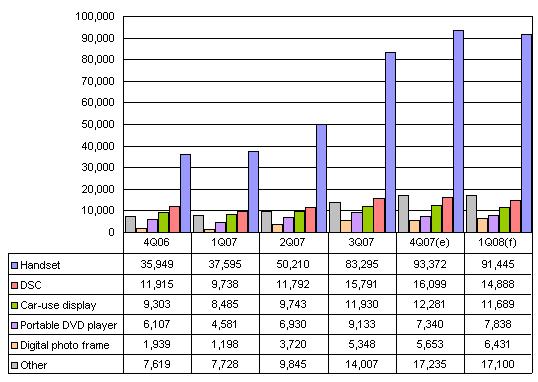

Chart 1: Small-to-medium-size TFT LCD panel shipments, 4Q06-1Q08 (thousand units)

Chart 2: Shipments by application, 4Q06-1Q08 (thousand units)

Chart 4: Overall TFT LCD shipment share by technology, 4Q06-1Q08

Chart 5: Handset-use TFT LCD shipment share by technology, 4Q06-1Q08

Chart 6: DSC-use TFT LCD shipment share by technology, 4Q06-1Q08

Introduction

Shipments of small- to medium-size panels were strong in the fourth quarter, as a result of the delivery fulfillment of orders that had been delayed by tight capacity in third quarter. Shipments of handset applications were particularly strong. Applications for portable DVD players were the only segment that saw shipments decline sequentially (19.6%) in the fourth quarter.

Demand remains strong in the traditional first-quarter low season. Increases in shipments for digital photo frame applications from Wintek, HannStar Display and Chi Hsin Electronics cancelled out part of the decreases in orders from international vendors for handset and digital still camera (DSC) applications. Overall shipments for the first quarter will only drop slightly.

Chart 1: Small-to-medium-size TFT LCD panel shipments, 4Q06-1Q08 (thousand units)

Source: Digitimes Research, January 2008

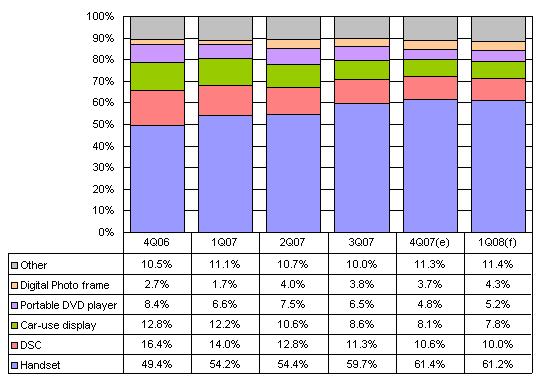

Breakdown by application

In the fourth quarter, handset application shipments continued to stay at a high level. Shipments of digital photo frame applications rose steadily. Taiwan panel makers have succeeded in entering the supply chain of such high-end MP3 players as the iPod nano and iPod touch. Panel shipments for China white-box MP3 players and low-cost notebooks were also increasing in the fourth quarter.

While shipments to the handset segment will decline in the first quarter because of seasonality, shipments to the digital photo frame segment will rise still, attesting to the growing popularity of the application.

Chart 2: Shipments by application, 4Q06-1Q08 (thousand units)

Note: The category "Other" includes MP3 players, low-cost notebooks, PDAs, digital camcorders, games consoles, and industrial PCs.

Source: Digitimes Research, January 2008

Handset applications' share topped 60% in the fourth quarter, and will remain at a similar level in the first quarter of 2008, despite a slight drop in shipments.

Chart 3: Shipment share by application, 4Q06-1Q08

Source: Digitimes Research, January 2008

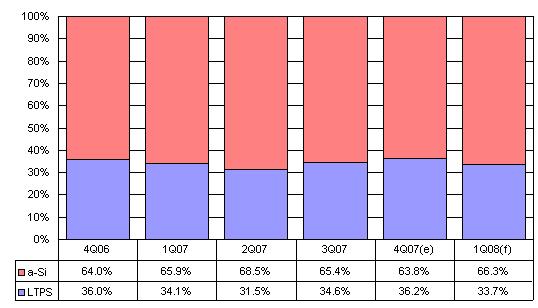

Product breakdown by technology

As shipments catering to international handset vendors' high-end models remained strong in the fourth quarter, the proportion of the LTPS segment went up slightly. In the first quarter, the LTPS segment's share will go down because of a decline in orders from international handset vendors. In turn the a-Si segment's share will go up, as shipments of entry-level handset-use TFT LCD panels from Wintek and Giantplus Technology will increase.

