South Korea-based IC design house Silicon Works saw revenues generated from its LCD driver IC (LDI) business fall for a second consecutive quarter sequentially in the second quarter of 2013, due to a slowdown in orders for Apple's iPad devices, as well as its narrow target applications, according to Digitimes Research.

Silicon Works' driver IC solutions are targeted mainly at tablets and notebooks. The company has reportedly entered the supply chain of Apple, through providing driver ICs to LG Display.

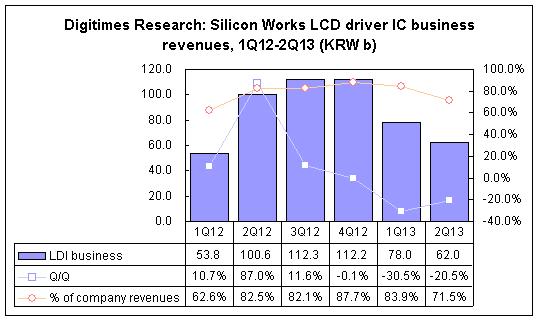

Buoyed by robust iPad sales, revenues of Silicon Works' LDI business climbed to KRW100.6 billion (US$3.43 billion) in the second quarter of 2012, Digitimes Research said. This represented an about 87% jump compared to KRW53.8 billion in the first quarter, and more than a doubling from only KRW47.4 billion in second-quarter 2011.

Silicon Works' LDI business accounted for more than 80% of company revenues in the second quarter of 2012, up from 60-62% over the previous four quarters, as a result of its rapid expansion, Digitimes Research indicated.

However, due to weakening demand for Apple's iPad, revenues of Silicon Works' LDI business fell below KRW100 billion in the first quarter of 2013, Digitimes Research observed. Revenues continued to contract in the second quarter, slipping to KRW62 billion or 71.5% of Silicon Works' total revenues.

In addition, unlike fellow Taiwan-based LCD driver IC companies, which target applications ranging from handsets, notebooks and LCD TVs, Silicon Works' LDI business was negatively affected by its unfavorable product mix in the first half of 2013, Digitimes Research noted.

Silicon Works' driver IC shipments for Apple's iPads, for instance, accounted for as much as 48% of company revenues in the third quarter of 2012. The proportion had already shrank to less than 30% in 2013, Digitimes Research pointed out.

Digitimes Research anticipates that Silicon Works' LDI business is set to suffer its first revenue decline since 2008 in 2013.

Source: Digitimes Research, October 2013