Biostar Microtech International has introduced an Intel G41 chipset-based motherboard series which includes the T41 HD, G41D3G, G41 DVI and G41-M7.

Biostar's G41-based motherboards integrate Intel's Graphics Media Accelerator X4500 GPU, supporting high-definition video playback, as well as Intel's Clear Video Technology, highlighted the company.

The T41 HD motherboard also comes with a DVI to HDMI adapter.

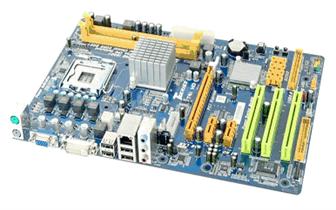

Biostar G41 chipset-based motherboard series

Photo: Company