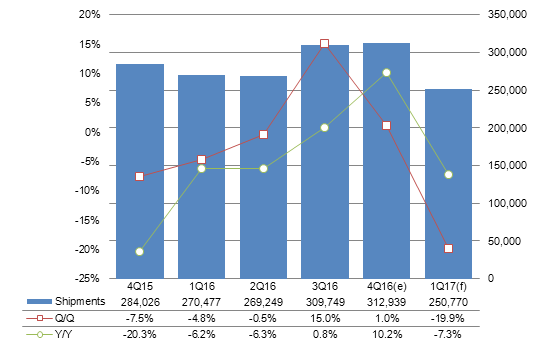

Chart 1: Small- to medium-size LCD shipments, 4Q15-1Q17 (k units)

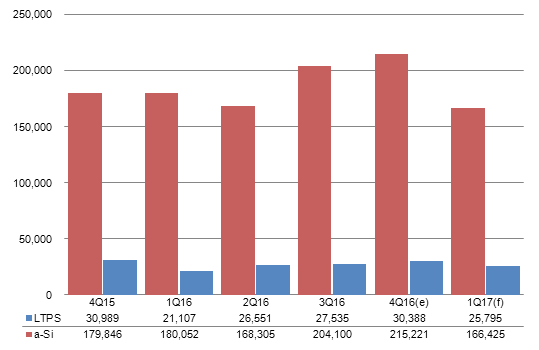

Chart 6: Handset panel shipments by technology, 4Q15-1Q17 (k units)

Chart 7: Handset panel shipment share by technology, 4Q15-1Q17

Chart 8: DSC panel shipments by technology, 4Q15-1Q17 (k units)

Chart 12: Small- to medium-size LCD shipments and global share, 2013-2018 (k units)

Introduction

- Taiwan makers shipped 312.94 million small- to medium-size LCD panels in the fourth quarter of 2016, increasing 1% sequentially and 10.2% on year.

- Taiwan makers are expected ship 250.77 million small- to medium-size LCD panels in the first quarter of 2017, falling 19.9% sequentially and 7.3% on year.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

Chart 1: Small- to medium-size LCD shipments, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

- The fourth quarter is the traditional slow season for the small- to medium-size LCD panel industry, but Taiwan makers managed to buck the seasonal trend with a slight sequential growth of 1% in their small- to medium-size panel shipments in fourth-quarter 2016 mainly due to HannStar Display's aggressive expansion in its feature phone panel capacity and significant shipments to the feature phone segment.

- However, the volume is expected to decrease almost 20% sequentially to reach 250.77 million units in the first quarter of 2017 because of seasonality, weakening demand for feature phone panels and fewer working hours in the quarter due to the Lunar New Year holidays.

Shipments breakdown

Applications

Chart 2: Shipments by application, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

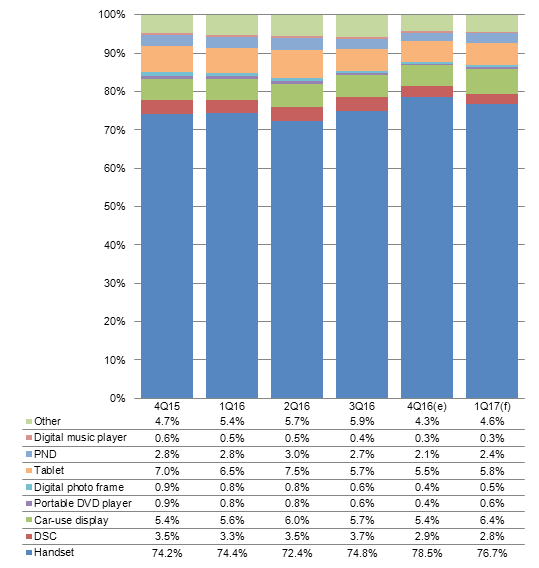

Chart 3: Shipment share by application, 4Q15-1Q17

Source: Digitimes Research, February 2017

- Because of HannStar's capacity expansion and significant shipments for feature phone panels, the handset segment was the only the one with sequential growth in the fourth quarter of 2016.

- Taiwan's small- to medium-size handset panel shipments were up 6% from a quarter ago in the fourth quarter of 2016.

- Tablet panel shipments only had a 1% sequential decline in the fourth quarter of 2016 because of demand from Amazon. Meanwhile, car-use display panel shipments dropped 4.4% sequentially. With the exception of the two, all other applications saw over 15% sequential declines during the quarter.

- Because of seasonality, most applications are expected to see sequential shipment declines in the first quarter.

