Chimei Innolux will be Taiwan's top supplier of large-size TFT-LCD panels in the second quarter by shipping 32.11 million units, followed by Au Optronics (AUO) with shipments of 30.66 units.

Taiwan-based panel makers will ship an estimated 71.28 million large-sized (over 9 inches, including for use in tablet PCs) panels during the second quarter of 2011, rising by 9.4% on quarter and by 1.6% on year and accounting for 40.3% of global total, according to Digitimes Research.

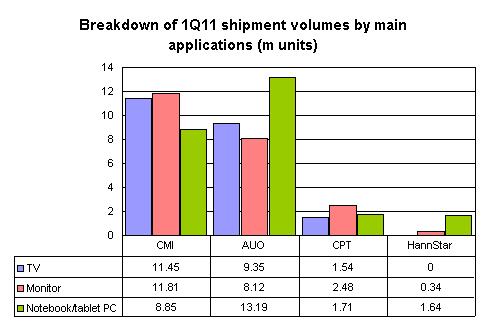

Besides CMI and AUO, the other Taiwan-based suppliers of large-size panels are Chunghwa Picture Tubes (CPT) and HannStar Display.

| Taiwan-based TFT-LCD panel makers: Breakdown of 1Q11 shipment volumes (m units) | ||||

| Company | Main applications | Total shipments | ||

| TV | Monitor | Notebook/tablet PC | ||

| CMI | 11.45 | 11.81 | 8.85 | 32.11 |

| AUO | 9.35 | 8.12 | 13.19 | 30.66 |

| CPT | 1.54 | 2.48 | 1.71 | 5.73 |

| HannStar | 0 | 0.34 | 1.64 | 1.98 |

| Total for each application | 22.34 | 22.75 | 25.39 | 70.48 |

Source: Digitimes Research, compiled by Digitimes, May 2011

Source: Digitimes Research, compiled by Digitimes, May 2011