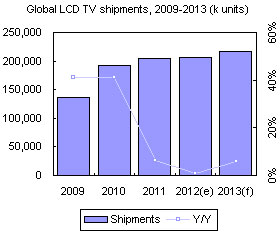

LCD TV shipments are expected to see a rebound in 2013, with an on-year increase in shipments of 5.7% due to demand from emerging markets and a revitalization of the US economy. China will also be an important market in 2013 and China-based TV vendors are expected to surpass Japan-based vendors in LCD TV shipments, with their total surpassing 50 million units. However, Korea-based TV vendors are expected to still hold the highest proportion of LCD TV shipments in 2013 at 37%.

Approximately 61 million, or 28%, of the LCD TVs shipped in 2013 will be outsourced to OEM manufacturers (as opposed to own-brand shipments), an on-year increase of 8.6%. Taiwan-based TV vendors are also expected to bump up their OEM shipments in 2013 by 18.6% to 44.5 million units, which will comprise 20% of global LCD TV shipments.

One reason for the slight increase in the share of OEM shipments will come from Japan-based TV vendors, which have increased their proportion of OEM-type shipments due to continuing losses in the LCD TV segment. The vendors have also been supplementing their R&D and production of entry-level to midrange products via Taiwan-based vendors and are looking for partners to help clear out their factories abroad. Among all Japan vendors in 2013, Toshiba may have only 23% of its shipments done in-house, which indicate that it will release over 10 million LCD TV order to OEMs. Meanwhile, Sony is expected to outsource 60% of its LCD TV production while Panasonic and Sharp are both expected to outsource about one third of their production, compared to less than 20% in 2012.

Taiwan-based LCD TV OEMs include TPV Technology, Foxconn Electronics, Wistron, Amtran Technology, Compal Electronics and Unihan, with most of their clients being in Japan. But the TV vendors are also expected to gain shipments through partnerships, such as the case between TPV and Philips as well as between Amtran and Vizio. Overall, TPV is expected to remain the largest Taiwan-based OEM in 2013 with an OEM market share of 38%, followed by Foxconn.

Ultra HD TVs will be a focus for LCD TV vendors in 2013 as well, and panel makers are expected to continue developing Ultra HD panels. Moreover, narrow bezel designs will also be a key design component for vendors in 2013 and LED backlit TVs will largely replace CCFL units during the time period as well.