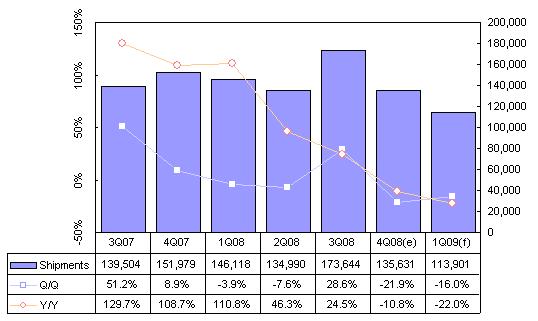

Chart 1: Small- to medium-size shipments, 3Q07-1Q09 (thousand units)

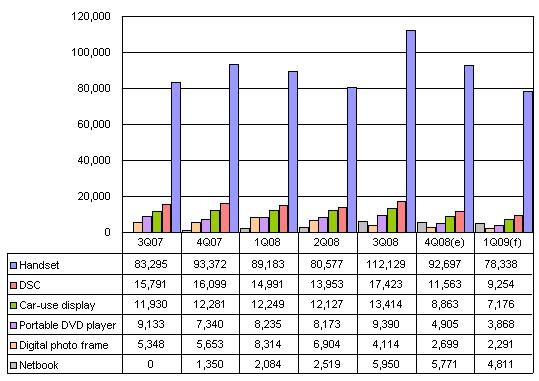

Chart 2: Shipments by application, 3Q07-1Q09 (thousand units)

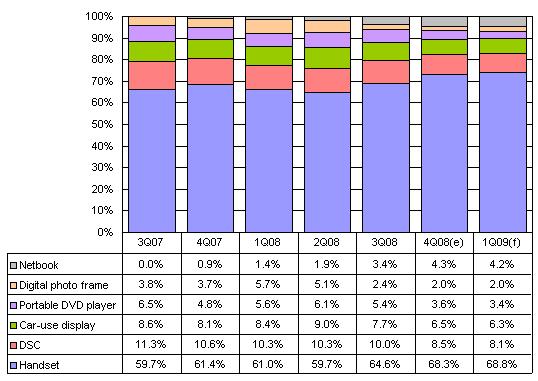

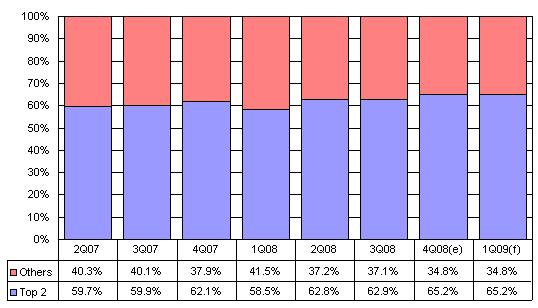

Chart 4: Overall TFT LCD shipment share by technology, 3Q07-1Q09

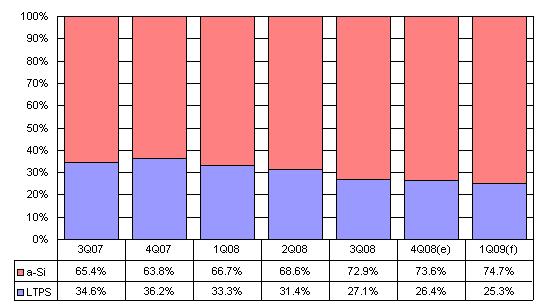

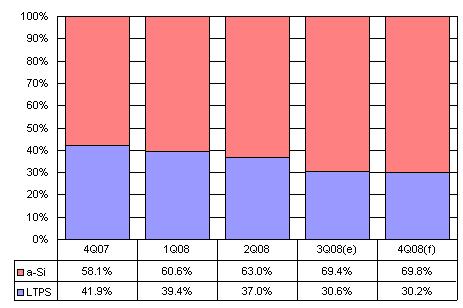

Chart 5: Handset-use TFT LCD shipment share by technology, 4Q07-4Q08

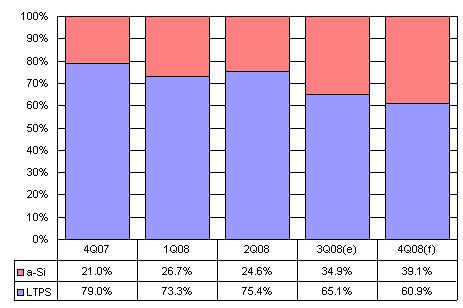

Chart 6: DSC-use TFT LCD shipment share by technology, 4Q07-4Q08

Introduction

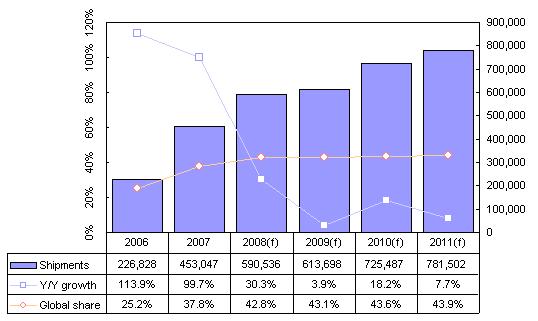

- Taiwan shipped 135.6 million small- to medium-size panels in the fourth quarter of 2008, down 21.9% sequentially and down 10.8% from the same period one year earlier.

