board charger (OBC) with a DC/DC converter, its three-in-one integrates an OBC, a DC/DC converter and an actuator, and its four-in-one is an ensemble of an OBC, a DC/DC converter, an actuator and an electric vehicle communication controller (EVCC). The EVCC serves as a communication interface to DC fast charging stations and can be regarded as a switch controller.

Delta also manufactures motors+actuators and has a decade of experience in automotive motors.

Delta is introducing motors only recently, later than other manufacturers in the supply chain, because automakers generally design their motors and outsource motor production to OEMs.

Delta has secured almost all large automakers as its power system customers.

Eight of the world's top ten automakers and 15 of the world's top 20 automakers are Delta's customers. It added a new Japanese customer in 2022.

The company declined to disclose its customers' names but it is believed they include European automaker Volkswagen and American automaker General Motors.

Delta's 2022 EV business revenue is poised to surge from 30% to 40%. The growth can be ascertained as it is currently fulfilling orders that were finalized two to three years ago.

Delta's EV business is budding and still operating at a loss but it is growing in scale.

Table 4: Delta EV business deployment and power system

Source: Delta, Digitimes Research, June 2022

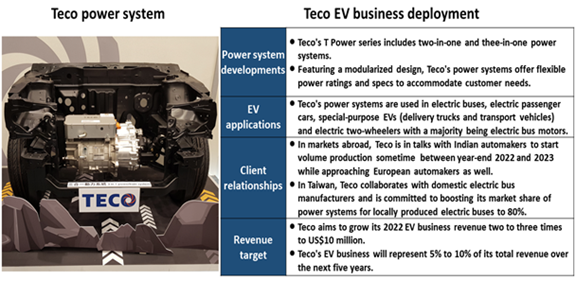

Teco

As a global industrial motor supplier, Teco is expanding into EV motors and power systems in recent years.

Its feature T Power series is based on a modularized design and thus supports adjustable motor length and a 50~250kW power range.

Its power systems are mainly used in electric buses, passenger cars and special-purpose vehicles, while a small portion is used in electric two-wheelers.

With respect to its power system customers, Teco mainly serves electric bus manufacturers in Taiwan and collaborates closely with Indian automakers abroad.

The EV motors produced at Teco's factory in Chungli are largely used in electric bus power systems. Its primary electric bus customer is RAC EV. Master Transportation uses Teco's products in some of its electric buses. Teco also works with Kuozui Motors to produce commercial vehicles (delivery trucks).

In markets abroad, Teco engages in close collaboration with Indian automakers, supplying passenger vehicle power systems. Teco's factory in Bangalore is expected to be in operation by year-end 2022.

Teco also serves large bus manufacturers in Southeast Asia and Singapore, while partnering with foreign firms to make automated guided vehicles (AGV).

Teco expects to ship more than 1,000 EV power systems in 2022. Teco's EV business will represent 5% to 10% of its total revenue over the next five years.

Table 5: Teco EV business deployment and power system

Source: Teco, Digitimes Research, June 2022

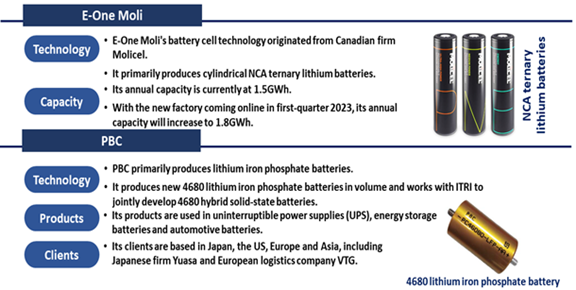

E-One Moli and PBC

E-One Moli is Taiwan's biggest lithium-ion battery supplier. It has plans to raise battery capacity in Kaohsiung.

It primarily produces NCA ternary lithium batteries. Its annual battery capacity is currently at 1.5GWh.

E-One Moli plans to add 1.8GWh of capacity at its new factory in the Xiaogang district in Kaohsiung, to churn out batteries enough for 24,000 EVs.

The construction of the new factory began in fourth-quarter 2021 and it is expected to be in operation in first-quarter 2023, boosting E-One Moli's annual capacity to 3.3GWh.

Appliance maker Dyson is E-One Moli's biggest customer. The added capacity will allow more of its batteries to be used in EVs.

PBC primarily produces lithium iron phosphate products while undertaking hybrid solid-state battery R&D.

Phoenix Silicon International (PSI) holds a 30.61% stake in PBC, which focuses on producing lithium iron phosphate battery cells.

As lithium iron phosphate batteries enjoy rising market demand for their high safety and low cost, PBC's battery revenue is growing at a 20% CAGR for five years.

PBC is volume producing its new 4680 lithium iron phosphate batteries, the same dimension as Tesla's new battery design. With technology transfer from ITRI, PBC is also developing 4680 hybrid solid-state batteries.

Table 6: E-One Moli and PBC EV battery business deployment

Source: companies, Digitimes Research, June 2022

Amita and ProLogium

Amita develops a diversity of battery technologies which allow it to accommodate wide-ranging applications and customer requirements. It operates a battery production base in Thailand.

