Introduction

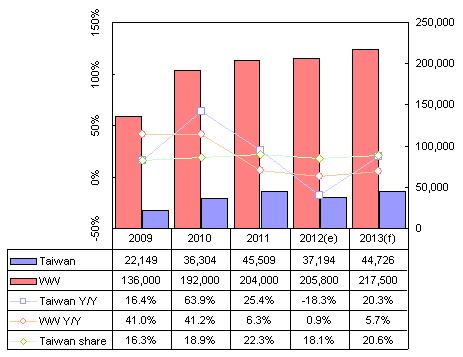

- Taiwan makers shipped 10.51 million LCD TVs in the fourth quarter of 2012, increasing 6.4% sequentially but decreasing 8.7% on year.

- Taiwan's LCD TV shipments will decrease 18.6% sequentially but increase 0.6% on year to reach 8.56 million units in the first quarter of 2013.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

Chart 1: LCD TV shipments, 3Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

- Fourth-quarter 2012 LCD TV shipments from Taiwan-based makers were 10.51 million units, showing an on-quarter increase of 6.4% but an on-year decrease of 8.7%. After three consecutive quarters with less than 10 million units in shipments, the firms finally managed to see shipments exceed 10 million units in the fourth quarter. The sequential growth was due to orders from new customers.

- Total shipments in 2012 were 37.2 million units, far lower than 45.54 million units in 2011.

- Foxconn increased shipments to Vizio, thanks to sufficient large-size panel capacity support.

- Cooperation between Wistron and China-based vendor Haier has been growing fast and by the fourth quarter, Wistron had begun providing products to Haier.

- Taiwan-based makers focused on new product sizes such as 39-, 50-, and 60-inch sets to attract new customers.

- The fourth quarter is traditionally a boom season for LCD TV shipments. However, the sequential growth rate was only 6% because some clients had already placed some of their orders early in the third quarter. Makers also noted that end market demand was weaker than expected in the fourth quarter.

- Demand change was the most significant in the US and Europe markets. Demand from Asia markets, such as China and emerging markets, continued to display steady growth.

- LCD TV shipments from Taiwan-based makers in the first quarter of 2013 are estimated at 8.56 million units, a fall of 18.6% on quarter and flat compared to the first quarter in 2012.

- The first quarter is traditionally a low season, and it is a main factor affecting shipments from Taiwan-based makers. Some Taiwan-based firms noted that demand in the North America and Europe markets was not as strong as expected in the fourth quarter of 2012, and inventory levels are high in the first quarter of 2013. Asia market demand is expected to slow down in the first quarter but demand ahead of the Lunar New Year holidays will still show slight growth; hence the shipment decrease will not be as steep compared to Europe and US markets

Shipment breakdown

Business model: OBM, OEM and ODM

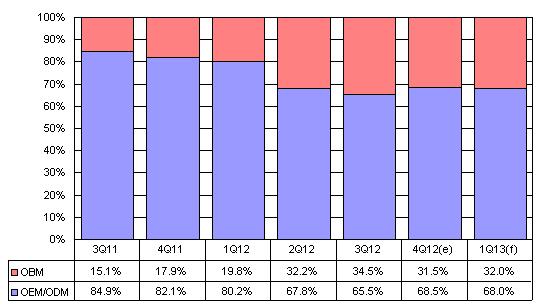

Chart 2: LCD TV shipments by business model, 3Q11-1Q13

Source: Digitimes Research, January 2013

- OBM shipment share had been growing continuously in previous quarters but fell to 31.5% in the fourth quarter 2012. The main reason is because Amtran, which focuses on OBM business, saw shipments fall in the fourth quarter.

- Amtran mainly provides products to Vizio, but the client increased OEM orders to TPV, Wistron and Foxconn in the fourth quarter, resulting in Amtran reporting shipment declines.

- TPV continued to account for 50% of the OBM shipments in the fourth quarter, and its share will remain similar in the first quarter of 2013.

- Shipment share of OBM will growth slightly in the first quarter, as shipments from Amtran are expected to grow.

