Biostar Microtech International has announced TA760G M2+ and A760G M2+ motherboards powered by AMD's 760G IGP chipset.

The 760G paired with AMD's SB710 southbridge offers graphics performance based on AMD's ATI Radeon HD 3000 GPU.

| Biostar TA760G M2+ motherboard specifications | |

| Item | Detail |

| CPU | AMD Phenom/Athlon/Sempron processors |

| Chipset | AMD 760G |

| Memory | Dual-channel DDR2 1066/800/667/533 |

| GPU | Integrated ATI Radeon HD 3000 |

Source: Company, compiled by Digitimes, January 2009

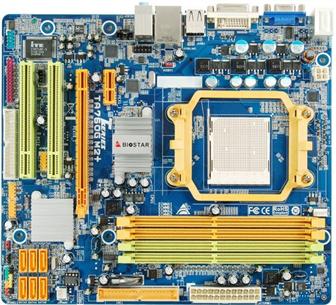

Biostar TA760G M2+ motherboard

Photo: Company