Chart 4: Overall TFT LCD shipment share by technology, 4Q06-1Q08

Source: Digitimes Research, January 2008

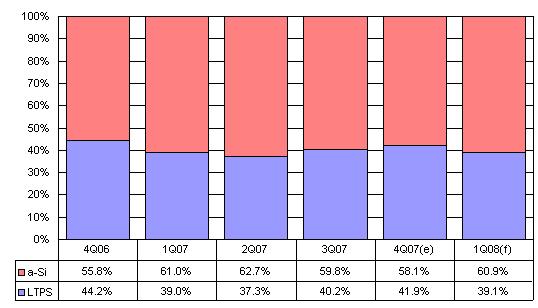

Strong demand for high-end handset applications from international vendors boosted the share of the LTPS segment in the fourth quarter. In the first quarter, handset application shipments to the a-Si segment will rise as a result of Wintek's and Giantplus' increased shipments of entry-level handset-use applications, while shipments to the LTPS segment will drop on decreased orders from international handset vendors.

Chart 5: Handset-use TFT LCD shipment share by technology, 4Q06-1Q08

Source: Digitimes Research, January 2008

Low-end applications for digital cameras have been phasing out fast, as the proportion of the LTPS segment continued rising in the fourth quarter. But in the first quarter, orders belonging to the a-Si segment are declining at a slower pace than the LTPS segment, and therefore the a-Si segment will see a slight rise in shipment proportion.

Chart 6: DSC-use TFT LCD shipment share by technology, 4Q06-1Q08

Source: Digitimes Research, January 2008

The Top-2 makers, AU Optronics (AUO) and TPO Displays saw their combined share rise in the fourth quarter, as their shipments to international handset vendors were strong.

In the first quarter, increased output from Wintek and Giantplus as a result of their acquisition of 3G lines from HannStar Display and Chunghwa Picture Tubes (CPT) respectively is expected to bite into the Top-2 makers' share.

Chart 7: Shipments by maker, 4Q06-1Q08

Note: The Top-2 makers are AUO and TPO, while the other makers are Wintek, Innolux, CPT, Giantplus, HannStar, PVI, and Chi Hsin.

Source: Digitimes Research, January 2008

Industry watch

Three major factors drove Taiwan's small- to medium-size LCD panel shipments up almost 100% last year. First, Taiwan makers started playing a major role in the supply chain for international vendors of DSC and handsets. Previously, Taiwan makers had played second fiddle to Japanese competitors. Second, demand from China's white-box handset was strong, and third, the popularity of digital photo frames was growing.

Handset applications for international vendors

Handset applications have usually accounted for about 70% of the global small-size panel shipments, or 60% of the total small- to medium-size panel shipments. Prior to 2005, entry-level to mid-range handsets mainly used STN LCD panels, while high-end handset applications were dominated by Japanese suppliers. Starting in 2006, Taiwan makers were starting to make technological breakthroughs. They were also beginning to use their 3G and 4G plants to make handset panels, reducing the production costs for entry-level a-Si TFT LCD panels to ranges close to that seen for STN panels. It triggered a wave of adoption of TFT LCD panels for use in entry-level handsets. Growing demand for multimedia functionalities also prompted makers to adopt LTPS TFT LCDs for mid-range handsets. Taiwan panel makers were in a strong position to step up their contention for the handset-use TFT LCD market with their Japanese competitors. As a result, Taiwan makers' shipments to international handset vendors started to grow significantly in the third quarter of 2007.

In 2007, Motorola's performance was poor, while Nokia's sales were stronger than expected. Their performances affected their panel suppliers in Japan, who adopted an “ad hoc” production policy that reserved production lines for specific clients. As a result, utilization of the “ad hoc” lines for Motorola was low, while their other production lines were unable to cater to strong demand from Nokia, which had to turn to Taiwan for support. Wintek, already a supplier of Nokia, and TPO Displays, benefited most from Nokia's increased orders. In 2006, 52%, or 54 million panels, of Taiwan's handset panel shipments were shipped to international vendors, but in 2007, the proportion rose to 66%, or 170 million units.

China white-box handsets

China's white-box handsets were previously seen as offering a market for low-cost and low-quality products. But the fast declining prices for TFT LCD panels, plus Taiwan makers' handset-use LCD module (LCM) deployment in China, accelerated the adoption of TFT LCDs for China's white-box handsets.

White-box handset suppliers in China tend to imitate the looks and feels of the brand-name vendors' best-selling and quality models, such as Apple's iPhone, Nokia's 6111i, and the LG Chocolate. The white-box models adopt 2.4-inch or larger panels, or even touch panels and sell for less than half the prices of the ones they imitate. These white-box vendors have become a strong source of orders for Taiwan's panel makers. Almost all of the TFT LCD panels for the China white-box handset market are supplied by Taiwan makers. In 2007, the TFT LCD panel shipments from Taiwan makers and their competitors to the China white-box handset market totaled 78 million units.

