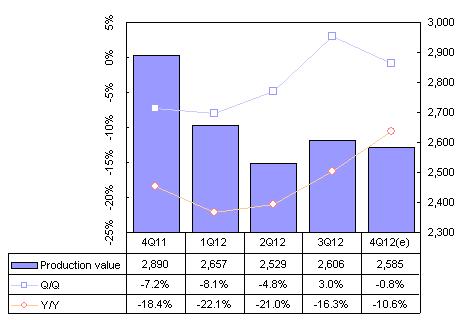

Chart 2: Taiwan LCD monitor production value, 4Q11-4Q12 (US$m)

Chart 5: Top five makers' share of Taiwan LCD monitor shipments, 1Q12-1Q13

Table 1: Taiwan's top-5 LCD monitor makers, 1Q12-1Q13 (k units)

Table 2: Global top-5 LCD monitor makers, 1Q12-1Q13 (k units)

Chart 6: Taiwan LCD monitor share by business model, 1Q12-1Q13

Introduction

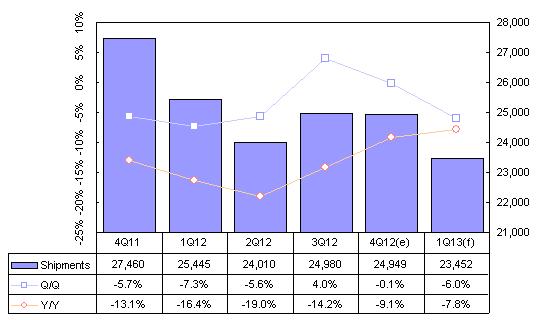

- Taiwan's LCD monitor shipments decreased 0.1% sequentially and 9.1% on year to reach 24.95 million units in the fourth quarter of 2012.

- Shipments will decrease 6% sequentially and 7.8% on year to reach 23.45 million units in the first quarter of 2013.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

Chart 1: LCD monitor shipments, 4Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

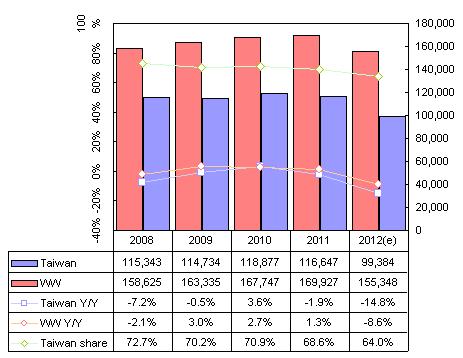

- LCD monitors shipped by Taiwan-based makers in the fourth quarter of 2012 remained flat but showed an on-year decrease of 9.1% compared to the fourth quarter of 2011.

- Total LCD monitor shipments from Taiwan-based firms in 2012 were 99.38 million units, an on-year decrease of 14.8% compared to 112 million units in 2011.

- In 2012, total global LCD monitor shipments were 155 million units, showing a sequential decrease of 8.1% compared to 170 million units in 2011

Shipments breakdown

Production value and ASP

Chart 2: Taiwan LCD monitor production value, 4Q11-4Q12 (US$m)

Source: Digitimes Research, January 2013

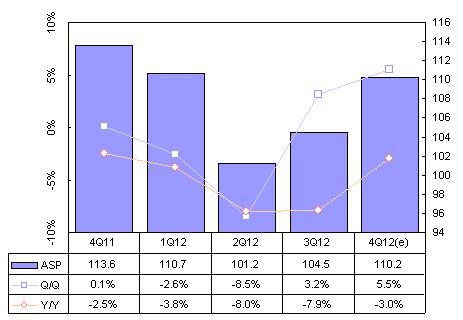

Chart 3: Taiwan LCD monitor ASP, 4Q11-4Q12 (US$)

Source: Digitimes Research, January 2013

- Falling panel prices and price competition between brands caused ASP to fall; Taiwan monitor makers' total output value showed a sequential drop of 0.8% in fourth-quarter 2012.

- Compared to 2011, the quarterly output value of Taiwan-based LCD monitor makers showed continuous drops in 2012.

Market share

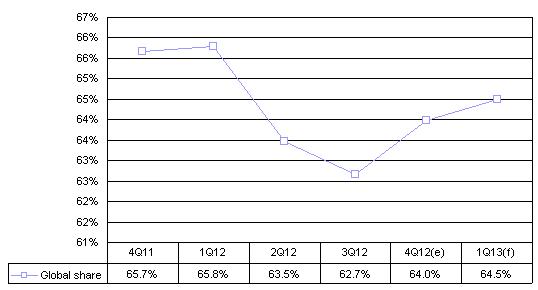

Chart 4: Worldwide market share, 4Q11-1Q13

Source: Digitimes Research, January 2013

- LCD monitor shipments from Taiwan-based makers will decrease by 6% in the first quarter of 2013 mainly because it is traditionally a low season.

