AMD has announced availability of its first six-core Opteron server processor (Istanbul) with Direct Connect Architecture for two-, four- and eight-socket servers.

Systems based on six-core AMD Opteron processors are expected to be available beginning later in the month from OEMs including Cray, Dell, Hewlett-Packard (HP), IBM and Sun Microsystems, along with support from motherboard and infrastructure partners. HE, SE and EE versions of the six-core AMD Opteron processor are planned for the second half of 2009, said AMD.

Six-Core AMD Opteron processors leverage existing platform infrastructure and a low-cost, power-efficient DDR2 memory architecture which can help lower system acquisition costs, highlighted AMD.

High performance computing (HPC), virtualization and database workloads can benefit from increased 4P Stream memory bandwidth of up to 60% enabled by HyperTransport Assist, which helps reduce processor to processor latency and traffic.

AMD Virtualization (AMD-V) technology and the AMD-P suite of power management features are available across all performance and power bands.

The new Six-Core AMD Opteron processor has up to 34 % more performance-per-Watt over the previous generation quad-core processors in the exact same platform, according to AMD.

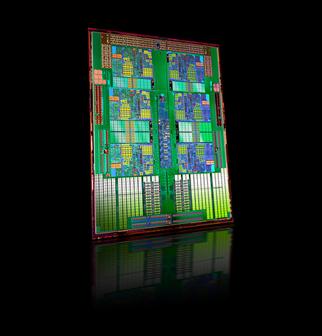

AMD six-core Istanbul server processor

Photo: Company