With the cost of developing a new semiconductor fab anticipated to surpass US$5.0 billion by 2015, more and more IDMs are adopting a fab-lite outsourcing model. The growth in the merchant foundry industry has also provided fabless IC design firms with access to reasonably-priced advanced-process capacity without the need for huge capital expenditure, and IC design has therefore grown as a share of the semiconductor market to 25.8%, up from less than 10% in 2000.

This Digitimes Special report focuses on how the foundry sector supports IC design customers through design services and trends among the key industry design platforms.

Chart 1: Cost structure of IC design projects by process node (US$m)

Chart 3: Photomask costs have increased massively for advanced processes (US$m)

Chart 4: Embedded software support for multiple platforms is already a necessity

Chart 6: Comparison of IC design project numbers with the evolution of process nodes

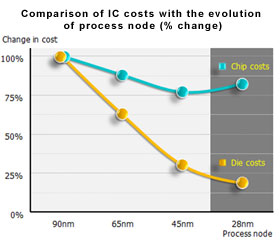

Chart 7: Comparison of IC costs with the evolution of process node (% change)

Chart 8: Design concepts of Apple's A4 processor architecture

Chart 10: Collaborative development effectively shortens the development process for devices

Chart 13: Semiconductor process technology versus factory construction costs (US$b)

Chart 14: Date of announcement of global IDM's asset-lighting strategies

Chart 16: IC design output value and share of the semiconductor market, 2007-2011 (US$b)

Chart 20: Merchant foundries' strategies for client selection and resource allocation

Chart 21: Taiwan IC design service industry value and growth, 2007-2011 (NT$b)

Chart 23: Share of Taiwan IC design service industry by product sectors, 2011

Chart 24: Share of Taiwan IC design service industry by application sector, 2011

Chart 25: Share of Taiwan IC design service industry by sales region, 2011

Chart 26: Share of Taiwan IC design service industry by process technology, 2011

Chart 27: Taiwan IC design industry chain and associated companies

Breakdown of revenues for Taiwan IC design service companies

Chart 28: Revenue share among companies in the Taiwan IC design service industry

Chart 29: Process platforms of the major global merchant foundries

Chart 30: Platform processes of Taiwan's major IC design service firms

Revenue distribution for the process platforms of Taiwan-based IC design service providers

Chart 31: Process platform share in the Taiwan IC design service industry, 2011

Chart 32: Evolution of Global Unichip's process technology and manufacturing service suppliers

Chart 35: Global Unichip's 2011 revenue share by application sector

Chart 36: Global Unichip's 2011 revenue share by sales region

Chart 37: Global Unichip's 2011 revenue share by process technology

Chart 38: Evolution of Alchip's process technology and manufacturing service suppliers

Chart 44: Evolution of Progate's process technology and manufacturing service suppliers

Chart 46: Overview of Goyatek's history and manufacturing service suppliers

Chart 48: Evolution of Faraday's process technology and manufacturing service suppliers

Chart 51: Faraday's 2011 revenue share by application sector

Chart 53: Faraday's 2011 revenue share by process technology

Chart 54: Overview of Socle's history and manufacturing service suppliers

Chart 55: Share of 12-inch wafer capacity among foundries on the Common Platform, 2011

Chart 56: CoAsia's main operations and manufacturing service suppliers

Chart 57: IC design services as share of CoAsia's revenues, 2007-2011 (NT$b)

Chart 58: Comparison of the evolution of process technology for foundries and IC design services

28nm design projects and 40nm manufacturing services will be the main growth drivers in 2012

Chart 60: Comparison of the evolution of process technology and the number of design projects

Chart 61: Global share of merchant foundry 12-inch capacity by platform, 2011

Chart 62: Process platforms in the Taiwan IC design service industry