- Taiwan-based LCD monitor shipments are likely to maintain a share of 63-65% in the global market because Samsung Electronics now focuses less on monitor products while LG Electronics has been issuing some OEM orders to Taiwan-based firms such as TPV Technology.

Makers

Chart 5: Top five makers' share of Taiwan LCD monitor shipments, 1Q12-1Q13

Source: Digitimes Research, January 2013

Source: Digitimes Research, January 2013

- TPV's shipments in the fourth quarter showed a slight sequential increase and the firm remained the world's leading LCD monitor maker.

- Due to the fact that the first quarter is traditionally a low season, shipments from major firms are all likely to show on-quarter decreases in first-quarter 2013.

- Amtran refocused on monitor products and is one of the few firms that reported shipment growth in 2012.

- The combined shipment share of the top five Taiwan-based LCD monitor makers is unlikely to change significantly while the combined shipment share of the top two makers will continue to be between 73-75%.

- Qisda has replaced Foxconn (Hon Hai) as the second largest LCD monitor maker, hence the combined shipment share of the top two makers among Taiwan-based firms can be maintained above 70%.

Note: The rankings are based on the makers' shipments that exclude own-brand products manufactured by outsourcing partners.

Source: Digitimes Research, January 2013

- TPV's 2013 LCD monitor shipment growth is likely to stay above industry average. Samsung and Foxconn Electronics (Hon Hai Precision Industry) are focusing more on large-size TV products, while LG have been releasing OEM orders to TPV.

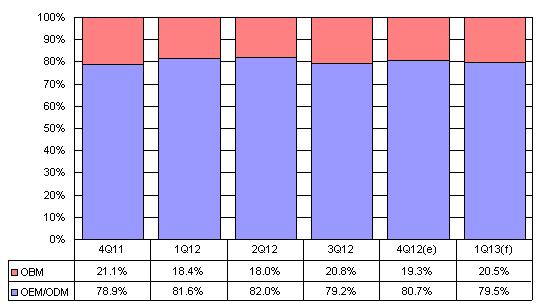

Business models: OBM, OEM/ODM

Chart 6: Taiwan LCD monitor share by business model, 1Q12-1Q13

Source: Digitimes Research, January 2013

- Among Taiwan-based firms, only TPV has relatively strong shipments for original brand manufacturing (OBM) business, while other firms mostly focus on OEM shipments.

- TPV's OBM shipments cover its own AOC brand, as we as Philips and another 5-6 smaller brands.

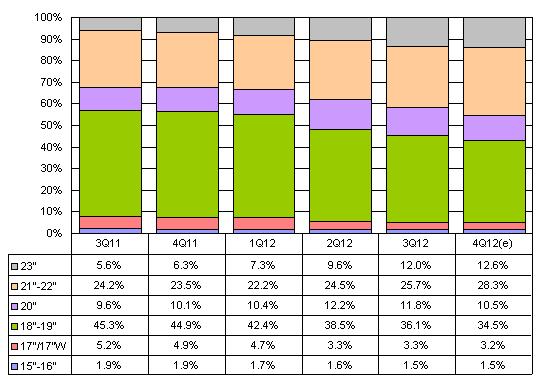

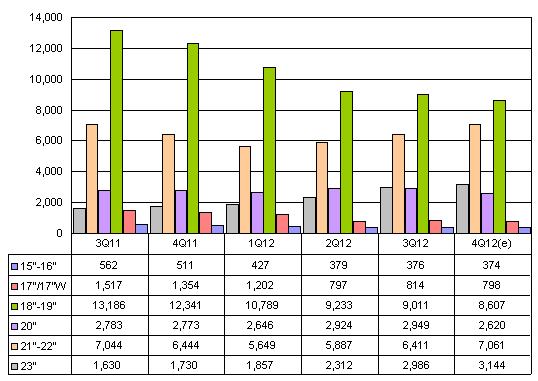

Screen sizes

Chart 7: LCD monitor share by screen size, 3Q11-4Q12

Source: Digitimes Research, January 2013

Chart 8: LCD monitor shipments by screen size, 3Q11-4Q12

Source: Digitimes Research, January 2013

Annual shipments

Chart 9: Global LCD monitor shipments, 2008-2012 (k units)

Source: Digitimes Research, January 2013

- Total LCD monitor shipments from Taiwan-based firms in 2012 were 99.38 million units, representing an on-year decrease of 14.8%.

- Only Amtran reported on-year increase in 2012 shipments; other Taiwan-based makers all reported declines.