- Small- to medium-size panel shipments will drop 16.0% sequentially and 22% on year in the first quarter of 2009.

- For the full year of 2008, Taiwan shipped 590.5 million small- to medium-size panels representing growth of 30.3% from 2007.

- Taiwan accounted for 42.8% of the global small- to medium-size panel market in 2008 and the share is forecast to increase to 43.1% in 2009.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers

Chart 1: Small- to medium-size shipments, 3Q07-1Q09 (thousand units)

Source: Digitimes Research, January 2009

Industry watch

- Shipments dropped in the fourth quarter of 2008 both sequentially and on year due to weak demand in the end-market.

- Shipments in the first quarter 2009 are expected to drop as panel makers continue to reduce their utilization rates during the traditional low season.

- Except the netbook segment, 2009 small- to medium-size shipments will continue to feel the impact of the global economic downturn.

- Handset will remain the top application for small-size panels (5-inch and under) with over 70% share of the global market in 2009.

- Handset vendors will continue to replace STN LCD panels with entry-level TFT-LCD panels, shipments of which are expected to increase 3.2% to 930 million units in 2009 worldwide.

- Global shipments of small-size panels are estimated to grow 1.8% to 1.31 billion units in 2009, up 1.8% compared to 2008.

- The market for medium-size (5- to 10.4-inch) panels is estimated to grow 20.8% to 110 million units, mainly due to the netbook popularity.

- Global shipments of netbook-use TFT-LCD panels are estimated to increase by 106.2% to 30 million units in 2009.

Shipment breakdown

Product breakdown by application

Chart 2: Shipments by application, 3Q07-1Q09 (thousand units)

Source: Digitimes Research, January 2009

- Netbook applications replaced portable DVD player applications as the largest medium-size segment in the fourth quarter, as demand for netbooks remained strong despite the economic downturn.

Chart 3: Shipment share by application, 3Q07-1Q09

Source: Digitimes Research, January 2009

- The share of handset applications in overall shipments increased to a record 68.3% in the fourth quarter of 2008, as shipments to the handset applications decreased less than all other applications, except netbook ones.

- The share of handset applications will grow further in the first quarter of 2009 as Chunghwa Picture Tubes (CPT) and Giantplus Technology will start shipping handset panels to new clients.

Breakdown by technology: Overall shipments

Chart 4: Overall TFT LCD shipment share by technology, 3Q07-1Q09

Source: Digitimes Research, January 2009

- With the economic downturn driving consumers to spend less, system makers are even more apt to adopt less expensive panel solutions so as to lower their production costs and product prices. The share of a-Si panels is expected to continue growing.

Breakdown by technology: Handsets

Chart 5: Handset-use TFT LCD shipment share by technology, 4Q07-4Q08

Source: Digitimes Research, January 2009

- In the handset segment, the share of a-Si panels only grew slightly in the fourth quarter of 2008, as demand from China's white-box market decreased.

Breakdown by technology: DSC

Chart 6: DSC-use TFT LCD shipment share by technology, 4Q07-4Q08

Source: Digitimes Research, January 2009

- Demand from the international DSC vendors for LTPS panels dropped in the fourth quarter amid sluggish demand in the end market.

- In contrast, adoption of a-Si panels in entry-level DSCs grew. As a result, the proportion of the a-Si segment went up.

Top makers

Chart 7: Top-2 makers, 2Q07-1Q09

Note: The Top-2 makers are AUO and TPO

Source: Digitimes Research, January 2009

- With their economies of scale, bigger panel makers may offer more competitive prices than their minor rivals to win orders from international vendors during the economic slowdown. The Top-2 makers, AU Optronics (AUO) and TPO Display, saw their combined share increase in the fourth quarter.

- But in the first quarter of 2009, the Top-2 makers will see their combined share stay flat, while CPT and Giantplus will start shipments to first-tier handset vendors.

Outlook till 2011

Chart 8: Small- to medium-size TFT LCD shipment and Taiwan's global share, 2006-2011 (thousand units)

Source: Digitimes Research, January 2009

- Although the small- to medium-size panel market may drop in 2009 because of the sluggish global economy, Taiwan's overall shipments, driven by handset and netbook applications, are expected to continue to grow.