- Vendors will need to restock their entry-level small- to medium-size panels for applications including portable DVD players and digital photo frames in the first quarter, while the car-use display applications usually see less impact from seasonality. These applications will only experience less than 10% sequential declines in the first quarter. However, the rest will all suffer from more than 10% drops.

Technology: LTPS and a-Si

Chart 4: Shipments by technology, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

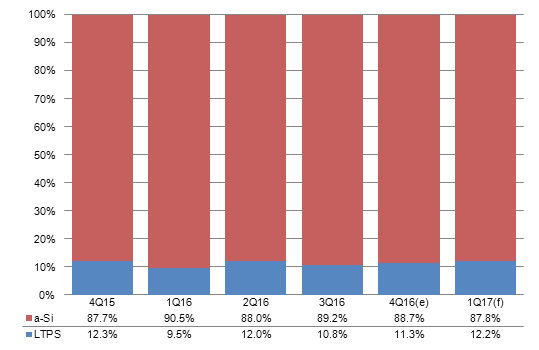

Chart 5: Shipment share by technology, 4Q15-1Q17

Source: Digitimes Research, February 2017

- AU Optronics (AUO) ramped up production at its new 6G line in Kunshan, eastern China in the fourth quarter. At the same time, Innolux also started production at its new 6G line in Kaohsiung, southern Taiwan. Both lines mainly produce LTPS smartphone panels for China-based vendors. Demand for LTPS applications from the China vendors was still strong in the fourth quarter, but will weaken in the fourth quarter because of seasonality.

- Taiwan's LTPS LCD panel shipments grew almost 6% sequentially in the fourth quarter.

- Because of weakening demand for feature phone panels, which are mainly made using the a-Si technology, Taiwan's a-Si LCD panel shipments will drop over 20% sequentially in the first quarter. LTPS' shipment share will rise above 12% since LTPS shipments will decrease by only about 14%.

Handset applications by technology

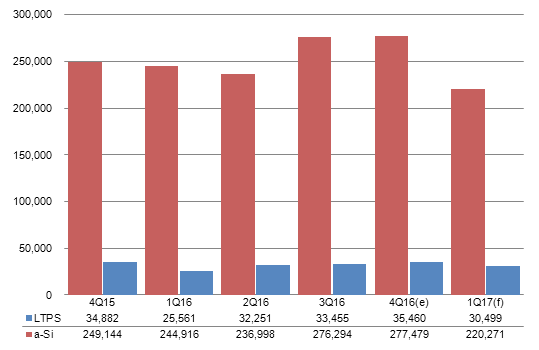

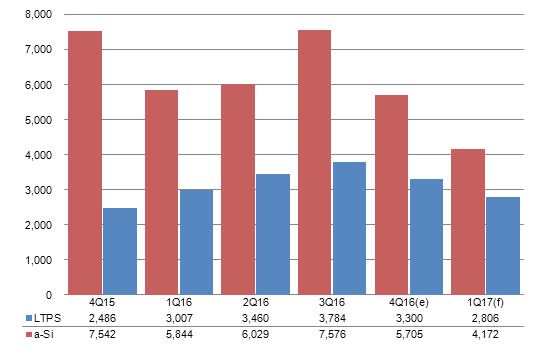

Chart 6: Handset panel shipments by technology, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

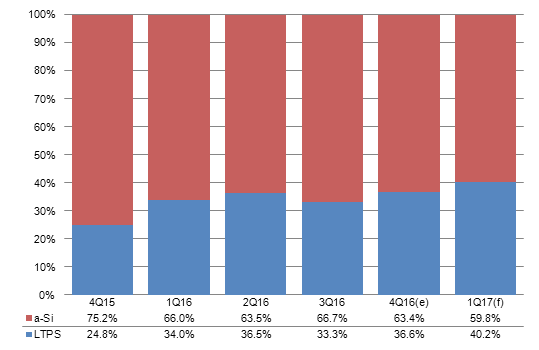

Chart 7: Handset panel shipment share by technology, 4Q15-1Q17

Source: Digitimes Research, February 2017

DSC applications by technology

Chart 8: DSC panel shipments by technology, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

Chart 9: DSC panel shipment share by technology, 4Q15-1Q17

Source: Digitimes Research, February 2017

Makers

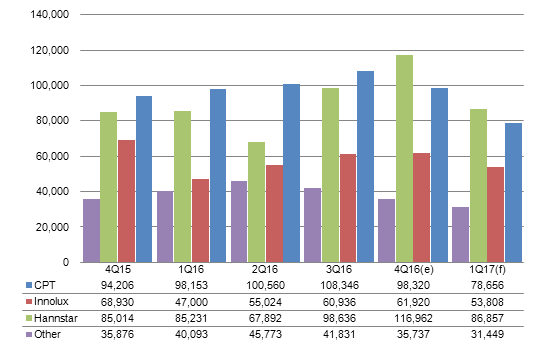

Chart 10: Top-3 makers' shipments, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

