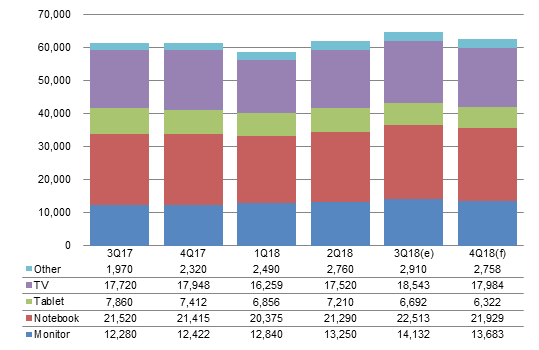

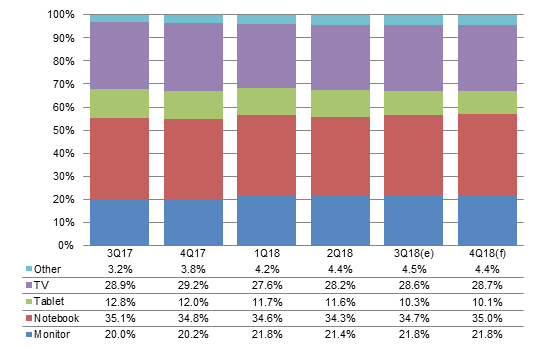

Chart 6: Worldwide shipments by application, 3Q17-4Q18 (k units)

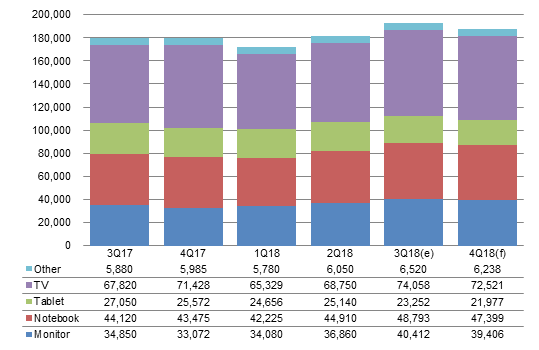

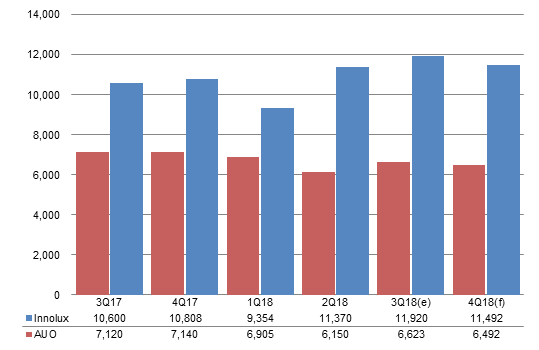

Chart 7: Monitor panel shipments by maker, 3Q17-4Q18 (k units)

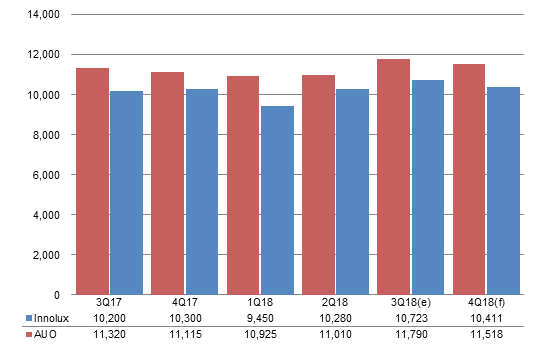

Chart 8: Notebook panel shipments by maker, 3Q17-4Q18 (k units)

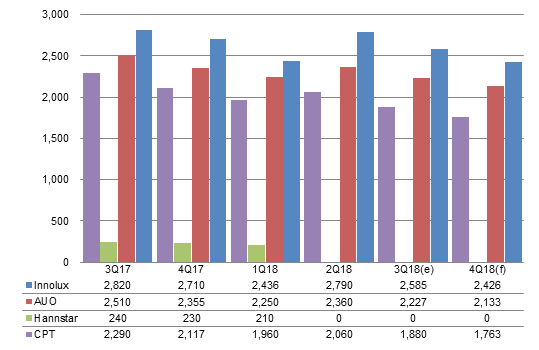

Chart 9: Tablet panel shipments by maker, 3Q17-4Q18 (k units)