Geographic markets

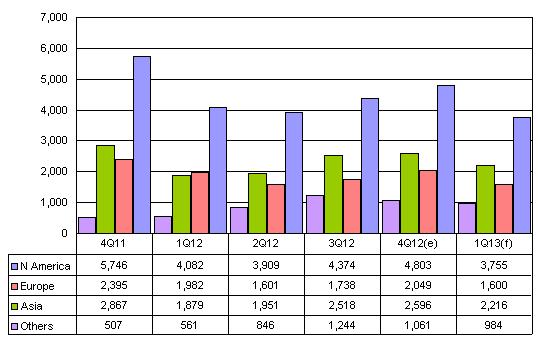

Chart 3: LCD TV shipments by region, 4Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

Chart 4: LCD TV shipment share by region, 4Q11-1Q13

Source: Digitimes Research, January 2013

- Due to the year-end holidays, shipment growth in Europe and North America markets was more significant than others in the fourth quarter 2012.

- Seasonality plays a significant role in the LCD TV markets in Europe and the US markets, and their share of shipments is expected to drop in the first-quarter low season. But North America remains Taiwan makers' biggest market. .

- The Asia market is expected to see sight growth ahead of the Lunar New Year holidays, and its share of shipments will rise in the first quarter.

Screen sizes

Chart 5: LCD TV shipment share by screen size, 4Q11-1Q13

Source: Digitimes Research, January 2013

Chart 6: LCD TV shipment share by screen size, 2Q12-1Q13

Source: Digitimes Research, January 2013

- Shipments to the 50-inch and larger segment showed an astonishing growth of 171% in the fourth quarter compared to the third quarter.

- Black Friday sales in the US market focused on ultra large-size products.

- Vizio's 60-inch sets manufactured by Foxconn carried a retail price of only US$688/units at Walmart, which sparked demand for low-price ultra large-size LCD TVs.

- Best Buy began to offer Vizio's low-price 60- and 70-inch products at the end of 2012. This in turn boosted Foxconn's shipments to the 60-inch and larger segment.

- Shipment share of 46-48 inch products from Taiwan-based firms in the fourth quarter fell from 8.5% to 8.1% due to increasing shipments of 50-inch and larger products.

- Shipment share for 40/42 inch decreased to 20.5% due to the rising shipments of 39-inch products.

- Shipments of 39-inch products showed growth potential as early as in the third quarter, and in the fourth quarter the 37-39 inch segment's shipment share grew to 10.3%.

- The 32-inch category continued to dominate in the fourth quarter with shipment share at 38.1%; but it was down from 41.0% in the third quarter.

- Shipments to the 50-inch and larger segment will show only a slight on-quarter decrease, reflecting the fact that large-size products are less affected by the seasonality.

- Demand for ultra large-size products in the Asia market is less significant than in the US market. Rising demand for 4x-inch TVs in Asia is predicted to push the shipment share of 40-48 inch products up by 2.7 percentage points.

Makers

Chart 7: LCD TV shipments by maker tier, 4Q11-1Q13

Source: Digitimes Research, January 2013

Source: Digitimes Research, January 2013

- TPV has been consistently the top maker, while the others have seen changes in their rankings.

- Compal leapfrogged Foxconn to second place in the second quarter, thanks to orders from Panasonic. But Foxconn regained the lost ground in the third quarter, during which its shipments to Sony became more stable and shipments to Vizio restarted. Foxconn's gap with Compal was widened in the fourth quarter.

- Amtran dropped off the top-five rankings in the fourth quarter because of dwindling shipments to Vizio.

- TPV's and Foxconn's rankings are unlikely to see changes in 2013.

- Compal is expected to remain number three in the first half of 2013, but it will not lead fourth- to sixth- place players by too wide a margin.

- Amtran will return to the top-five rankings in the first quarter of 2013 thanks to ultra-large size TV shipments to Vizio.

Annual shipments

Chart 8: Taiwan LCD TV shipment forecast, 2009-2013 ( k units)

Source: Digitimes Research, January 2013