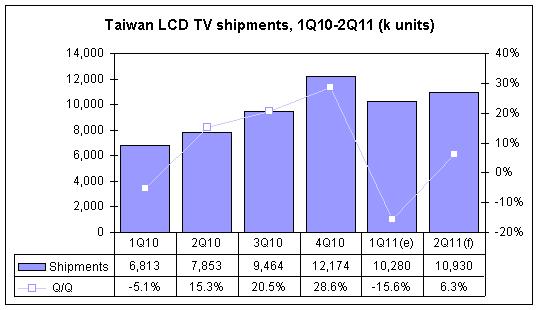

LCD TV panel supply will be tight in second-quarter 2011 because of unstable supply of some of the components. Digitimes Research predicts that Taiwan-based makers will ship 10.93 million LCD TVs in the second quarter, up 6.3% sequentially and 39.2% on year.

Taiwan makers' total LCD TV shipments will reach 54.88 million units in 2011, accounting for 26% of the global total.

Source: Digitimes Research, April 2011