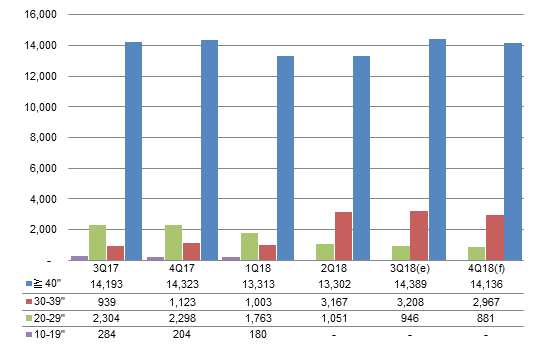

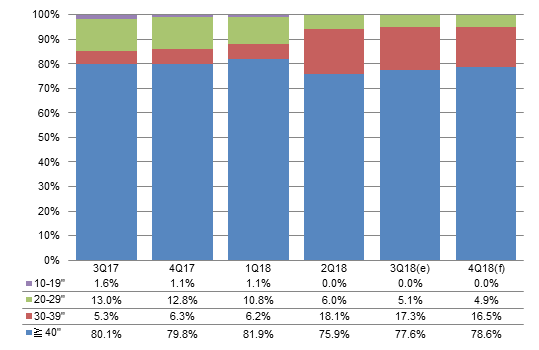

Chart 10: LCD TV panel shipments by maker, 3Q17-4Q18 (k units)

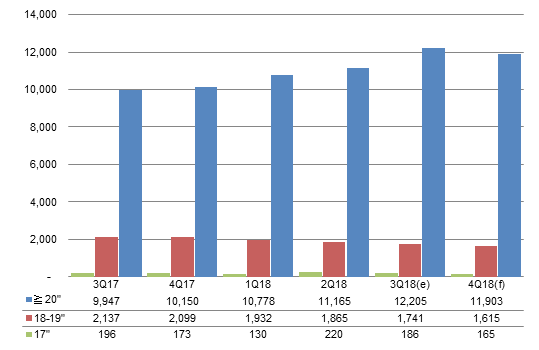

Chart 11: Monitor panel shipments by size, 3Q17-4Q18 (k units)

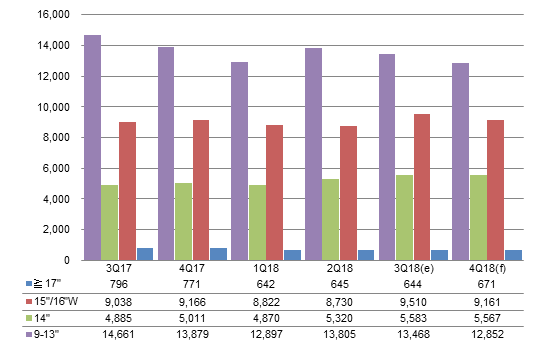

Chart 13: Notebook and tablet panel shipments by size, 3Q17-4Q18 (k units)

