Introduction

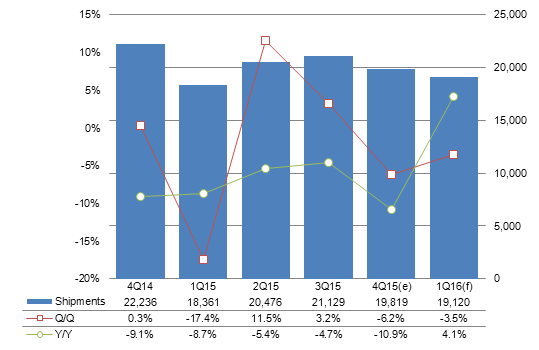

- Taiwan makers shipped 19.82 million monitors in the fourth quarter of 2015, decreasing 6.2% sequentially and 10.9% on year.

- Taiwan’s monitor shipments will reach 19.12 million units in the first quarter of 2016, down 3.5% sequentially but up 4.1% on year.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

Chart 1: LCD monitor shipments, 4Q14-1Q16 (k units)

Source: Digitimes Research, January 2016

- Taiwan makers saw their LCD monitor shipments drop 6.2% on quarter and 10.9% on year to reach only 19.82 million units in the fourth quarter of 2015.

- The on-year decline in fourth-quarter 2015 was worse than that seen in the same period of 2014, indicating that the LCD monitor industry still showed no sign of recovery.

- The shipments will continue to slip by 3.5% sequentially in the first quarter of 2016 to reach 19.12 million units. However, the volume will represent the first on-year growth the Taiwan makers will have seen since the first quarter of 2011.

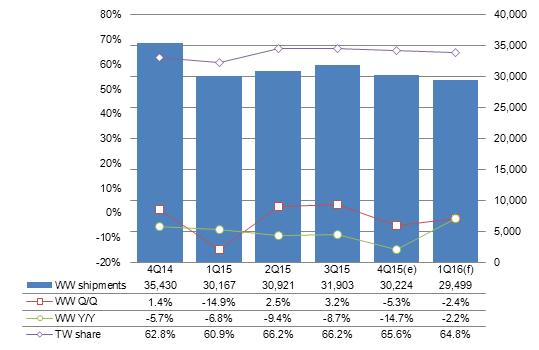

Chart 2: Taiwan's worldwide market share, 4Q14-1Q16 (k units)

Source: Digitimes Research, January 2016

- The top-two makers TPV and Qisda both saw decreased shipments in the fourth quarter of 2015, as Taiwan’s share of worldwide LCD monitor shipments dropped to 65.6%.

- As the depreciation of the Chinese currency had significantly impacted TPV’s profit, TPV was less aggressive about selling LCD monitors to China in the fourth quarter of 2015.

- Taiwan’s share of worldwide LCD monitor shipments will decrease further to less than 65% in the first quarter of 2016, during which Samsung will see increased LCD monitor shipments, LG’s shipments will stay flat, and Taiwan vendors’ shipments will decline.

Shipments breakdown

Production value and ASP

Chart 3: Taiwan LCD monitor production value, 3Q14-4Q15 (US$m)

Source: Digitimes Research, January 2016

Chart 4: Taiwan LCD monitor ASP, 3Q14-4Q15 (US$)

Source: Digitimes Research, January 2016

- The depreciation of the Taiwan dollar against the greenback contributed to a shrink in Taiwan’s LCD monitor ASP from US$112.80 in third-quarter 2015 to US$111.30 in fourth-quarter 2015. Production value also dropped to US$2.21 million.

Makers

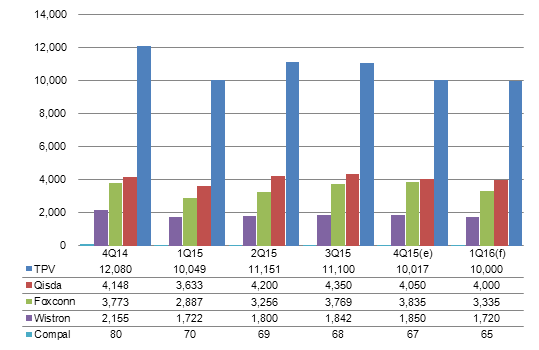

Chart 5: Shipments by top-5 makers, 4Q14-1Q16 (k units)

Source: Digitimes Research, January 2016

- TPV and Qisda both suffered sequential shipment drops in the fourth quarter of 2015.

- One of the major clients, Dell, gave Foxconn some of the orders originally handled by TPV and Qisda. Such a shift helped Foxconn achieve shipment growth in the fourth quarter of 2015.

- Foxconn will see the sharpest sequential decline (13%) in shipments among all makers in first-quarter 2016. However, the company will see a 15% on-year growth.