Amita is volume producing ternary, lithium iron phosphate, and lithium titanate batteries while jointly developing hybrid solid-state batteries with ITRI.

Aside from common ternary and lithium iron phosphate batteries, lithium titanate batteries are mainly used in electric boats.

Lithium titanate batteries are known for its fast charging and long-life capabilities. They last virtually as long as boats so there is no need for replacement, which is an advantage due to the high replacement cost for marine batteries.

Amita works with ITRI to jointly develop hybrid solid-state batteries for use in electric scooters, energy storage devices and consumer electronics.

The solid-state batteries are being tested in eMOVING two-wheelers and will be used in high-end energy storage applications sometime between year-end 2022 and 2023.

Amita also joins forces with a startup to put the batteries to use in electronics and portable devices which are set to begin volume production in 2023 or 2024.

Amita's capacity in Taiwan is of a smaller scale but its capacity in Thailand reaches the GWh level. The construction of the factory in Thailand has completed and Amita is working on ramping up the yield.

ProLogium focuses on developing solid-state batteries and works closely with European automaker Mercedes-Benz.

Founded in 2006, Taiwan-based ProLogium specializes in solid-state battery development and production.

ProLogium works closely with leading automaker Mercedes-Benz. A Mercedes-Benz representative was appointed a ProLogium board member.

In early 2022, ProLogium and Mercedes-Benz entered into a technology cooperation agreement to develop solid-state batteries for EVs and test them in Mercedes-Benz EVs.

Mercedes-Benz invested close to EUR100 million in ProLogium. The deal not only allows Mercedes-Benz to sit on the board of ProLogium but will also help ProLogium expand production in Europe.

ProLogium also works with Taiwan-based Gogoro to develop solid-state batteries for two-wheelers with an aim to increase the range and extend the time between battery swaps.

In May 2022, ProLogium and South Korean steel group POSCO Holdings entered into a cooperation deal. POSCO will supply cathode and anode materials as well as solid electrolyte to ProLogium.

POSCO subsidiary POSCO JK Solid Solution is set to begin volume production of solid electrolyte in second-half 2022, which is in line with ProLogium's timeline to mass produce solid-state batteries by year-end 2022.

ProLogium has built an annual solid-state battery capacity of 3GWh at its Taoyuan factory to come online by year-end 2022. EVs equipped with ProLogium's solid-state batteries will enter volume production at the earliest in 2025.

Table 7: Amita and ProLogium EV battery business deployment

Source: companies, Digitimes Research, June 2022

Mechema and CoreMax

Mechema primarily produces cathode materials cobalt sulfate and nickel sulfate and uses metal recovery techniques to extract precious metals.

It has a 30-year history of developing cobalt and nickel products and a 20-year history of recovering metals.

Its cobalt sulfate and nickel sulfate products are mainly used in EV batteries.

They were initially used in hybrid vehicles (one of them being the Toyota Prius). Ten years ago, Mechema formed a partnership with Japan-based Toda Kogyo to use its cobalt sulfate and nickel sulfate products in battery electric vehicles (BEV). Mechema provides battery materials to leading Japanese battery cell maker Panasonic, which in turn supplies to Tesla.

With respect to metal recovery, Mechema guarantees a 90% recovery rate and recovers cobalt, nickel and manganese. Amid rapidly rising precious metal costs, metal recovery is a good way to save costs.

Thanks to soaring EV sales, Mechema's 2021 battery material revenue surged 100% to NT$2.13 billion and represented 51% of the company's overall revenue.

CoreMax primarily produces cathode materials nickel sulfate and cobalt sulfate and continues to expand capacity to keep up with downstream demand.

The company built its first battery material production line in 1999, providing nickel sulfate and cobalt sulfate among power battery materials.

CoreMax supplies to American and European EV makers.

It added its third battery material production line in Toufen in 2017, making products for Japanese battery manufacturer Panasonic, which then supplies products to Tesla.

Having penetrated into the supply chain of a leading European automaker in 2019, CoreMax became a tier-1 supplier.

With battery material revenue representing an increasing proportion of its overall revenue, CoreMax is actively expanding its capacity.

CoreMax's power battery materials accounted for 58% of its overall revenue in 2021 mainly owing to strong power battery demand. The share is projected to grow to 70% in 2022 and 75% to 80% of the orders are standing orders.

CoreMax is making active efforts toward capacity expansion for cathode materials nickel sulfate and cobalt sulfate.

Its monthly capacity of nickel sulfate increased from 1,800~2,200 tons to 3,000~3,300 tons as of year-end 2021 and is set to further expand 50% in 2022.

Its monthly capacity of cobalt sulfate increased three times from 350~450 tons to 1,500~1,800 tons as of year-end 2021 and is set to further increase 1.5 times in 2022.

Table 8: Mechema and CoreMax EV battery material business deployment

Source: companies, Digitimes Research, June 2022