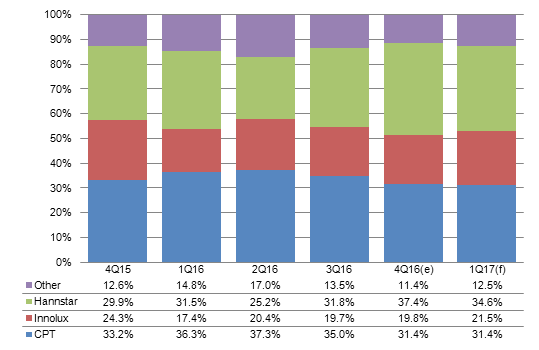

Chart 11: Top-3 makers' shipment share, 4Q15-1Q17

Source: Digitimes Research, February 2017

- HannStar's shipments grew 18.6% sequentially in the fourth quarter of 2016 as a result of increased demand for its feature phone panels and capacity expansion. The strong growth pushed HannStar's shipments to reach 116.96 million units and it became the largest small- to medium-size panel supplier in Taiwan.

- Chunghwa Picture Tubes (CPT) sold its stake in panel and module maker Giantplus Technology to Japan-based Ortustech, and beginning from December 2016, CPT stopped including Giantplus' output in its shipment figures. CPT's fourth-quarter 2016 shipments therefore dropped 9.3% sequentially.

- With Innolux's 6G production line in Kaohsiung starting production and some of the company's previous China-based smartphone clients shifting their orders from China-based panel maker Century Technology, the Taiwan-based maker's shipments rose slightly by 1.6% from sequentially in the fourth quarter of 2016.

- Taiwan's top-three small- to medium-size panel suppliers are all expected to see sequential shipment declines in the first quarter due to seasonality.

- HannStar has turned its production focus back to smartphone panels in the first quarter as demand for feature phone panels has dropped dramatically. As smartphone applications are typically bigger than feature-phone ones in size, HannStar's shipments will drop 25.7% sequentially because the number of panels it can cut from a substrate decreases significantly.

- Excluding Giantplus' output, CPT's shipments will be down by 20% sequentially in the first quarter of 2017 due to seasonality and weak demand in the India market. CPT had an over 50% stake Giantplus, but sold it all to Ortustech in November 2016.

- Giantplus' panels are mainly handset, digital camera and industrial control applications. The company's panel shipments used to account for about 10% of CPT's volume.

- Taiwan-based E Ink has shifted all its capacity to manufacturing e-paper.

- Seasonality plus fewer working days during the Lunar New Year period, Innolux's shipments will slip 13.1% sequentially in the first quarter of 2017.

Outlook till 2018

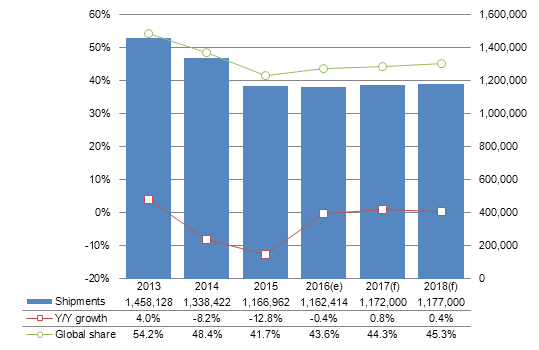

Chart 12: Small- to medium-size LCD shipments and global share, 2013-2018 (k units)

Source: Digitimes Research, February 2017

- Taiwan's 2016 shipments decreased less than expected and were only down by 0.4% to reach 1.16 billion units. In 2016, the LCD panel market saw shortages. China-based BOE was expanding its in-house LCD module capacity; therefore it devoted more of its panel capacity to in-house needs and reduced supplies of feature phone applications to outside clients, some of whom turned to Taiwan makers. The shift of orders from BOE helped stabilize Taiwan's shipments in 2016.

- From 2017-2018, the global panel industry is expected to see nine new 6G LTPS LCD/AMOLED production lines entering mass production, heating up competition in the mid-range to high-end smartphone panel market.

- China-based makers have been expanding their LTPS LCD and AMOLED panel capacity to prepare for the expected growth in adoption of such panels by high-end smartphones.

- AUO's 6G line in Kunshan and Innolux's 6G line in Kaohsiung have already begun mass production. CPT's 6G line in Fuzhou, southern China will also start mass production soon. The increased capacity will boost Taiwan's overall 2017 shipments by 0.8% on year, while its share of worldwide shipments will rise to above 44%.