- Korea-based Samsung Electronics shipped 3.35 million LCD monitors in the third quarter of 2015 and 3.21 million units in the fourth, while another Korea vendor LG Electronics shipped 2.86 million units in the third quarter of 2015 and 2.8 million units in the fourth.

- Foxconn surpassed Samsung and became the third-largest LCD monitor maker worldwide in the third quarter and remained there in the fourth quarter.

Business models: OBM, OEM/ODM

Chart 6: Shipments by business model, 3Q14-4Q15 (k units)

Source: Digitimes Research, January 2016

- TPV was the only Taiwan maker with shipping OBM (own brand) monitors and the OBM segment accounted for 39.8% of TPV’s overall monitor shipments in the fourth quarter, down from 41.3% in the third.

- TPV’s LCD monitor brands include AOC, Phillips, Envision, Topview and Maya.

Screen sizes

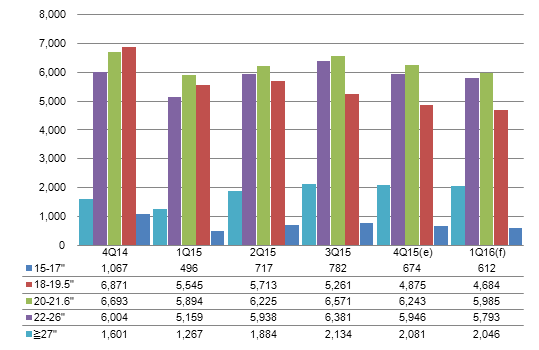

Chart 7: Shipments by screen size, 4Q14-1Q16 (k units)

Source: Digitimes Research, January 2016

Chart 8: Shipment share by screen size, 4Q14-1Q16

Source: Digitimes Research, January 2016

- Combined shipments to the 20-inch and above segments accounted for 72% of Taiwan’s overall monitor shipments in the fourth quarter 2015, and the 20- to 21.6-inch was the largest segment with shipments totaling over 6.2 million.

- Shipments to the 27-inch and above segment came to around two million units in the fourth quarter of 2015 and the volume will stay flat in the first quarter of 2016 to account for 10% of Taiwan’s overall shipments.

- Shipments in the 15- to 17-inch segment are mainly products for emerging or education markets.

- In the first quarter of 2016, Taiwan’s LCD monitor shipments will continue to be mostly large-size models.

Outlook of 2016

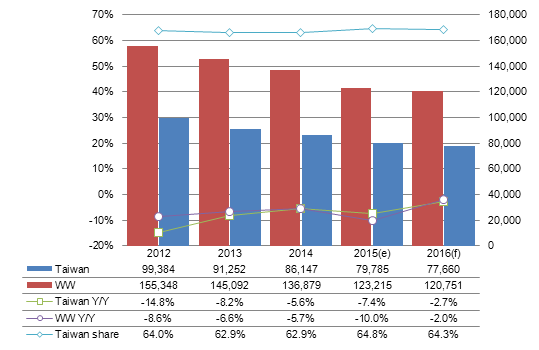

Chart 9: Taiwan and worldwide LCD monitor shipments, 2012-2016 (k units)

Source: Digitimes Research, January 2016

- Taiwan’s LCD monitor shipments dropped by 7.4% to fewer than 80 million units in 2015, while worldwide shipments declined 10% to reach 123.22 million units. Demand in the PC market was not helped by the late arrival of desktop Skylake processors, which were announced in August and September of 2015. Taiwan rose to 64.8% in global shipment share in 2015.

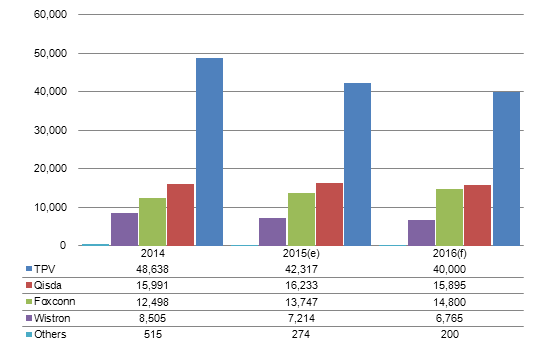

Chart 10: Shipments by top makers, 2014-2016 (k units)

Source: Digitimes Research, January 2016

- Foxconn enjoyed nearly 10% on-year shipment growth in 2015. It has been soliciting orders from Dell, HP and Lenovo by offering low quotes.

- Qisda, which is eager to boost profitability rather than shipment volume, is mainly landing orders with high gross margin, such as those for medical and gaming LCD monitors. Such a strategy gave Qisda only a 1.5% in on-year shipment growth in 2015.

- Foxconn’s shipments are expected to grow another 7.7% on year in 2016 and it will be the only Taiwan-based maker to see growth.