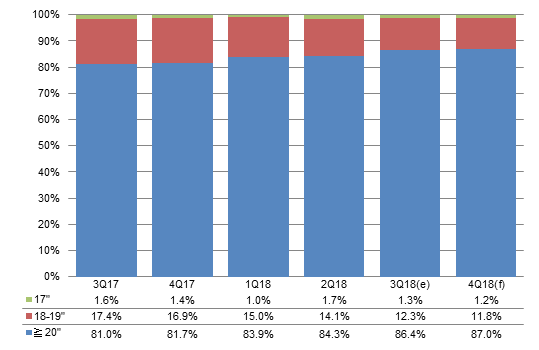

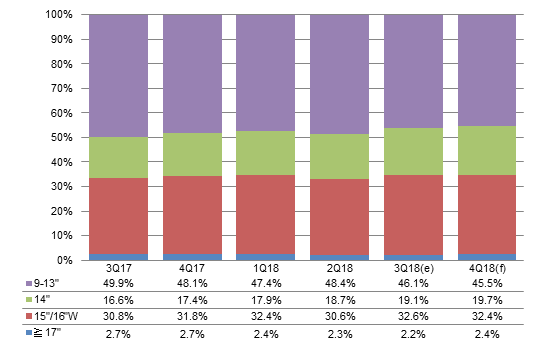

Chart 14: Notebook and tablet panel shipment share by size, 3Q17-4Q18

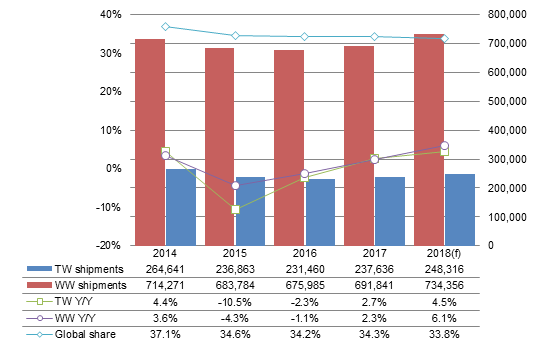

Chart 17: Taiwan large-size panel shipments and share of global market, 2014-2018 (k units)

Introduction

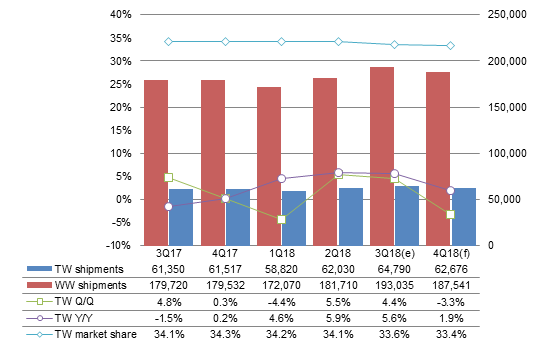

Chart 1: Large-size TFT LCD shipments, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Entering the traditional strong season, Taiwan's large-size TFT LCD panel shipments increased 4.4% sequentially and 5.6% on year to arrive at 64.79 million units in the third quarter. However, the results were weaker than what Digitimes Research originally had expected due to weak demand from the tablet segment. (Note: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.)

Worldwide shipments increased 6.2% sequentially and 7.4% on year to come to 193.04 million units in the third quarter.

With China-based panel makers' new capacity joining mass production, Taiwan's panel shipments for the four major application segments all witnessed weaker growths than the global averages.

In the fourth quarter, Taiwan's shipments will experience a sequential decline of 3.3% as new capacity from China makers will increase competition for Taiwan makers.

Demand for IT applications will turn feeble in the fourth quarter as many clients already stocked extra inventory in the third quarter. Orders for tablet panels will remain sluggish.

The US-China trade tensions will continue in the fourth quarter, resulting in a conservative view from the end market toward the end-device sales in the later-half of fourth-quarter 2018.

Shipments breakdown

Makers

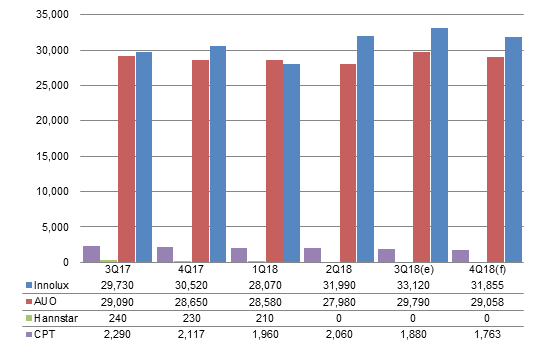

Chart 2: Shipments by maker, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 3: Shipment share by maker, 3Q17-4Q18

Source: Digitimes Research, October 2018

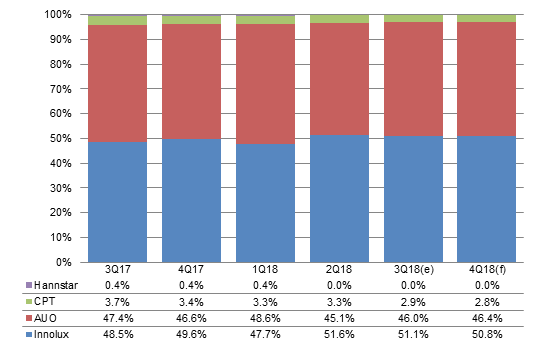

Applications

Chart 4: Shipments by application, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 5: Shipment share by application, 3Q17-4Q18

Source: Digitimes Research, October 2018

Taiwan's shipments of monitor, TV and notebook panels rose 6.7%, 5.8% and 5.7% on quarter, respectively in the third quarter. Makers had strengthened their IT-related panel supply (monitor and notebook) for the quarter as a precaution against possible driver IC shortages.