Digital photo frames

The growing popularity of digital photo frames has also boosted the shipments of medium-size TFT panels. When Philips made a head-start in launching digital photo frames in 2005, they were meant to be niche products with an annual shipment of a few dozen thousands. But medium-size TFT LCD prices began to fall fast in 2006 when Taiwan makers started making them at their 4.5G lines in 2006. The decline in prices means that makers who did not have 4.5G lines would hardly make profits if they continued to have a strong presence in the digital photo frame market. As these makers shifted their focus to higher added-value applications, such as car-use displays and industrial PCs, supply of digital photo frame-use panels decreased. At the same time the prices for digital photo frames on the end market were falling, and in turn boosted demand. Entry-level 7-inch TFT LCD panels for digital photo frames were then running short, and the shortages in turn sent their prices up in 2007. In the second half of 2007, Korea's LG.Philips LCD (LPL, now renamed LG Displays) and Taiwan's Innolux Display also started using their 5G lines to process medium-size panels in order to meet the strong demand from the digital photo market.

Panel makers' expansion and reshuffled relations

In 2007, the LCD panel industry saw many of its players forge tighter ties or take other measures in anticipation of strong demand for the small- to medium-size segment in 2008. CPT decided to sell a 3G line to LCD module (LCM) maker Giantplus Technology and to form a strategic alliance – CPT is now Giantplus' biggest shareholder. Wintek also agreed to acquire HannStar's second 3G line. CMO established Chi Hsin Electronics to develop the small- to medium-size LCM market. These developments are positive for Taiwan's small- to medium-size LCD panel industry.

Before CPT and Giantplus stuck the partnership, CPT's medium-size panel production chiefly came from its 4G and 4.5G plants, plus an estimated 10-15% of capacity from its 3G line. The 3G plant that CPT has sold Giantplus will be entirely used to process small-size panels. A 3G substrate will produce 8-10 times more small-size panels than medium-size ones. In the first quarter of 2008, CPT is shifting the focus of its 4.5G plant to the medium-size segment, and therefore still needs Giantplus' support for the small-size segment. About 20% of Giantplus' 3G plant is devoted to supplying CPT.

Wintek is ramping up production at its second 3G plant, which it has just taken over from HannStar. In the past, Wintek had only one 3G plant, which was also acquired from HannStar. Limited capacity had prevented Wintek from expanding its product range to meet clients' needs. The addition of the second 3G line will enable it to expand its range of applications, such as digital photo frames.

HannStar, which has only one LCD panel plant (what it calls a 5.3G line) left, is also gearing up for the digital photo frame market. The 5.3G line is 20-30% more efficient that an ordinary 5G line. The medium-size segment currently accounts for 10% of the plant's capacity.

Chi Hsin, a subsidiary of CMO, currently mainly ships medium-size TF LCD panels. Its first-quarter shipments are expected to reach 2-3 million units. Its share remains low.

1Q seasonality not strong

The seasonal downturn in the first quarter has not been strong. Dispelling previous speculations that the small- to medium-size panel market would see price declines, demand has turned out to be strong enough to keep prices stable. The growing popularity of low-cost notebooks, such as Asustek's Eee PC, is one of the price stabilizing factors. While low-cost notebooks and entry-level digital photo frames both adopt 7-inch panels, the panel prices for the former applications are 20-30% higher than the latter.

The first-quarter seasonality has been more tangible for the small-size segment. Decreases in shipments of high-end LTPS applications due to reduced demand from major international clients have been deeper than the a-Si TFT LCD segment. But the small-size segment will see demand pick up in the second quarter.

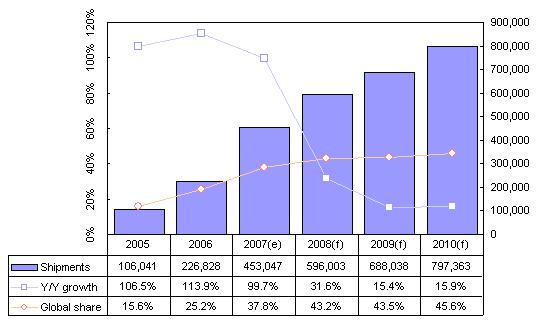

Outlook till 2010

Taiwan's shipments and global market share will continue rising through 2010, as orders from white-box handset vendors will show particularly strong growth. But not much new capacity is expected to be added, so shipment growth will start slowing down significantly this year.

Chart 8: Taiwan small-to-medium-size TFT LCD shipments and global market share, 2005-2010 (thousand units)

Source: Digitimes Research, January 2008

NOTE: Unless otherwise indicated, figures and tables refer to output from Taiwan makers.