Driver IC shortages had been originally expected to last till the end of 2018. But weak smartphone demand in the third quarter resulted in more wafer capacity being allocated to the manufacturing of driver ICs, allowing Taiwan's panel makers to increase their IT-related panel output.

Tablet panel shipments slipped 7.2% sequentially in the third quarter as demand for tablets continued shrinking, cannibalized by large-size smartphones. A lack of new features also crippled non-iPad tablets' sales.

Chart 6: Worldwide shipments by application, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Applications by maker

Chart 7: Monitor panel shipments by maker, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

China-based makers saw some 8.6G and above production lines begin mass production in the third quarter and the new capacity has mostly been used for manufacturing monitor panels initially to ramp up utilization rates. Monitor panel supply from the China Electronics (CEC) Group's panel manufacturing affiliate went up dramatically in the third quarter.

BOE's monitor panel shipments also grew 8.8% sequentially in the third quarter.

With driver IC shortages improving compared to the first half of 2018, AU Optronics (AUO) expanded its monitor panel supply by 9.4% sequentially in the third quarter. AUO is currently the leading supplier of high-end monitor panels especially in the gaming monitor panel sector.

Innolux has been shifting a part of its TV panel capacity to manufacture monitor panels since the first half of 2018. The company's monitor panel shipments in the third quarter had weaker growth than that of AUO.

In the fourth quarter, both Innolux and AUO will see monitor panel shipments slow down after the strong pick-up in the third quarter.

Chart 8: Notebook panel shipments by maker, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Taiwan makers also raised their notebook panel supply sequentially in the third quarter. However, AUO's and Innolux's shipments will slip 2.3% and 2.9% on quarter, respectively in the fourth quarter.

Taiwan's share of worldwide notebook panel shipments will slump from over 47% during the period from third-quarter 2017 to second-quarter 2018, to 46.3% in second-half 2018.

With Samsung Display terminating notebook panel supply, many end device vendors have turned to LG Display and some China-based makers. In response, LG Display dramatically expanded its notebook panel supply in the third quarter, while CEC has also begun increasing production for notebook applications.

Chart 9: Tablet panel shipments by maker, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Demand for tablets is expected to remain weak in both fourth-quarter 2018 and first-quarter 2019, affecting the upstream supply chain's panel shipments in third-quarter and fourth-quarter 2018.

Taiwan makers will see their tablet panel shipments slump by 4-6% sequentially in the fourth quarter.

Apple's new iPads announced at the end of October are expected to be the only devices with satisfactory sales in the fourth quarter, but their panels are supplied by non-Taiwan makers such as BOE, LG Display and Sharp.

Chart 10: LCD TV panel shipments by maker, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Third-quarter 2018 was traditionally a peak season for the TV panel industry with Taiwan's related shipments increasing 5.8% sequentially. However, the growth was inferior to the worldwide average of 7.7% due to competition from China makers' new capacity.

AUO's and Innolux's TV panel shipments increased 7.7% and 4.8% on quarter, respectively in the third quarter, but China's overall large-size LCD panel capacity had gone up 10.8% sequentially and 35.1% on year during the quarter, significantly boosting the supply of TV and monitor panels from China.

In the fourth quarter, TV vendors' demand for larger-size panels for the year-end holiday season is expected to pick up, but unit shipments for Taiwan makers are expected to fall, as fewer pieces of larger-size panels can be produced from a substrate. And with growing competition from China makers, Taiwan's TV panel shipments are expected to slip 3% sequentially.

Applications by size

Chart 11: Monitor panel shipments by size, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 12: Monitor panel shipment share by size, 3Q17-4Q18

Source: Digitimes Research, October 2018

Chart 13: Notebook and tablet panel shipments by size, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 14: Notebook and tablet panel shipment share by size, 3Q17-4Q18

Source: Digitimes Research, October 2018

Chart 15: TV panel shipments by size, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 16: TV panel shipment share by size, 3Q17-4Q18

Source: Digitimes Research, October 2018

Annual shipments

Chart 17: Taiwan large-size panel shipments and share of global market, 2014-2018 (k units)

Source: Digitimes Research, October 2018